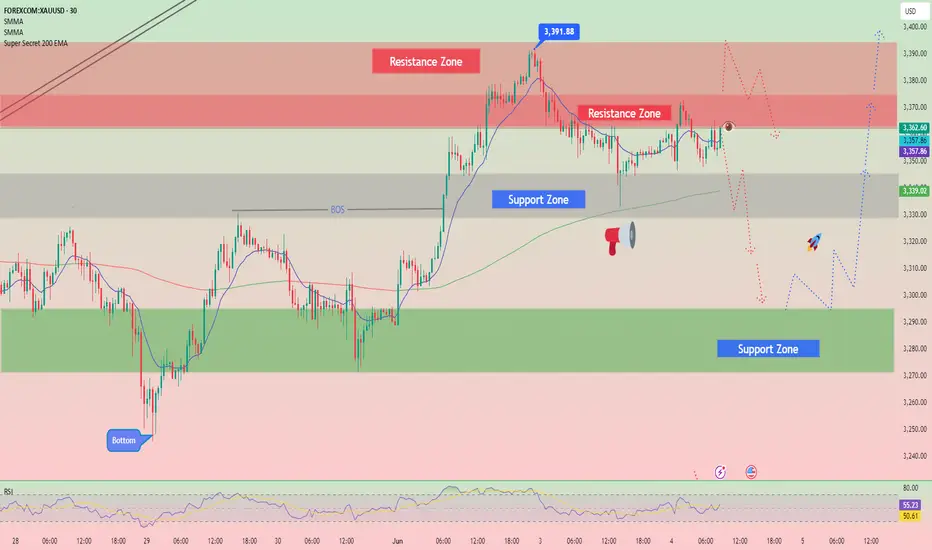

Gold is trading around 3,355, reaching the 100% technical rebound according to the Fibonacci extension indicator. Gold could continue to rise in the coming days and could reach 161.8% around 3,437.

8/8 Murray has acted as a strong selling zone in the past, so we believe this level could serve as a good selling point only if the gold price consolidates below 3,392.

On the other hand, we believe that below 3,378, gold could undergo a technical correction toward the 61.8% Fibonacci retracement level located at 3,345. This level could offer a good point to resume buying, with targets at 161.8% or around the 8/8 Murray level located at 3,437.

Gold left a gap at 3,427 in early May, and we believe it could close this gap in the coming days. Therefore, any pullback in he coming day will be seen as a buying opportunity. The key is for the price of gold to remain within the uptrend channel or above the 200 EMA located at 3,260.

At the opening of this week's trading sessions, gold left a gap around 3,289, and it is likely that this gap could be filled in the coming days. A pullback below 3,307 could confirm the decline and could even reach 3,260.

At current price levels, we believe gold will undergo a technical correction, so we must be very cautious. The key would be to sell below 3,380. The indicator is giving a negative signal, which indicates a potential technical correction in the coming hours.

8/8 Murray has acted as a strong selling zone in the past, so we believe this level could serve as a good selling point only if the gold price consolidates below 3,392.

On the other hand, we believe that below 3,378, gold could undergo a technical correction toward the 61.8% Fibonacci retracement level located at 3,345. This level could offer a good point to resume buying, with targets at 161.8% or around the 8/8 Murray level located at 3,437.

Gold left a gap at 3,427 in early May, and we believe it could close this gap in the coming days. Therefore, any pullback in he coming day will be seen as a buying opportunity. The key is for the price of gold to remain within the uptrend channel or above the 200 EMA located at 3,260.

At the opening of this week's trading sessions, gold left a gap around 3,289, and it is likely that this gap could be filled in the coming days. A pullback below 3,307 could confirm the decline and could even reach 3,260.

At current price levels, we believe gold will undergo a technical correction, so we must be very cautious. The key would be to sell below 3,380. The indicator is giving a negative signal, which indicates a potential technical correction in the coming hours.

DAILY FREE SIGNAL. FREE SIGNAL (95% accuracy) TP AND SL PROVIDED

In This Channel, i Will Provide you a profitable Scalping And Swing Trade Follow My Signals

PUBLIC TELEGRAM CHANNEL

t.me/CEO_PREMIUM_ANALYSIS

In This Channel, i Will Provide you a profitable Scalping And Swing Trade Follow My Signals

PUBLIC TELEGRAM CHANNEL

t.me/CEO_PREMIUM_ANALYSIS

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

DAILY FREE SIGNAL. FREE SIGNAL (95% accuracy) TP AND SL PROVIDED

In This Channel, i Will Provide you a profitable Scalping And Swing Trade Follow My Signals

PUBLIC TELEGRAM CHANNEL

t.me/CEO_PREMIUM_ANALYSIS

In This Channel, i Will Provide you a profitable Scalping And Swing Trade Follow My Signals

PUBLIC TELEGRAM CHANNEL

t.me/CEO_PREMIUM_ANALYSIS

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.