Hello everyone, let’s take a look at  XAUUSD !

XAUUSD !

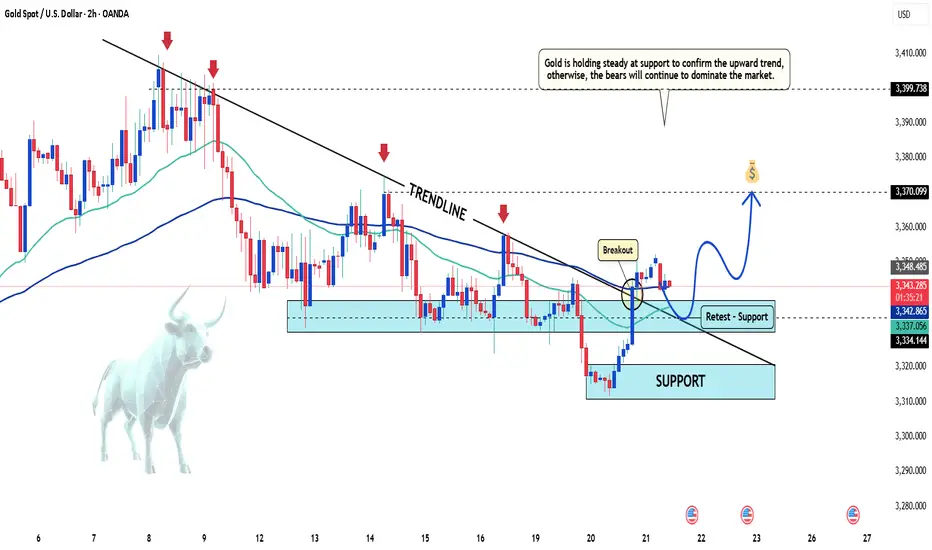

Yesterday, gold continued to surprise us, as the metal made a strong recovery on Wednesday, trading around 3,345 USD in the US session after dropping to a three-week low of 3,311 USD earlier.

This recovery occurred as the US Dollar (USD) dropped from a one-week high. Additionally, gold reversed sharply upward as tensions in Ukraine did not ease as expected. The escalating tensions are not just between the US, Russia, and Ukraine, but Europe also wants its influence on the matter. Since Europe is not willing to compromise, a peace agreement seems unlikely to be reached.

From a technical perspective, gold successfully tested the previous resistance at 3,330 USD, turning it into new support, breaking out of the downward trendline. If gold maintains strength above this level, the next key targets to watch are 3,357 and 3,370 USD.

Regarding the trend outlook: Investors are closely watching the minutes from the latest Federal Open Market Committee (FOMC) meeting to gain insights into the US monetary policy direction in the short term.

Fed Chairman Jerome Powell will speak on Friday morning and is expected to update the Fed's monetary policy framework. Powell’s speech could provide a new perspective on internal FOMC support for a potential interest rate cut in September, which could set a new trend for XAU/USD.

Stay tuned with me! Don’t forget to like the post and share your views in the comments.

Good luck!

Yesterday, gold continued to surprise us, as the metal made a strong recovery on Wednesday, trading around 3,345 USD in the US session after dropping to a three-week low of 3,311 USD earlier.

This recovery occurred as the US Dollar (USD) dropped from a one-week high. Additionally, gold reversed sharply upward as tensions in Ukraine did not ease as expected. The escalating tensions are not just between the US, Russia, and Ukraine, but Europe also wants its influence on the matter. Since Europe is not willing to compromise, a peace agreement seems unlikely to be reached.

From a technical perspective, gold successfully tested the previous resistance at 3,330 USD, turning it into new support, breaking out of the downward trendline. If gold maintains strength above this level, the next key targets to watch are 3,357 and 3,370 USD.

Regarding the trend outlook: Investors are closely watching the minutes from the latest Federal Open Market Committee (FOMC) meeting to gain insights into the US monetary policy direction in the short term.

Fed Chairman Jerome Powell will speak on Friday morning and is expected to update the Fed's monetary policy framework. Powell’s speech could provide a new perspective on internal FOMC support for a potential interest rate cut in September, which could set a new trend for XAU/USD.

Stay tuned with me! Don’t forget to like the post and share your views in the comments.

Good luck!

Trade active

✅ Receive 7–10 high-quality signals daily for Forex, Gold, and Bitcoin

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+6v7LMJO7cI04Nzg1

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+6v7LMJO7cI04Nzg1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ Receive 7–10 high-quality signals daily for Forex, Gold, and Bitcoin

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+6v7LMJO7cI04Nzg1

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+6v7LMJO7cI04Nzg1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.