Hello everyone, what’s your view on  XAUUSD ?

XAUUSD ?

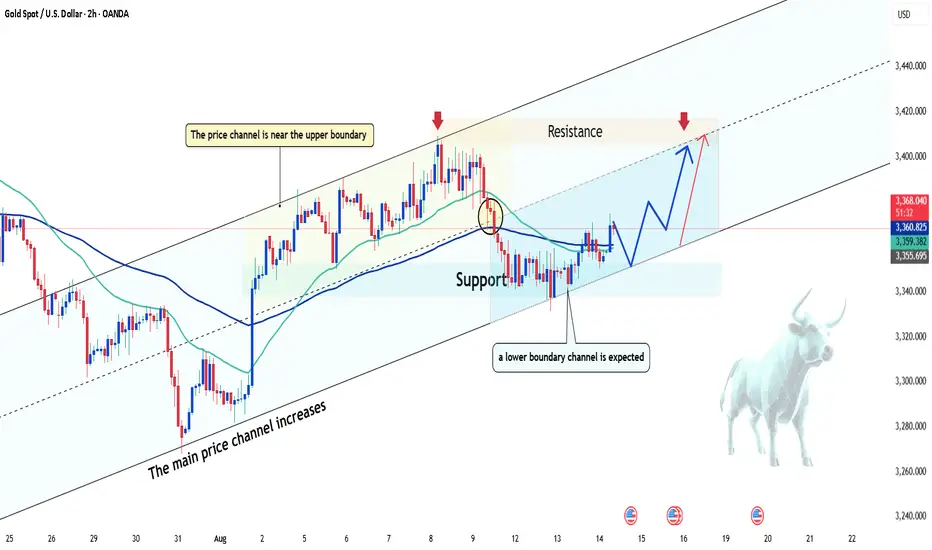

Gold is reversing some of its previous losses and is moving within an upward price channel. The precious metal has climbed to $3,368, recovering more than $12 on the day. This marks a rebound in the global gold market after two consecutive sessions of decline.

A weaker US dollar has supported this uptick, with gold hovering around $3,350/oz ahead of the upcoming meeting between US President Donald Trump and Russian President Vladimir Putin. If the Alaska meeting fails to resolve tensions, gold could climb back toward the $3,400 mark.

From a technical perspective, gold is moving in a main upward channel and could form two smaller sub-channels (the upper channel already completed). If support near $3,350 holds, the next target will be the round $3,400 level.

Looking at the outlook: Today, key economic indicators, including Core PPI (Core Producer Price Index), PPI (Producer Price Index), and Unemployment Claims, will be released. Forecasts suggest that Core PPI and PPI will increase by 0.2%, while Unemployment Claims are expected to drop to 225K.

If PPI is high, this could cause the Fed to maintain high interest rates, putting downward pressure on gold. However, if Unemployment Claims increase, gold could benefit from its safe-haven role and continue to rise (two opposing factors). Therefore, follow these developments to determine the precise direction for gold.

With this information, I am leaning towards a recovery in gold. What about you?

Gold is reversing some of its previous losses and is moving within an upward price channel. The precious metal has climbed to $3,368, recovering more than $12 on the day. This marks a rebound in the global gold market after two consecutive sessions of decline.

A weaker US dollar has supported this uptick, with gold hovering around $3,350/oz ahead of the upcoming meeting between US President Donald Trump and Russian President Vladimir Putin. If the Alaska meeting fails to resolve tensions, gold could climb back toward the $3,400 mark.

From a technical perspective, gold is moving in a main upward channel and could form two smaller sub-channels (the upper channel already completed). If support near $3,350 holds, the next target will be the round $3,400 level.

Looking at the outlook: Today, key economic indicators, including Core PPI (Core Producer Price Index), PPI (Producer Price Index), and Unemployment Claims, will be released. Forecasts suggest that Core PPI and PPI will increase by 0.2%, while Unemployment Claims are expected to drop to 225K.

If PPI is high, this could cause the Fed to maintain high interest rates, putting downward pressure on gold. However, if Unemployment Claims increase, gold could benefit from its safe-haven role and continue to rise (two opposing factors). Therefore, follow these developments to determine the precise direction for gold.

With this information, I am leaning towards a recovery in gold. What about you?

Trade active

Gold is trading around 3,350 USD — pay attention, if it breaks and closes below this level, buying will no longer be the priority!Note

Contrary to expectations, gold saw a steep correction yesterday. The precious metal is now trading around 3,340 USD, roughly 20 USD lower than the previous session’s high.Note

This drop came after yesterday’s economic data release. Both the US Core PPI and PPI m/m surged by 0.9% (well above the 0.2% forecast), signaling significant producer inflation pressure. At the same time, Initial Jobless Claims fell slightly to 224K, better than the 225K forecast.✅ Receive 7–10 high-quality signals daily for Forex, Gold, and Bitcoin

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+6v7LMJO7cI04Nzg1

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+6v7LMJO7cI04Nzg1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ Receive 7–10 high-quality signals daily for Forex, Gold, and Bitcoin

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+6v7LMJO7cI04Nzg1

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+6v7LMJO7cI04Nzg1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.