Spot gold rose 1.5% to $3,249.80 an ounce in early Asian trading before paring losses, up about 0.55% on the day at press time.

Moody's Ratings announced late Friday that it had removed the U.S. government's top credit rating, downgrading the country from Aaa to Aa1.

Moody's blamed successive U.S. presidents and lawmakers for the growing budget deficit, although Moody's said the situation showed little sign of improving.

"While we recognize that the United States has significant economic and fiscal strength, we believe that these strengths are no longer sufficient to fully offset the deterioration in fiscal metrics," Moody's said in a statement.

This “black swan” event has raised concerns about the US financial situation. Safe-haven buying has fueled a sharp rise in gold prices. In addition, the weakening of the US dollar has also benefited the gold price trend.

This downgrade is likely to add to Wall Street’s growing concerns about the US government bond market. While rising yields typically boost their respective currencies, debt concerns could increase skepticism about the USD.

Gold prices have been volatile in recent months. Last week, gold posted its biggest weekly decline since November as geopolitical tensions eased. The move followed a sharp rally in gold, which topped $3,500 an ounce for the first time last month.

Gold is still up more than 20% this year, driven by global conflicts, tariffs from US President Donald Trump and flows into exchange-traded funds.

![GOLD MARKET ANALYSIS AND COMMENTARY - [May 19 - May 23]](https://tradingview.sweetlogin.com/proxy-s3/j/JVEoKcGq_mid.png)

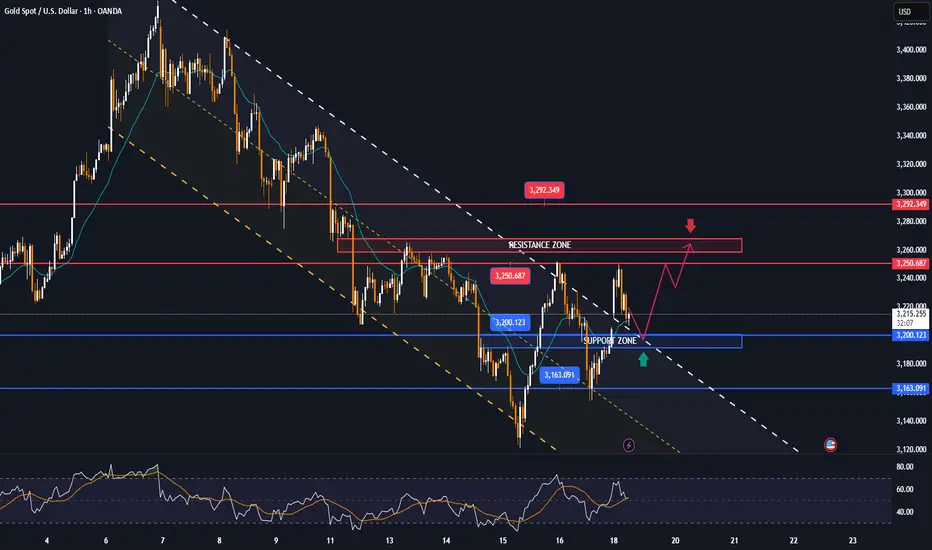

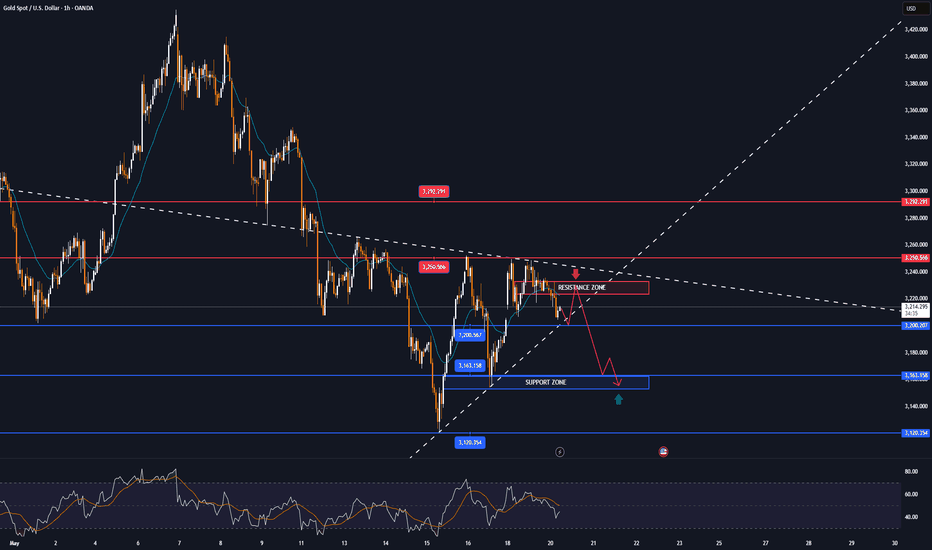

Technical outlook

After gold reached the target resistance of 3,250 USD, it weakened slightly again, this resistance level is noted by readers in the weekly publication.

In the short term, gold still has a bearish outlook with the nearest resistance at 3,250 USD followed by the confluence of EMA21 and Fibonacci retracement 0.382%.

In terms of momentum, the Relative Strength Index (RSI) is still below 50, 50 is now acting as resistance while the RSI is still quite far from the oversold zone, indicating that there is still room for a decline in momentum ahead.

As long as gold remains below the 21 EMA, it remains bearish in the short term and a break below $3,200 would continue to push gold lower with a target of around $3,163 in the short term.

For gold to qualify for the upside, it needs to move above the 21 EMA, break the $3,300 base point and then target around $3,371 in the short term.

Intraday, the bearish outlook for gold in the short term will be highlighted again by the following levels.

Support: $3,200 – $3,163

Resistance: $3,250 – $3,292

SELL XAUUSD PRICE 3261 - 3259⚡️

↠↠ Stop Loss 3265

→Take Profit 1 3253

↨

→Take Profit 2 3247

BUY XAUUSD PRICE 3199 - 3201⚡️

↠↠ Stop Loss 3195

→Take Profit 1 3207

↨

→Take Profit 2 3213

Note

DXY index continues to plummet below 100.20Note

Gold prices hover above $3,300/ozNote

According to technical analysis, gold is on the rise with the next resistance levels being 3,350 – 3,400 – 3,438 and could head towards the historical peak of 3,500 USD/oz if it does not fall below the support level of 3,300 USD.Note

Gold price turns down to below 3,310 USD/ozNote

▫️ Spot gold fell more than $16 in 15 minutes, back below $3,290 an ounce, down 0.14% on the day.Note

Gold price continues to increase strongly to nearly 3,330 USD/ozNote

* World gold prices turned around and increased sharply after Mr. Trump threatened to impose new import taxes.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.