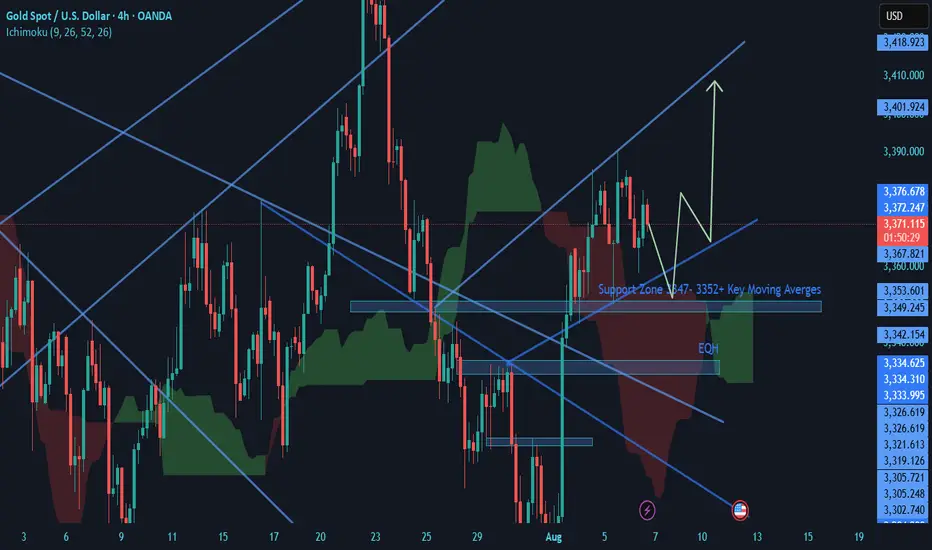

Gold Technical Update:

Gold is currently exhibiting a bullish market structure, forming a bullish flag pattern on both the 4H and Daily timeframes, alongside an ascending triangle formation. Once this pattern completes, a breakout above the 3390 resistance is likely, potentially pushing the price toward the 3400–3430 zone.

Price remains above the Ichimoku Cloud, which indicates continued bullish momentum and provides a strong support zone around 3345–3352, reinforced by moving averages and structural support levels.

Today, the price has made a higher low at 3358, compared to the previous day’s low, suggesting strength in the current uptrend. A break above the psychological level of 3400 is anticipated, which could trigger bullish continuation toward 3430.

In light of the current technical setup, I maintain a bullish outlook, expecting the trend to continue. However, this view will be reassessed if price breaks below the daily lows of Tuesday and Wednesday, and closes below the 50-day moving average.

Good luck and trade safe!

Gold is currently exhibiting a bullish market structure, forming a bullish flag pattern on both the 4H and Daily timeframes, alongside an ascending triangle formation. Once this pattern completes, a breakout above the 3390 resistance is likely, potentially pushing the price toward the 3400–3430 zone.

Price remains above the Ichimoku Cloud, which indicates continued bullish momentum and provides a strong support zone around 3345–3352, reinforced by moving averages and structural support levels.

Today, the price has made a higher low at 3358, compared to the previous day’s low, suggesting strength in the current uptrend. A break above the psychological level of 3400 is anticipated, which could trigger bullish continuation toward 3430.

In light of the current technical setup, I maintain a bullish outlook, expecting the trend to continue. However, this view will be reassessed if price breaks below the daily lows of Tuesday and Wednesday, and closes below the 50-day moving average.

Good luck and trade safe!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.