Last Friday’s meeting between US President Donald Trump and Russian President Vladimir Putin laid the groundwork for a possible solution.

Trump met with Ukrainian President Volodymyr Zelensky and other European leaders on Monday to prepare for a possible ceasefire and push for a three-way meeting to start talks between Kyiv and Moscow.

Trump said “Putin, Zelensky need to be flexible” and offer Ukraine some security guarantees to prevent another Russian attack. However, Trump has said he will not allow Ukraine to join NATO.

Geopolitical developments suggest that a positive outcome from Trump’s meetings with Putin, Zelensky and European leaders could end the ongoing war. Rumors of a possible de-escalation of the conflict between Ukraine and Russia have weighed on gold, which typically benefits from global uncertainty. Traders are looking to the minutes of the Federal Reserve’s meeting today (Wednesday) and a speech by Fed Chairman Jerome Powell on Friday for guidance on the policy path.

Gold itself does not generate interest, but is traditionally seen as a safe haven in times of uncertainty and tends to perform well in low-interest-rate environments.

According to CME Group’s FedWatch tool, traders are currently pricing in an 85% chance that the Fed will cut rates by 25 basis points in September.

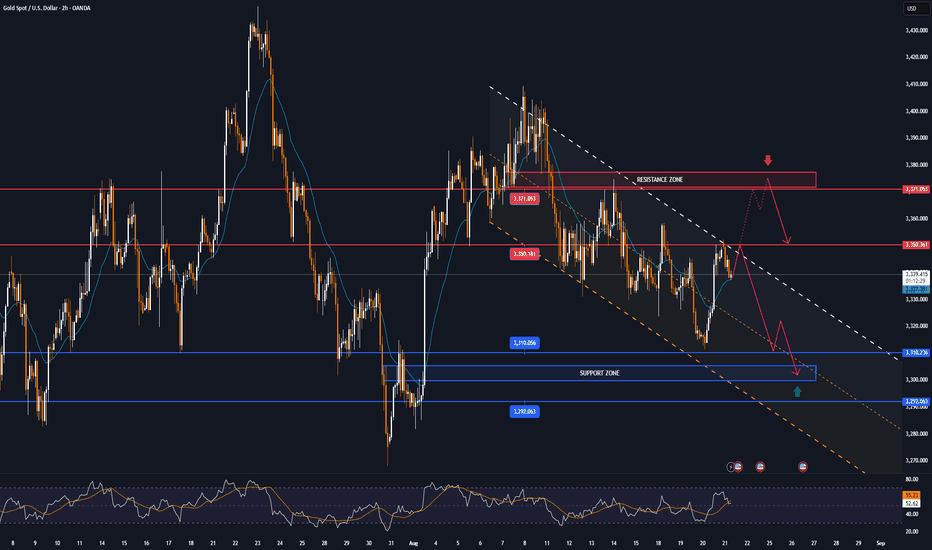

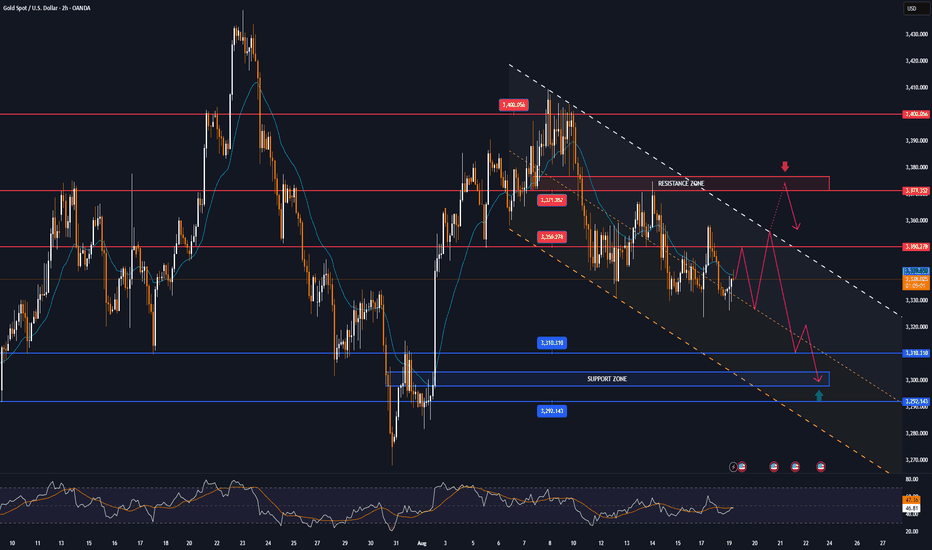

Technical Outlook Analysis

Gold is in a key technical position with support noted to readers in the previous issue at $3,310, followed by the psychological point of $3,300 and the 0.382% Fibonacci retracement.

If gold sells below $3,292 it will be in a position to expect a short-term decline, with the target likely to be $3,246 rather than the 0.50% Fibonacci retracement.

Motivationally, the RSI is pointing below 50 and is far from the oversold zone (0-20) suggesting that there is still plenty of room for downside ahead.

At the same time, gold is also under pressure from the EMA21 line, where if gold cannot move above this moving average, it will not have enough conditions to increase in the short term.

During the day, overall, gold is still moving sideways and has not yet had a sustainable trend, it is also in a very important technical area with important supports. And the notable points will be listed as follows.

Support: 3,310 - 3,300 - 3,292 USD

Resistance: 3,350 - 3,371 USD

SELL XAUUSD PRICE 3351 - 3349⚡️

↠↠ Stop Loss 3355

→Take Profit 1 3343

↨

→Take Profit 2 3337

BUY XAUUSD PRICE 3279 - 3281⚡️

↠↠ Stop Loss 3275

→Take Profit 1 3287

↨

→Take Profit 2 3293

Note

The world's largest gold ETF, SPDR Gold Trust, fell 3.16 tonnes.Trade active

Plan SELL +50pips close a part move SL to entry.🔥Trade closed: target reached

Plan SELL HIT TP1 +110pips. Heading to TP2 😵😵😵Note

Gold prices on August 20 jumped nearly $40, reaching a high of $3,350 and closing at $3,348.20/oz after holding 100-day support, thanks to bottom-fishing buying and a weakening USD.Note

Gold prices edged lower as the dollar rose to a two-week high, as investors focused on Federal Reserve Chairman Powell's speech at the Jackson Hole conference.Note

The world's largest gold ETF, SPDR Gold Trust, kept its holdings unchanged.Note

▫️Spot gold hit $3,370 an ounce, up 0.13% on the day.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.