Hello traders,

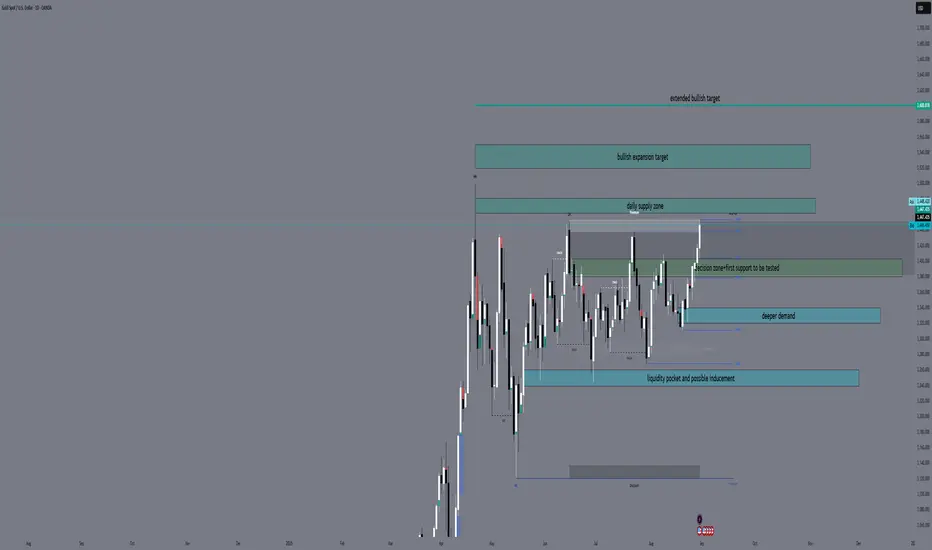

Gold closed August with a strong daily close in premium territory, pressing into the 3460–3480 supply. Bulls still control momentum, but September opens with price testing critical levels where continuation or retracement will be decided.

🔹 Daily Structural Zones

Premium Supply Zone (3460–3480) → overhead resistance where sellers may attempt control.

Decision Zone (3400–3380) → first key support, aligned with EMA 21, pivot for continuation or correction.

Mid-Term Demand Zone (3340–3320) → valid Order Block, aligned with EMA 100, stronger structural support.

Liquidity Retest Zone (3260–3240) → liquidity pocket / inducement area, a level where short-term sweeps and reactions may occur.

🔹 EMA Confluence (Daily)

EMA 5 (3409) → immediate bullish guide.

EMA 21 (3370) → inside Decision Zone.

EMA 50 (3349) → near Mid-Term Demand.

EMA 100 (3330) → aligned with Mid-Term Demand Zone.

EMA 200 (3074) → deeper long-term support, outside daily range.

💡 Interpretation: EMAs confirm layered supports. Decision Zone is short-term pivot, Mid-Term Demand is the first true OB, and below it price could sweep the Liquidity Retest Zone.

🔹 Daily Progression Map

Bullish scenario:

Break above Premium Supply (3460–3480) → unlocks Bullish Expansion Target (3520–3550).

Further continuation → Extended Bullish Target (3600).

Bearish scenario:

Rejection at Premium Supply → pullback into Decision Zone (3400–3380, EMA 21 confluence).

If Decision Zone fails → test into Mid-Term Demand OB (3340–3320, EMA 100 confluence).

Break below 3320 → liquidity sweep into Liquidity Retest Zone (3260–3240) before deeper targets are considered.

🔹 Daily Bias – September

Bullish → while above 3400 (Decision Zone).

Neutral → range between 3480 and 3400.

Bearish shift → only if D1 closes below 3320.

🔹 Conclusion

Gold opens September in premium territory, facing resistance at supply.

Breakout above 3480 → continuation to 3520–3550 and 3600.

Rejection → correction into Decision Zone (3400–3380), then Mid-Term Demand OB (3340–3320).

Below 3320 → expect liquidity play around 3260–3240 before any deeper move.

✨ What’s your view for gold in September? Drop your thoughts below 👇

Don’t forget to🚀🚀🚀my plan and follow GoldFxMinds for daily outlooks and precision sniper-entry plans 🚀📈

Gold closed August with a strong daily close in premium territory, pressing into the 3460–3480 supply. Bulls still control momentum, but September opens with price testing critical levels where continuation or retracement will be decided.

🔹 Daily Structural Zones

Premium Supply Zone (3460–3480) → overhead resistance where sellers may attempt control.

Decision Zone (3400–3380) → first key support, aligned with EMA 21, pivot for continuation or correction.

Mid-Term Demand Zone (3340–3320) → valid Order Block, aligned with EMA 100, stronger structural support.

Liquidity Retest Zone (3260–3240) → liquidity pocket / inducement area, a level where short-term sweeps and reactions may occur.

🔹 EMA Confluence (Daily)

EMA 5 (3409) → immediate bullish guide.

EMA 21 (3370) → inside Decision Zone.

EMA 50 (3349) → near Mid-Term Demand.

EMA 100 (3330) → aligned with Mid-Term Demand Zone.

EMA 200 (3074) → deeper long-term support, outside daily range.

💡 Interpretation: EMAs confirm layered supports. Decision Zone is short-term pivot, Mid-Term Demand is the first true OB, and below it price could sweep the Liquidity Retest Zone.

🔹 Daily Progression Map

Bullish scenario:

Break above Premium Supply (3460–3480) → unlocks Bullish Expansion Target (3520–3550).

Further continuation → Extended Bullish Target (3600).

Bearish scenario:

Rejection at Premium Supply → pullback into Decision Zone (3400–3380, EMA 21 confluence).

If Decision Zone fails → test into Mid-Term Demand OB (3340–3320, EMA 100 confluence).

Break below 3320 → liquidity sweep into Liquidity Retest Zone (3260–3240) before deeper targets are considered.

🔹 Daily Bias – September

Bullish → while above 3400 (Decision Zone).

Neutral → range between 3480 and 3400.

Bearish shift → only if D1 closes below 3320.

🔹 Conclusion

Gold opens September in premium territory, facing resistance at supply.

Breakout above 3480 → continuation to 3520–3550 and 3600.

Rejection → correction into Decision Zone (3400–3380), then Mid-Term Demand OB (3340–3320).

Below 3320 → expect liquidity play around 3260–3240 before any deeper move.

✨ What’s your view for gold in September? Drop your thoughts below 👇

Don’t forget to🚀🚀🚀my plan and follow GoldFxMinds for daily outlooks and precision sniper-entry plans 🚀📈

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.