Fundamental Analysis: What’s Shaking Up Gold Prices?

USD Index Up 0.2%: A stronger dollar makes gold pricier for foreign buyers, creating short-term pressure. But don’t worry—gold remains the ultimate safe-haven in times of uncertainty! 📉

US Treasury Yields Rise 0.4%: Higher yields make non-yielding gold less attractive. Still, with persistent inflation, gold’s allure as a hedge stays strong! ⚖️

Fed Drama: Trump vs. Lisa Cook: Earlier this week, Trump announced plans to oust Fed Governor Lisa Cook from the Board of Governors. Cook’s legal team fired back, filing a lawsuit to block her removal, setting the stage for a prolonged legal battle. The result? Gold surged to a 2-week high on August 26 following this news. Political uncertainty = Rocket fuel for gold! 🔥🇺🇸

Key Economic Data on the Horizon: Investors are on edge awaiting GDP data today (28/08) and the PCE index—Fed’s favorite inflation gauge—on 29/08. Reuters’ poll forecasts PCE inflation at 2.6% for July 2025, matching June’s level. If the data comes in softer than expected, the Fed might cut rates, sending gold soaring! 📊 What’s your take on the Fed’s next rate move?

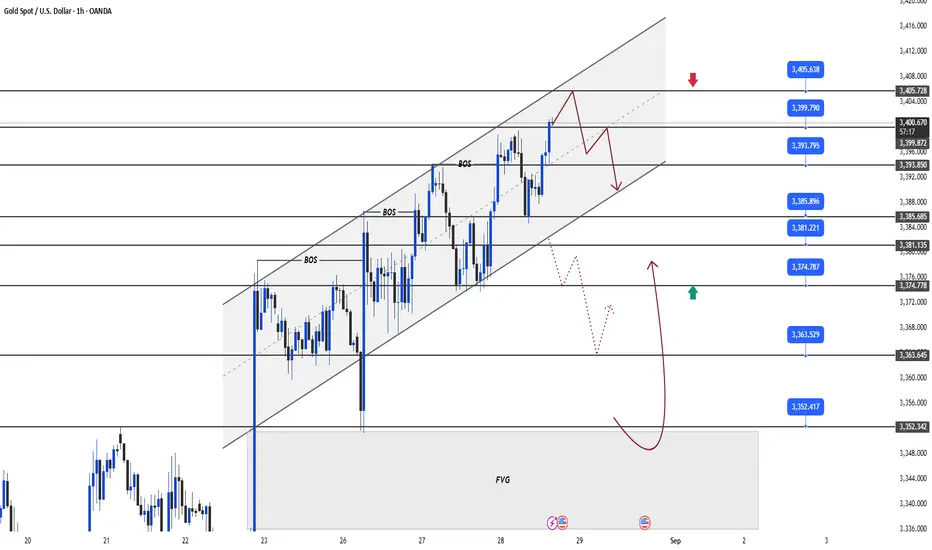

Technical Analysis: Bullish Trend Intact, But Watch for a Pullback!

Gold continues its bullish run, breaking through the 3393 level with a clear BOS (Break of Structure), signaling the uptrend is alive and well! However, price is hesitating around the 340x resistance zone, with risks of a sharp pullback at any moment. Strategy: BUY short-term to ride the momentum, but be ready to SELL on signs of a structural reversal. Don’t miss out! 📉📈

Key Resistance: 3399 - 3405

Key Support: 3393 - 3385 - 3381 - 3374 - 3363 - 3352

Sell Zone: 3403 - 3405

SL: 3410

TP: 3399 - 3393 - 3385 - 3381 - 3374

Buy Zone: 3375 - 3373

SL: 3369

TP: 3381 - 3385 - 3393 - 3400

#Gold #XAUUSD #TradingView #Fed #Trump #PCE #GDP #GoldTrading #Finance #Investing #TechnicalAnalysis #MarketUpdate #Crypto #Forex

USD Index Up 0.2%: A stronger dollar makes gold pricier for foreign buyers, creating short-term pressure. But don’t worry—gold remains the ultimate safe-haven in times of uncertainty! 📉

US Treasury Yields Rise 0.4%: Higher yields make non-yielding gold less attractive. Still, with persistent inflation, gold’s allure as a hedge stays strong! ⚖️

Fed Drama: Trump vs. Lisa Cook: Earlier this week, Trump announced plans to oust Fed Governor Lisa Cook from the Board of Governors. Cook’s legal team fired back, filing a lawsuit to block her removal, setting the stage for a prolonged legal battle. The result? Gold surged to a 2-week high on August 26 following this news. Political uncertainty = Rocket fuel for gold! 🔥🇺🇸

Key Economic Data on the Horizon: Investors are on edge awaiting GDP data today (28/08) and the PCE index—Fed’s favorite inflation gauge—on 29/08. Reuters’ poll forecasts PCE inflation at 2.6% for July 2025, matching June’s level. If the data comes in softer than expected, the Fed might cut rates, sending gold soaring! 📊 What’s your take on the Fed’s next rate move?

Technical Analysis: Bullish Trend Intact, But Watch for a Pullback!

Gold continues its bullish run, breaking through the 3393 level with a clear BOS (Break of Structure), signaling the uptrend is alive and well! However, price is hesitating around the 340x resistance zone, with risks of a sharp pullback at any moment. Strategy: BUY short-term to ride the momentum, but be ready to SELL on signs of a structural reversal. Don’t miss out! 📉📈

Key Resistance: 3399 - 3405

Key Support: 3393 - 3385 - 3381 - 3374 - 3363 - 3352

Sell Zone: 3403 - 3405

SL: 3410

TP: 3399 - 3393 - 3385 - 3381 - 3374

Buy Zone: 3375 - 3373

SL: 3369

TP: 3381 - 3385 - 3393 - 3400

#Gold #XAUUSD #TradingView #Fed #Trump #PCE #GDP #GoldTrading #Finance #Investing #TechnicalAnalysis #MarketUpdate #Crypto #Forex

🔥 Ready to Elevate Your Trading Game?

t.me/+1aSqbdspbEdkYjU9

✅ Dive into in-depth technical & fundamental analysis

✅ Master risk management tips to safeguard your capital

📩 Join our TradingView community now!

t.me/+1aSqbdspbEdkYjU9

t.me/+1aSqbdspbEdkYjU9

✅ Dive into in-depth technical & fundamental analysis

✅ Master risk management tips to safeguard your capital

📩 Join our TradingView community now!

t.me/+1aSqbdspbEdkYjU9

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔥 Ready to Elevate Your Trading Game?

t.me/+1aSqbdspbEdkYjU9

✅ Dive into in-depth technical & fundamental analysis

✅ Master risk management tips to safeguard your capital

📩 Join our TradingView community now!

t.me/+1aSqbdspbEdkYjU9

t.me/+1aSqbdspbEdkYjU9

✅ Dive into in-depth technical & fundamental analysis

✅ Master risk management tips to safeguard your capital

📩 Join our TradingView community now!

t.me/+1aSqbdspbEdkYjU9

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.