🧠 Combined Market Intelligence Report

Focus Asset: XAU/USD (Gold/USD)

Current Price: $3,381.65

🌍 Macro Overview: Key Weekly Market Themes

🏦 Central Bank Policy Divergence

Federal Reserve: Held rates steady; Powell struck a more cautious tone. Seven members now forecast no cuts in 2025. Rate cut probability softened early in the week, then revived after Fed Governor Waller hinted at a possible July cut.

Swiss National Bank (SNB): Cut rates to 0.00%, surprising markets and signaling potential for negative rates if needed.

Bank of Japan (BOJ): Maintained rates at 0.50%, slowed bond tapering, signaled caution amid trade and inflation uncertainty.

ECB & BOE: Mostly neutral/dovish tones. ECB may cut in 6 months; BOE remained split.

🧩 Implication: Diverging monetary paths and policy uncertainty support demand for neutral reserve assets like gold.

⚔️ Geopolitical Risk: Israel-Iran Conflict

Markets opened bullish on gold due to de-escalation signals from Iran, but risk-off sentiment returned midweek after:

Trump’s “unconditional surrender” demand

Iran’s “irreparable damage” threat

Reports of possible U.S. strikes

By Friday, Trump hit “pause” for 2 weeks of diplomacy.

🧩 Implication: Geopolitical tension is unresolved. Gold remains a top safe-haven hedge as military conflict risk persists.

📉 Macro Data Weakness

U.S. Retail Sales: -0.9% (vs. -0.4% expected)

U.S. Industrial Production: -0.2%

Philly Fed Manufacturing: -4.0

UK Retail Sales: -2.7% m/m

Eurozone Wage Growth: 3.4% y/y (missed expectations)

Australia Jobs: -2.5k (vs. +15k expected)

🧩 Implication: Global slowdown signals strengthen gold’s appeal as a defensive and inflation-hedging asset.

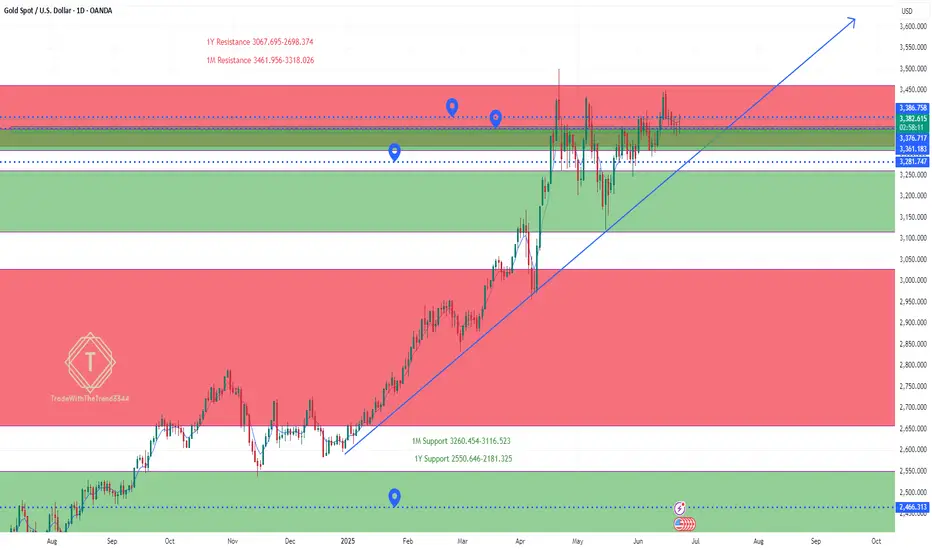

📊 Technical Outlook for XAU/USD (Gold)

🔹 Current Price: $3,381.65

🔸 Key Indicators (1D)

Indicator Value Signal

RSI 55.65 Slightly bullish (>50)

Stochastic %K / %D 51.23 / 53.33 Neutral zone

Williams %R -44.18 Mid-range, no strong signal

Bollinger Mid-Band 3,381.55 Price = BB midline (balance point)

Keltner Mid-Channel 3,381.94 Matching price (consolidation)

📍 Key Price Levels

Support: $3,360 → $3,345

Resistance: $3,410 → $3,430

Breakout Point: Close above $3,410 confirms upside momentum

Breakdown Point: Close below $3,360 confirms renewed selling pressure

📈 Forecast for Gold (XAU/USD) – Next 1–5 Days

🔮 Fundamental Bias: 🔼 Mildly Bullish

Unresolved geopolitical tension = sustained safe-haven flows

Global economic softness = pressure on real yields

Mixed Fed tone, SNB cut = supportive macro backdrop for gold

📉 Technical Bias: 🔁 Neutral to Bullish

RSI above 50, price above major midlines = buyers still in control

Consolidation at key pivot level ($3,381) suggests accumulation, not exhaustion

If price breaks above $3,410 and sustains, rally toward $3,430–3,460 is likely

If price breaks below $3,360, watch for a retest of $3,345–3,330 support zone

🎯 Final XAU/USD Forecast Summary

Time Frame Direction Price Targets Confidence Risk Catalyst

1–2 Days 🔁 Sideways-to-Bullish $3,390 → $3,410 Moderate News on Fed, Trump-Iran

3–5 Days 🔼 Bullish $3,430 → $3,460 High Breakout + geopolitics

Bearish Case 🔽 If < $3,360 $3,345 → $3,330 Moderate Peace deal + strong USD

⚠️ Trade Considerations

If bullish breakout (> $3,410) → potential swing trade toward $3,460

If failed breakout (< $3,360) → reversion trade toward $3,330

Avoid aggressive positions until volatility picks up, as current setup is range-bound with breakout potential.

The Support and Resistance outlined in green and red are the respective support/resistance for this pair currently for 1M-1Y timeframes!

No Nonsense. Just Really Good Market Insights. Leave a Boost

TradeWithTheTrend3344

Focus Asset: XAU/USD (Gold/USD)

Current Price: $3,381.65

🌍 Macro Overview: Key Weekly Market Themes

🏦 Central Bank Policy Divergence

Federal Reserve: Held rates steady; Powell struck a more cautious tone. Seven members now forecast no cuts in 2025. Rate cut probability softened early in the week, then revived after Fed Governor Waller hinted at a possible July cut.

Swiss National Bank (SNB): Cut rates to 0.00%, surprising markets and signaling potential for negative rates if needed.

Bank of Japan (BOJ): Maintained rates at 0.50%, slowed bond tapering, signaled caution amid trade and inflation uncertainty.

ECB & BOE: Mostly neutral/dovish tones. ECB may cut in 6 months; BOE remained split.

🧩 Implication: Diverging monetary paths and policy uncertainty support demand for neutral reserve assets like gold.

⚔️ Geopolitical Risk: Israel-Iran Conflict

Markets opened bullish on gold due to de-escalation signals from Iran, but risk-off sentiment returned midweek after:

Trump’s “unconditional surrender” demand

Iran’s “irreparable damage” threat

Reports of possible U.S. strikes

By Friday, Trump hit “pause” for 2 weeks of diplomacy.

🧩 Implication: Geopolitical tension is unresolved. Gold remains a top safe-haven hedge as military conflict risk persists.

📉 Macro Data Weakness

U.S. Retail Sales: -0.9% (vs. -0.4% expected)

U.S. Industrial Production: -0.2%

Philly Fed Manufacturing: -4.0

UK Retail Sales: -2.7% m/m

Eurozone Wage Growth: 3.4% y/y (missed expectations)

Australia Jobs: -2.5k (vs. +15k expected)

🧩 Implication: Global slowdown signals strengthen gold’s appeal as a defensive and inflation-hedging asset.

📊 Technical Outlook for XAU/USD (Gold)

🔹 Current Price: $3,381.65

🔸 Key Indicators (1D)

Indicator Value Signal

RSI 55.65 Slightly bullish (>50)

Stochastic %K / %D 51.23 / 53.33 Neutral zone

Williams %R -44.18 Mid-range, no strong signal

Bollinger Mid-Band 3,381.55 Price = BB midline (balance point)

Keltner Mid-Channel 3,381.94 Matching price (consolidation)

📍 Key Price Levels

Support: $3,360 → $3,345

Resistance: $3,410 → $3,430

Breakout Point: Close above $3,410 confirms upside momentum

Breakdown Point: Close below $3,360 confirms renewed selling pressure

📈 Forecast for Gold (XAU/USD) – Next 1–5 Days

🔮 Fundamental Bias: 🔼 Mildly Bullish

Unresolved geopolitical tension = sustained safe-haven flows

Global economic softness = pressure on real yields

Mixed Fed tone, SNB cut = supportive macro backdrop for gold

📉 Technical Bias: 🔁 Neutral to Bullish

RSI above 50, price above major midlines = buyers still in control

Consolidation at key pivot level ($3,381) suggests accumulation, not exhaustion

If price breaks above $3,410 and sustains, rally toward $3,430–3,460 is likely

If price breaks below $3,360, watch for a retest of $3,345–3,330 support zone

🎯 Final XAU/USD Forecast Summary

Time Frame Direction Price Targets Confidence Risk Catalyst

1–2 Days 🔁 Sideways-to-Bullish $3,390 → $3,410 Moderate News on Fed, Trump-Iran

3–5 Days 🔼 Bullish $3,430 → $3,460 High Breakout + geopolitics

Bearish Case 🔽 If < $3,360 $3,345 → $3,330 Moderate Peace deal + strong USD

⚠️ Trade Considerations

If bullish breakout (> $3,410) → potential swing trade toward $3,460

If failed breakout (< $3,360) → reversion trade toward $3,330

Avoid aggressive positions until volatility picks up, as current setup is range-bound with breakout potential.

The Support and Resistance outlined in green and red are the respective support/resistance for this pair currently for 1M-1Y timeframes!

No Nonsense. Just Really Good Market Insights. Leave a Boost

TradeWithTheTrend3344

Trade active

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.