📊 Market Overview

Gold trades near $3,487/oz, supported by Fed rate-cut bets and a weaker USD. Traders await this week’s NFP for clearer direction.

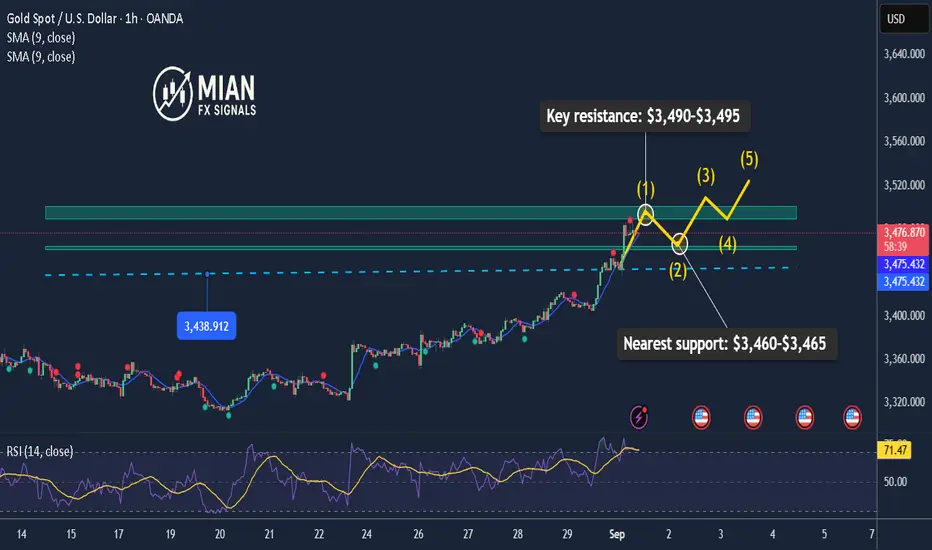

📉 Technical Analysis

• Key resistance: $3,490–$3,500

• Nearest support: $3,465

• EMA 09: Price remains above EMA 09 → short-term uptrend still intact.

• Momentum: High RSI, signaling risk of a short-term pullback.

📌 Outlook

Gold remains in a short-term uptrend, but volatility around $3,490–3,500 will define the next move.

💡 Suggested Trading Strategy

Base Scenario

• 🔻 SELL XAU/USD at $3,490–$3,493 → TP $3,470, SL $3,496

• 🔺 BUY XAU/USD at $3,464–$3,467 → TP $3,485, SL $3,461

Gold trades near $3,487/oz, supported by Fed rate-cut bets and a weaker USD. Traders await this week’s NFP for clearer direction.

📉 Technical Analysis

• Key resistance: $3,490–$3,500

• Nearest support: $3,465

• EMA 09: Price remains above EMA 09 → short-term uptrend still intact.

• Momentum: High RSI, signaling risk of a short-term pullback.

📌 Outlook

Gold remains in a short-term uptrend, but volatility around $3,490–3,500 will define the next move.

💡 Suggested Trading Strategy

Base Scenario

• 🔻 SELL XAU/USD at $3,490–$3,493 → TP $3,470, SL $3,496

• 🔺 BUY XAU/USD at $3,464–$3,467 → TP $3,485, SL $3,461

Trade active

Gold still shows strong buying interest around the $3,465 zone, and the rebound to $3,474 indicates bulls remain in short-term controlTrade closed: target reached

Gold is maintaining a bullish trend driven by Fed rate cut expectations and strong safe-haven demand📊 Forex | Gold | Crypto Market Insights & Signals

📰 Real-time news updates & expert analysis

📈 Daily Buy/Sell signals for investors

💡 Technical breakdowns & market outlooks

🔗 Join our free group: t.me/+DmS-dVFJMm40MDM9

📰 Real-time news updates & expert analysis

📈 Daily Buy/Sell signals for investors

💡 Technical breakdowns & market outlooks

🔗 Join our free group: t.me/+DmS-dVFJMm40MDM9

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📊 Forex | Gold | Crypto Market Insights & Signals

📰 Real-time news updates & expert analysis

📈 Daily Buy/Sell signals for investors

💡 Technical breakdowns & market outlooks

🔗 Join our free group: t.me/+DmS-dVFJMm40MDM9

📰 Real-time news updates & expert analysis

📈 Daily Buy/Sell signals for investors

💡 Technical breakdowns & market outlooks

🔗 Join our free group: t.me/+DmS-dVFJMm40MDM9

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.