Technical picture

Bullish momentum is strengthening: US jobs shortage has caused an influx into safe havens, which has contributed to gold's growth

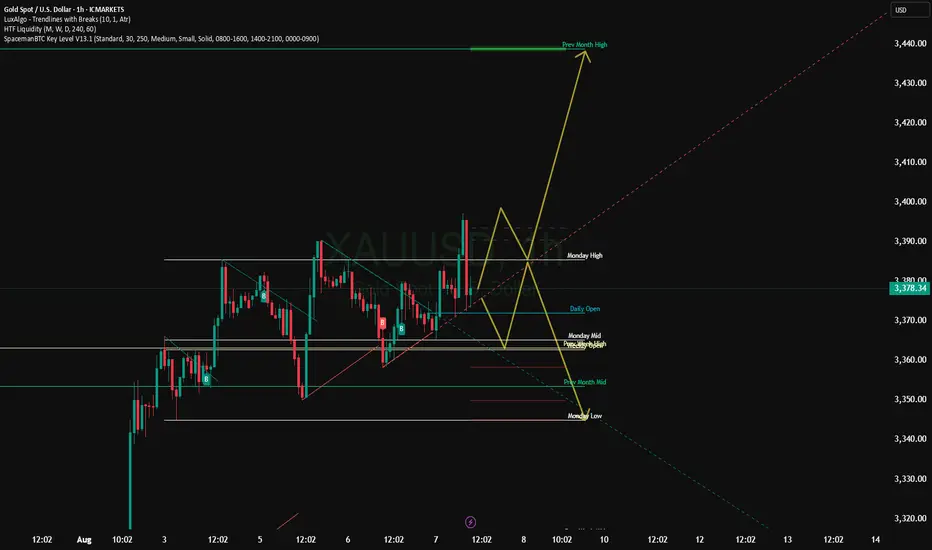

A reversal signal is forming: a bounce from the lower line of Bollinger Bands is observed, and a bullish cross of EMA-8 and EMA-21 is also forming, plus a moderately positive MACD - a classic "buy on dip" entry pattern

Key levels:

Support: around $3,330 - a support zone coinciding with the 21- and 50-day SMAs. Below — potential for decline to $3,297-$3,283

Resistance: $3,380 — resistance, breakout of which could open the way to $3,440-$3,450

Structural pattern: breakout from triangle to the downside could signal a deeper correction

Industry consensus: Citi has revised its target range up to $3,300-$3,600 in the next three months, based on a weak US economy and rising geo-risk

Meanwhile, HSBC warns of possible weakness — forecast for 2025-2026 from $3,215 to $2,350 in a more bearish scenario

Bullish momentum is strengthening: US jobs shortage has caused an influx into safe havens, which has contributed to gold's growth

A reversal signal is forming: a bounce from the lower line of Bollinger Bands is observed, and a bullish cross of EMA-8 and EMA-21 is also forming, plus a moderately positive MACD - a classic "buy on dip" entry pattern

Key levels:

Support: around $3,330 - a support zone coinciding with the 21- and 50-day SMAs. Below — potential for decline to $3,297-$3,283

Resistance: $3,380 — resistance, breakout of which could open the way to $3,440-$3,450

Structural pattern: breakout from triangle to the downside could signal a deeper correction

Industry consensus: Citi has revised its target range up to $3,300-$3,600 in the next three months, based on a weak US economy and rising geo-risk

Meanwhile, HSBC warns of possible weakness — forecast for 2025-2026 from $3,215 to $2,350 in a more bearish scenario

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.