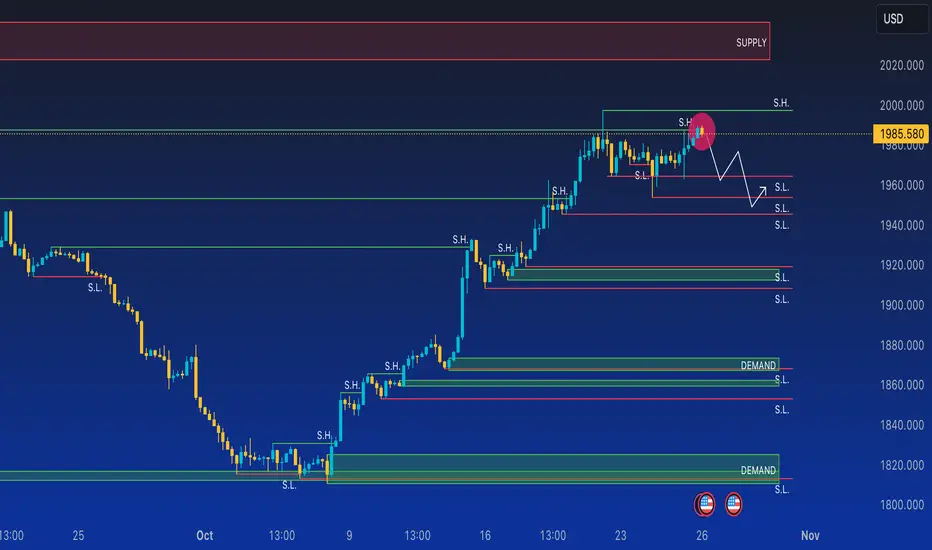

The price of gold XAU/USD appears to be reacting only modestly to the recent positive momentum of the US dollar and the increase in US Treasury yields. Currently, the immediate resistance is positioned at $1,988. If surpassed, gold buyers could target the five-month highs at $1,997 and the $2,000 threshold. On the other hand, in the event of an upward rejection, we may see support at $1,963 during a correction, with the psychological level of $1,950 as the possible next level. Gold sellers may attempt to test the October 19th low at $1,945 in case of a decline. Investors have sought refuge in gold and the US dollar due to the rise in US Treasury yields and tensions in the Hamas-Israel conflict. They are also cautious about high-risk assets while awaiting the preliminary US GDP report, which could influence the Federal Reserve's outlook. Tensions in the Middle East could support the price of gold in the short term, but US economic data could shift focus to the future of Federal Reserve interest rates. The ECB is considering changes in its tightening program, with a focus on its president's message. Furthermore, the price has broken a swing high at the $1,985 level and has started to descend manually. I will assess whether to enter the market to ride this descent during London or after the New York opening. Let me know what you think, leave a like, and comment. Greetings from Nicola, the CEO of Forex48 Trading Academy.

Note

After briefly dropping to $1,970 following positive US GDP data, Gold rebounded above $1,980. The 10-year US Treasury bond yield turned negative, supporting XAU/USD. XAU/USD is on a two-day uptrend, still overbought on the daily chart. Gold remains above its moving averages, with the 20-day moving average leading the way. Technical indicators are overbought with no signs of exhaustion. The monthly peak at $1,997.17 acts as immediate resistance. In the short term, the 4-hour chart suggests an upside bias. XAU/USD finds buying interest near the 20-day moving average, while longer-term averages maintain their bullish positions.Spot Gold reached $1,993.44 per troy ounce on early Thursday, dropping slightly before Wall Street's opening. On one hand, the European Central Bank (ECB) decided to maintain rates after ten consecutive hikes, citing unanimous agreement and ruling out rate cuts for now. The poor economic performance of the Euro Zone was the actual reason, even though not explicitly stated. The US Dollar strengthened with the news, further boosted by better-than-expected Q3 GDP data showing 4.9% growth. Federal Reserve Chairman Powell's remarks emphasized the need for below-trend growth to combat inflation, leaving market players considering their impact.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.