Core Themes

1. Geopolitical Drivers: Escalating tensions in the Middle East, particularly U.S. airstrikes on Iranian nuclear facilities, are fueling gold's "flight to safety" narrative. Analysts anticipate sustained demand for gold amid potential regional conflict.

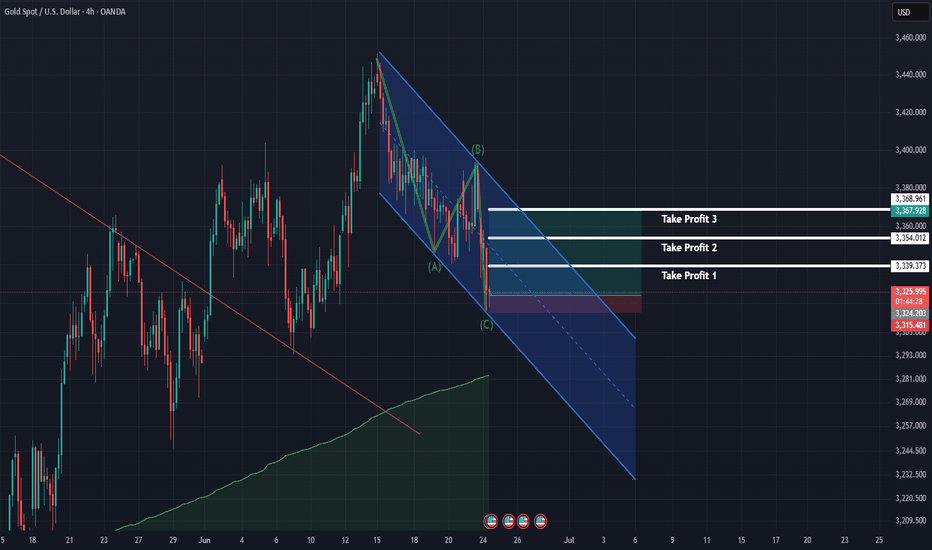

2. Technical Bullish Bias: Gold is in an uptrend, respecting key support levels and forming higher lows within an ascending channel. Breakouts above resistance (e.g., $3,439–$3,501) could validate further gains.

3. Correction vs. Continuation: While short-term pullbacks are expected (e.g., testing $3,320–$3,200), the broader bullish structure suggests corrections are temporary.

---

Key Technical Levels

Support:

- Immediate: $3,320 (lower channel boundary)

- Deeper: $3,200 (critical level; break could extend corrections)

Resistance:

- Short-term: $3,378–$3,382 (upper channel boundary)

- Mid-term: $3,439 (previous resistance; target for bullish continuation)

- Long-term: $3,501 (potential next resistance; requires strong momentum)

Fibonacci Retracements:

- 23.6%: $3,360–$3,370 (support zone for long entries)

- 50.0%: $3,400 (conservative take-profit target)

- 61.8%: $3,415 (key golden ratio level; likely Wave (5) peak)

- 100%: $3,435–$3,440 (aggressive target; upper channel line)

---

Trade Setups & Strategies

1. Long Entry:

- Target: $3,400–$3,435 (Fibonacci extensions)

- Stop-Loss: Below $3,315 (break of key support)

- Entry Zone: $3,360–$3,370 (near ascending channel support and 23.6% Fib)

2. Bullish Confirmation:

- Breakout Above $3,378: Validates continuation toward $3,439 and $3,501.

- Volume Increase: Confirms strength at key levels (e.g., $3,360–$3,370).

---

Risk Management & Key Risks

- Stop-Loss Placement:

- Longs: Below $3,315 (protects against deeper corrections).

- Shorts: Above $3,350 (avoids false breakouts).

- Volatility: Monitor geopolitical developments (e.g., U.S.-Iran escalation) that could trigger rapid price swings.

- Correction Risks: If gold fails to hold $3,320, a drop to $3,200 may occur, requiring tighter stops.

---

Fundamental Outlook

- Safe-Haven Demand: Rising tensions are likely to sustain gold's appeal.

- Inflation & Rate Outlook: Persistent inflation concerns and potential rate cuts (if economic data weakens) could further support gold.

- Negotiation Risk: De-escalation or Iran's concessions may pause the bullish momentum, leading to a reversal toward $3,340–$3,320.

---

Conclusion

Gold is in a strong bullish phase, driven by geopolitical risks and technical structure. Traders should focus on buying dips near $3,320–$3,370 with targets toward $3,439–$3,501. However, monitor the $3,320 support and geopolitical developments closely. If the trend breaks, a retest of $3,200 could follow. Always use stop-losses to manage risk.

Final Note: The market is highly volatile, so position sizing and risk management are critical. Stay alert for news updates and technical confirmations (e.g., closes above $3,378)

1. Geopolitical Drivers: Escalating tensions in the Middle East, particularly U.S. airstrikes on Iranian nuclear facilities, are fueling gold's "flight to safety" narrative. Analysts anticipate sustained demand for gold amid potential regional conflict.

2. Technical Bullish Bias: Gold is in an uptrend, respecting key support levels and forming higher lows within an ascending channel. Breakouts above resistance (e.g., $3,439–$3,501) could validate further gains.

3. Correction vs. Continuation: While short-term pullbacks are expected (e.g., testing $3,320–$3,200), the broader bullish structure suggests corrections are temporary.

---

Key Technical Levels

Support:

- Immediate: $3,320 (lower channel boundary)

- Deeper: $3,200 (critical level; break could extend corrections)

Resistance:

- Short-term: $3,378–$3,382 (upper channel boundary)

- Mid-term: $3,439 (previous resistance; target for bullish continuation)

- Long-term: $3,501 (potential next resistance; requires strong momentum)

Fibonacci Retracements:

- 23.6%: $3,360–$3,370 (support zone for long entries)

- 50.0%: $3,400 (conservative take-profit target)

- 61.8%: $3,415 (key golden ratio level; likely Wave (5) peak)

- 100%: $3,435–$3,440 (aggressive target; upper channel line)

---

Trade Setups & Strategies

1. Long Entry:

- Target: $3,400–$3,435 (Fibonacci extensions)

- Stop-Loss: Below $3,315 (break of key support)

- Entry Zone: $3,360–$3,370 (near ascending channel support and 23.6% Fib)

2. Bullish Confirmation:

- Breakout Above $3,378: Validates continuation toward $3,439 and $3,501.

- Volume Increase: Confirms strength at key levels (e.g., $3,360–$3,370).

---

Risk Management & Key Risks

- Stop-Loss Placement:

- Longs: Below $3,315 (protects against deeper corrections).

- Shorts: Above $3,350 (avoids false breakouts).

- Volatility: Monitor geopolitical developments (e.g., U.S.-Iran escalation) that could trigger rapid price swings.

- Correction Risks: If gold fails to hold $3,320, a drop to $3,200 may occur, requiring tighter stops.

---

Fundamental Outlook

- Safe-Haven Demand: Rising tensions are likely to sustain gold's appeal.

- Inflation & Rate Outlook: Persistent inflation concerns and potential rate cuts (if economic data weakens) could further support gold.

- Negotiation Risk: De-escalation or Iran's concessions may pause the bullish momentum, leading to a reversal toward $3,340–$3,320.

---

Conclusion

Gold is in a strong bullish phase, driven by geopolitical risks and technical structure. Traders should focus on buying dips near $3,320–$3,370 with targets toward $3,439–$3,501. However, monitor the $3,320 support and geopolitical developments closely. If the trend breaks, a retest of $3,200 could follow. Always use stop-losses to manage risk.

Final Note: The market is highly volatile, so position sizing and risk management are critical. Stay alert for news updates and technical confirmations (e.g., closes above $3,378)

Trade active

Stop loss is set at the entry point: 3359. I'm holding the position toward 3436, and will adjust the take profit based on market conditions.

The final target is 3499.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.