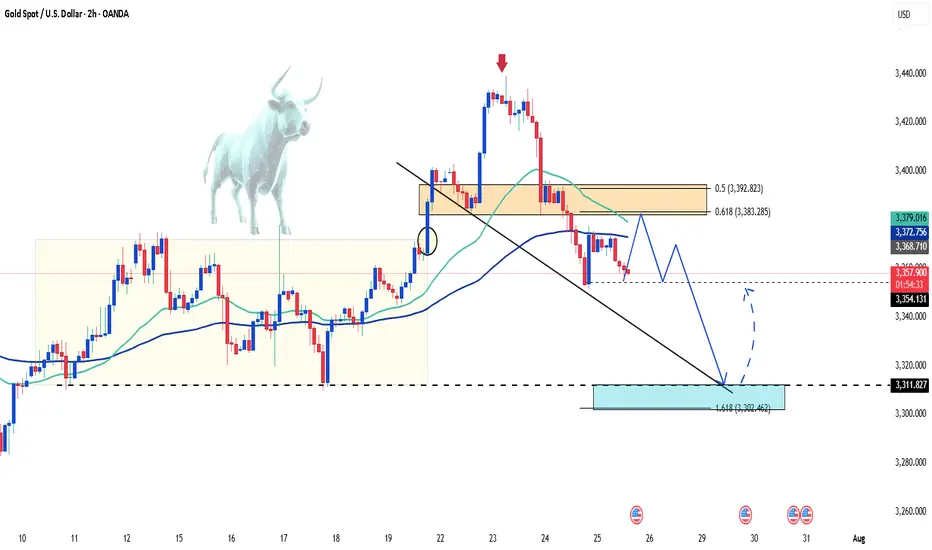

Gold prices continued to decline this morning as investors locked in profits following the precious metal’s recent rally above $3,400.

In the short term, further downside is possible if profit-taking persists and capital flows shift toward equities, especially as U.S. stock markets hover near record highs. However, gold remains a favored safe-haven asset for the long run amid ongoing global economic and geopolitical uncertainties.

Markets are also turning their focus to the upcoming Federal Reserve policy meeting on July 29–30. While the Fed is expected to hold interest rates steady this time, many investors still anticipate a potential rate cut in September. A low interest rate environment typically supports non-yielding assets like gold.

In the short term, further downside is possible if profit-taking persists and capital flows shift toward equities, especially as U.S. stock markets hover near record highs. However, gold remains a favored safe-haven asset for the long run amid ongoing global economic and geopolitical uncertainties.

Markets are also turning their focus to the upcoming Federal Reserve policy meeting on July 29–30. While the Fed is expected to hold interest rates steady this time, many investors still anticipate a potential rate cut in September. A low interest rate environment typically supports non-yielding assets like gold.

✅ Receive 7–10 high-quality signals daily for Forex, Gold, and Bitcoin

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+6v7LMJO7cI04Nzg1

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+6v7LMJO7cI04Nzg1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ Receive 7–10 high-quality signals daily for Forex, Gold, and Bitcoin

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+6v7LMJO7cI04Nzg1

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+6v7LMJO7cI04Nzg1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.