Hey traders 👋

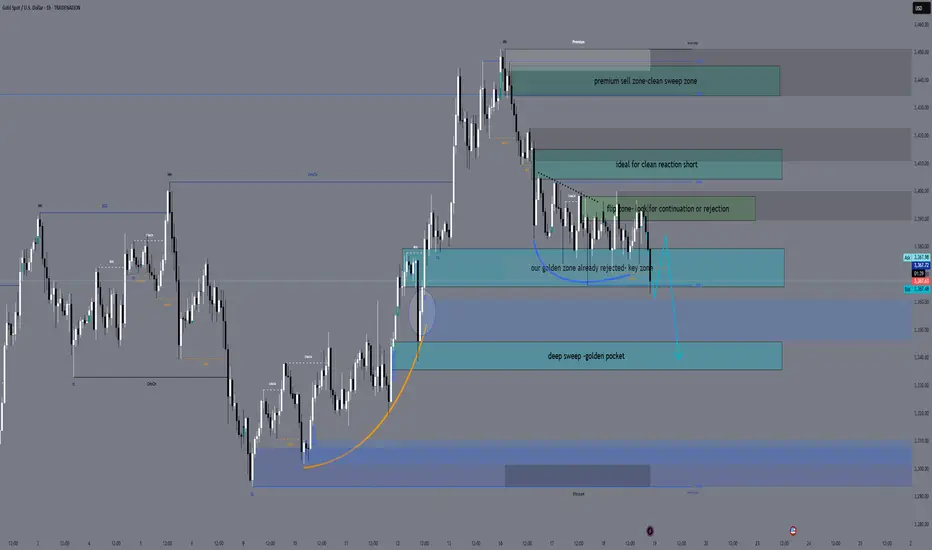

After yesterday’s FOMC fireworks and a weak reaction to initial retail sales data, gold broke structure into 3363 and is now floating below key resistance. Price is compressing under the previous H1 lower high, and liquidity continues to build on both sides — perfect conditions for engineered spikes.

Let’s break it down clearly.

🌍 Macro & Sentiment

Yesterday’s FOMC left rates unchanged, but Fed tone leaned hawkish.

Retail Sales and Unemployment Claims disappointed — slight downside pressure on the dollar.

Geopolitical front remains tense: no ceasefire in Gaza, Iran-Israel rhetoric escalates, and Russia-Ukraine conflict is ongoing.

Liquidity is king — and gold is being boxed for the next big move.

📉 Bias & Structure

Daily: Compression after FOMC, lower high remains in control.

H4: Bearish break below 3380, EMA21 hovering above price.

H1: Trendline structure broken, EMA5/21 forming bearish cross, RSI below 50.

Fibo: H1 drawn from 3452 to 3363 — key golden zone at 3405–3415.

🎯 Bias: Tactical Bearish under 3415 — looking for short-term bounces or premium traps to sell.

🧠 Sniper Zones

🔻 Sell Zones

1️⃣ 3405 – 3415

→ Key golden zone + EMA21 + FVG

→ Monitor M15/M5 rejection for continuation sells

2️⃣ 3435 – 3445

→ Premium OB trap zone

→ If price spikes irrationally, this becomes the extreme reversal area

🔺 Buy Zones

1️⃣ 3365 – 3380

→ Golden buy zone — real fib confluence

→ Already tapped today, but any clean retest may offer reactive bounce trades

2️⃣ 3335 – 3345

→ Extreme flush zone — only valid if deep dump occurs

→ Watch for exhaustion and M15 reversal confirmation

🔻 Emergency Buy Zone:

3305 – 3292

🧠 Why this zone?

✅ H4 untested Order Block + FVG (June 11 candle).

✅ 78.6% Fibonacci retracement (H1 swing from 3452 → 3363).

✅ RSI likely to print oversold.

✅ Deep discount structure — potential final inducement for reversal.

🔔 Important:

This is a backup zone, not for blind entries.

It only becomes active if 3335 breaks with conviction (full candle body close + volume).

Look for M15/M5 confirmation (divergence + price action signal) before engaging.

🔄 Flip Zone

3390 – 3398

→ Volume zone from FOMC + OB test

→ If reclaimed cleanly, may flip intraday bias short-term

📌 Battle Notes

Gold tapped 3363 today, reacting mildly.

If price retraces toward 3405–3415, I’ll watch for shorts — but no early entries.

Below 3365, watch for another bounce or setup around 3345.

Flip zone remains indecisive until confirmed with volume.

🧭 Plan Recap

→ Bearish under 3415

→ Pullback into 3405–3415 = short setup

→ Retest 3365–3380 = bounce watch

→ Flush into 3335 = reversal zone

→ 3435+ = irrational spike trap

🧠 Stay sniper. Wait for price to come to your zones — and execute only on confirmed reactions.

—

🚀 If this helped bring clarity, tap that 🚀, leave your bias in the comments, and hit FOLLOW for real structure-based trading.

🟨 Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

— GoldFxMinds 🧠✨

After yesterday’s FOMC fireworks and a weak reaction to initial retail sales data, gold broke structure into 3363 and is now floating below key resistance. Price is compressing under the previous H1 lower high, and liquidity continues to build on both sides — perfect conditions for engineered spikes.

Let’s break it down clearly.

🌍 Macro & Sentiment

Yesterday’s FOMC left rates unchanged, but Fed tone leaned hawkish.

Retail Sales and Unemployment Claims disappointed — slight downside pressure on the dollar.

Geopolitical front remains tense: no ceasefire in Gaza, Iran-Israel rhetoric escalates, and Russia-Ukraine conflict is ongoing.

Liquidity is king — and gold is being boxed for the next big move.

📉 Bias & Structure

Daily: Compression after FOMC, lower high remains in control.

H4: Bearish break below 3380, EMA21 hovering above price.

H1: Trendline structure broken, EMA5/21 forming bearish cross, RSI below 50.

Fibo: H1 drawn from 3452 to 3363 — key golden zone at 3405–3415.

🎯 Bias: Tactical Bearish under 3415 — looking for short-term bounces or premium traps to sell.

🧠 Sniper Zones

🔻 Sell Zones

1️⃣ 3405 – 3415

→ Key golden zone + EMA21 + FVG

→ Monitor M15/M5 rejection for continuation sells

2️⃣ 3435 – 3445

→ Premium OB trap zone

→ If price spikes irrationally, this becomes the extreme reversal area

🔺 Buy Zones

1️⃣ 3365 – 3380

→ Golden buy zone — real fib confluence

→ Already tapped today, but any clean retest may offer reactive bounce trades

2️⃣ 3335 – 3345

→ Extreme flush zone — only valid if deep dump occurs

→ Watch for exhaustion and M15 reversal confirmation

🔻 Emergency Buy Zone:

3305 – 3292

🧠 Why this zone?

✅ H4 untested Order Block + FVG (June 11 candle).

✅ 78.6% Fibonacci retracement (H1 swing from 3452 → 3363).

✅ RSI likely to print oversold.

✅ Deep discount structure — potential final inducement for reversal.

🔔 Important:

This is a backup zone, not for blind entries.

It only becomes active if 3335 breaks with conviction (full candle body close + volume).

Look for M15/M5 confirmation (divergence + price action signal) before engaging.

🔄 Flip Zone

3390 – 3398

→ Volume zone from FOMC + OB test

→ If reclaimed cleanly, may flip intraday bias short-term

📌 Battle Notes

Gold tapped 3363 today, reacting mildly.

If price retraces toward 3405–3415, I’ll watch for shorts — but no early entries.

Below 3365, watch for another bounce or setup around 3345.

Flip zone remains indecisive until confirmed with volume.

🧭 Plan Recap

→ Bearish under 3415

→ Pullback into 3405–3415 = short setup

→ Retest 3365–3380 = bounce watch

→ Flush into 3335 = reversal zone

→ 3435+ = irrational spike trap

🧠 Stay sniper. Wait for price to come to your zones — and execute only on confirmed reactions.

—

🚀 If this helped bring clarity, tap that 🚀, leave your bias in the comments, and hit FOLLOW for real structure-based trading.

🟨 Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

— GoldFxMinds 🧠✨

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.