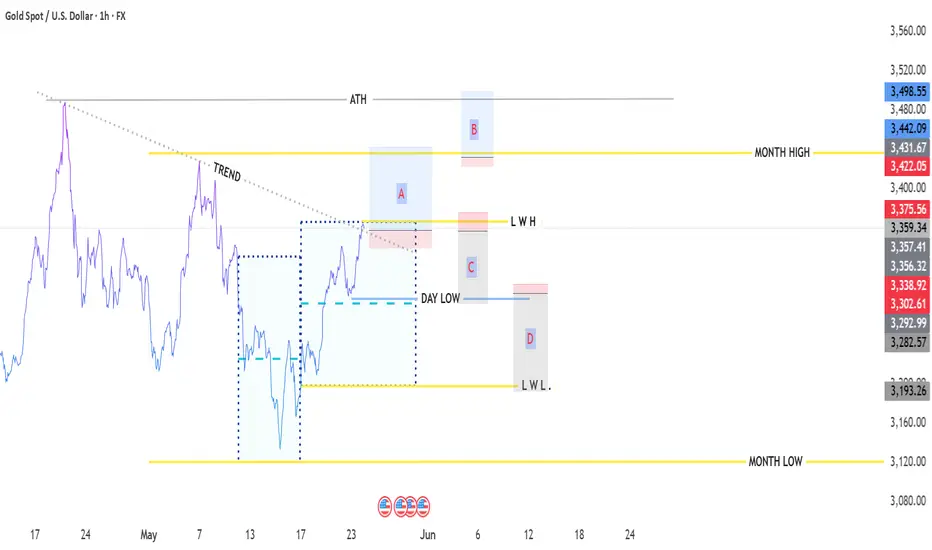

Current Market Status * price $3358

💡 LIKE AND FOLLOW FOR MORE 💡

📊 Key Events This Week:

May 28: FOMC Meeting

May 29: Unemployment Data

May 30: Core PCE Index

📈Long Position Setup (Buy Zone)

Entry: $3,350-$3,355

Targets:

------ $3,420 (2.1% gain)

------ $3,480 (3.9% gain)

------ $3,550 (5.7% gain)

Stop Loss: $3,300 (1.5% risk)

___ Rationale:

- Support at weekly zone ($3,330)

- Potential Fed dovish pivot

- Monthly light buyer interest

- Safe-haven demand potential

📉 Short Position Setup (Sell Zone)

Entry: $3,380-$3,390

Targets:

----- $3,330 (1.5% gain)

----- $3,280 (3.0% gain)

----- $3,220 (4.7% gain)

Stop Loss: $3,420 (1.2% risk)

___Rationale:

Resistance at weekly high ($3,586)

Potential strong USD if Fed remains hawkish

Overbought conditions possible

Profit-taking at key levels

⚠️ Critical Risk Factors

FOMC interest rate decision

US economic data surprises

Geopolitial developments

Physical gold demand changes

🔍 Key Technical Levels

Support: $3,330 (weekly), $3,280 (monthly)

Resistance: $3,420 (main zone), $3,550 (ATH)

Pivot Point: $3,360

💡 LIKE AND FOLLOW FOR MORE 💡

📊 Key Events This Week:

May 28: FOMC Meeting

May 29: Unemployment Data

May 30: Core PCE Index

📈Long Position Setup (Buy Zone)

Entry: $3,350-$3,355

Targets:

------ $3,420 (2.1% gain)

------ $3,480 (3.9% gain)

------ $3,550 (5.7% gain)

Stop Loss: $3,300 (1.5% risk)

___ Rationale:

- Support at weekly zone ($3,330)

- Potential Fed dovish pivot

- Monthly light buyer interest

- Safe-haven demand potential

📉 Short Position Setup (Sell Zone)

Entry: $3,380-$3,390

Targets:

----- $3,330 (1.5% gain)

----- $3,280 (3.0% gain)

----- $3,220 (4.7% gain)

Stop Loss: $3,420 (1.2% risk)

___Rationale:

Resistance at weekly high ($3,586)

Potential strong USD if Fed remains hawkish

Overbought conditions possible

Profit-taking at key levels

⚠️ Critical Risk Factors

FOMC interest rate decision

US economic data surprises

Geopolitial developments

Physical gold demand changes

🔍 Key Technical Levels

Support: $3,330 (weekly), $3,280 (monthly)

Resistance: $3,420 (main zone), $3,550 (ATH)

Pivot Point: $3,360

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.