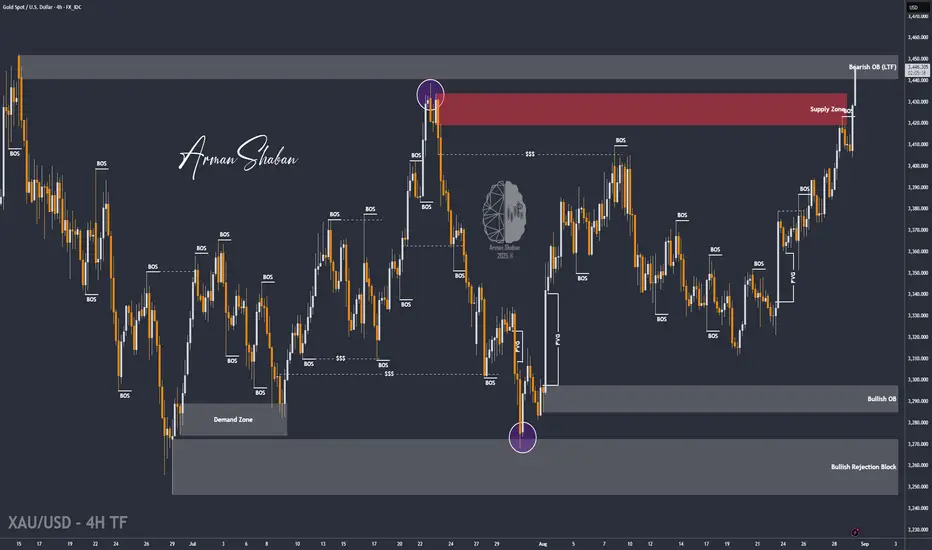

By analyzing the gold chart on the 4-hour timeframe, we can see that, as expected from our analysis two days ago, the price began its bullish move from the $3383 zone and successfully hit all four targets at $3393, $3398, $3404, and $3409 — but it didn’t stop there! Gold continued its rally beyond those levels.

As anticipated in yesterday’s outlook, we closely watched the $3419–$3429 supply zone for a potential bearish reaction. When price reached $3424, it dropped to $3404, validating our second scenario as well. Although the drop could’ve extended further, the combined result of both scenarios delivered over 500 pips of total profit!

After hitting $3404, gold gained demand again — and with the release of the U.S. Core PCE data, this bullish trend strengthened, pushing price up toward its all-time high (ATH) near $3500. Gold is now trading around $3447, just 500 pips away from that historic level.

Given the increasing odds of a Fed rate cut in September, the bullish momentum is likely to continue. In my view, a new ATH for gold could be on the horizon in the coming weeks.

Hope this analysis helps you ride the wave — make the most of it! 💰📈

THE LATEST ANALYSIS 👇🏼

Will $3500 be the next stop for gold? 👀

👇 Drop your thoughts below & don’t miss the next update!

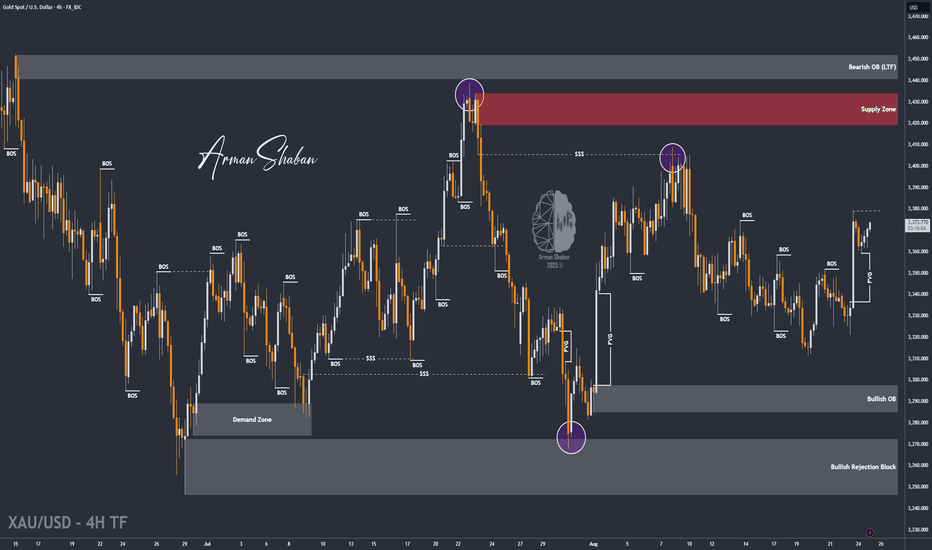

As anticipated in yesterday’s outlook, we closely watched the $3419–$3429 supply zone for a potential bearish reaction. When price reached $3424, it dropped to $3404, validating our second scenario as well. Although the drop could’ve extended further, the combined result of both scenarios delivered over 500 pips of total profit!

After hitting $3404, gold gained demand again — and with the release of the U.S. Core PCE data, this bullish trend strengthened, pushing price up toward its all-time high (ATH) near $3500. Gold is now trading around $3447, just 500 pips away from that historic level.

Given the increasing odds of a Fed rate cut in September, the bullish momentum is likely to continue. In my view, a new ATH for gold could be on the horizon in the coming weeks.

Hope this analysis helps you ride the wave — make the most of it! 💰📈

THE LATEST ANALYSIS 👇🏼

Will $3500 be the next stop for gold? 👀

👇 Drop your thoughts below & don’t miss the next update!

Trade active

By analyzing the gold chart on the 4-hour timeframe, we can see that today, as expected, gold continued its bullish move after the market opened and surged up to $3490, delivering an impressive gain of over 450 pips!After hitting this key level, selling pressure increased, leading to a pullback down to $3466. Currently, gold is trading around $3477, and I expect the next bullish leg to push it toward $3500, which is our next target.

Today, gold came within $10 of its previous All-Time High (ATH) — and now, we’re closer than ever to seeing a new record high!

📌 This analysis will be updated soon — stay tuned!

Trade closed: target reached

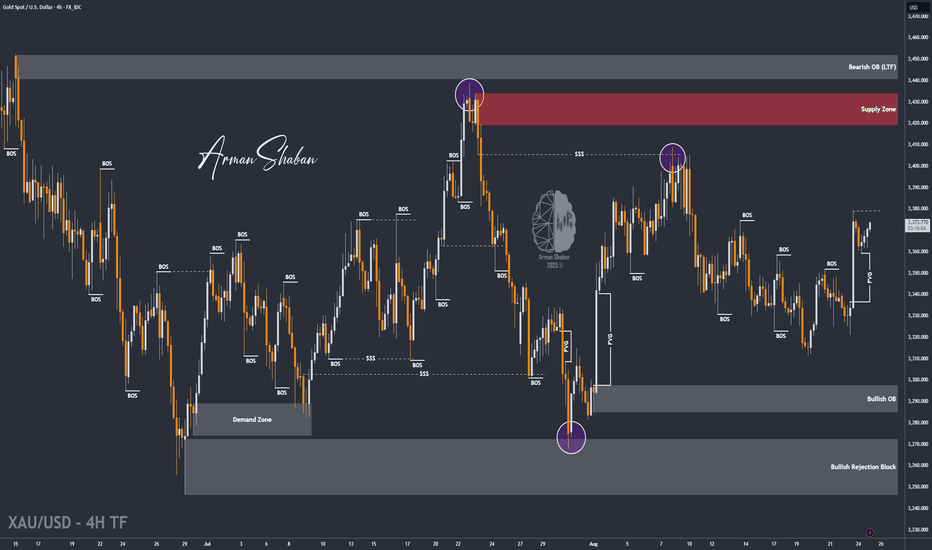

• Gold races to an all-time high above $3,500/ozSpot gold surged past the $3,500 mark, reaching a record price of $3,508.70/oz, driven by mounting expectations for a U.S. Federal Reserve rate cut, a weaker dollar, and global market uncertainty.

• Markets pricing in aggressive rate cuts

A softer dollar—hovering near a five-week low—combined with nearly 90% odds of a September rate cut, is fueling bullish sentiment in gold.

• Global uncertainty continues to boost demand

Investors are flocking to safe-haven assets amid continued economic and geopolitical tensions, propelling gold toward the $3,550–$3,570 range.

📊 Market Outlook

With Fed rate-cut bets intensifying and economic risks mounting, gold looks poised to challenge the $3,600 resistance soon. Weakness in the dollar and growing investor caution could keep the momentum strong—if the market remains resilient.

✅ Prepared by: Arman Shaban

⚜️ Free Telegram Channel : t.me/PriceAction_ICT

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚜️ Free Telegram Channel : t.me/PriceAction_ICT

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.