👋 Hello traders,

We start the new day with gold sitting near 3335, right under heavy resistance. Markets remain sensitive to this week’s Retail Sales, FOMC minutes, and PMI releases, which could inject volatility into dollar flows and gold’s momentum.

📊 Macro & News Context

The market is waiting on US CPI and FOMC minutes this week – both can set the tone for USD strength/weakness.

Geopolitical tensions (BRICS currency talks + Middle East headlines) keep safe-haven flows alive, giving gold extra volatility.

Dollar index is holding firm, but yields are softening, which adds fuel to gold’s upside pullbacks.

📈 Daily Bias & Trend

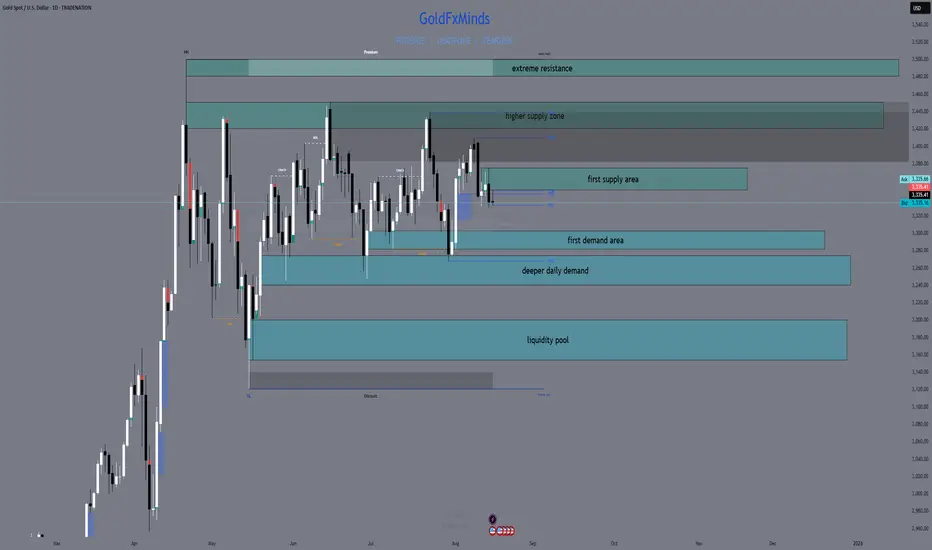

Trend: Still bullish on HTF, but daily is showing signs of exhaustion near supply zones.

EMA Flow: EMA 5 & 21 locked bullish above 3310; EMA 50 around 3280 is the deeper support.

RSI: Cooling off from overbought, but still above midline – showing room for retracement before another push.

🔑 Daily Key Zones

Resistance

3350–3370 → Immediate daily supply, strong reaction area above price.

3420–3450 → Extension resistance zone (OB + FVG confluence).

3480–3500 → Extreme long-term resistance cap.

Support

3300–3280 → First daily demand, aligned with EMA21 support.

3275–3240 → Stronger demand, deeper structure level.

3200–3150 → Refined zone:

Top (3200–3150) = OB-based support.

Bottom wick (3150–3120) = Liquidity pool / magnet, not an entry zone.

🎯 Outlook & Action Plan

If gold rejects 3350–3370, we could see a retracement first into 3300–3280, then deeper towards 3275–3240 if macro flows align.

A clean break above 3370 opens the door to 3420–3450. Watch for liquidity sweeps and OB reactions before committing.

Below 3240, gold risks tapping the 3200–3150 liquidity pool, which may attract buyers again for a long-term swing.

✨ This Daily map gives us a full range: immediate reactions near 3350–3370, supports at 3300 & 3275, and a long-term magnet around 3150.

💡 What’s your outlook? Do you expect gold to revisit deeper supports before extending higher, or push directly into fresh highs?

👉 If you find this helpful, boost this idea🚀🚀🚀 & hit follow to stay updated with every sniper-level outlook. Let’s grow this community together ❤️📝🌍

Stay sharp,

GoldFxMinds

📌 Disclosure: Outlook based on Trade Nation charts. Educational purpose only — not financial advice.

We start the new day with gold sitting near 3335, right under heavy resistance. Markets remain sensitive to this week’s Retail Sales, FOMC minutes, and PMI releases, which could inject volatility into dollar flows and gold’s momentum.

📊 Macro & News Context

The market is waiting on US CPI and FOMC minutes this week – both can set the tone for USD strength/weakness.

Geopolitical tensions (BRICS currency talks + Middle East headlines) keep safe-haven flows alive, giving gold extra volatility.

Dollar index is holding firm, but yields are softening, which adds fuel to gold’s upside pullbacks.

📈 Daily Bias & Trend

Trend: Still bullish on HTF, but daily is showing signs of exhaustion near supply zones.

EMA Flow: EMA 5 & 21 locked bullish above 3310; EMA 50 around 3280 is the deeper support.

RSI: Cooling off from overbought, but still above midline – showing room for retracement before another push.

🔑 Daily Key Zones

Resistance

3350–3370 → Immediate daily supply, strong reaction area above price.

3420–3450 → Extension resistance zone (OB + FVG confluence).

3480–3500 → Extreme long-term resistance cap.

Support

3300–3280 → First daily demand, aligned with EMA21 support.

3275–3240 → Stronger demand, deeper structure level.

3200–3150 → Refined zone:

Top (3200–3150) = OB-based support.

Bottom wick (3150–3120) = Liquidity pool / magnet, not an entry zone.

🎯 Outlook & Action Plan

If gold rejects 3350–3370, we could see a retracement first into 3300–3280, then deeper towards 3275–3240 if macro flows align.

A clean break above 3370 opens the door to 3420–3450. Watch for liquidity sweeps and OB reactions before committing.

Below 3240, gold risks tapping the 3200–3150 liquidity pool, which may attract buyers again for a long-term swing.

✨ This Daily map gives us a full range: immediate reactions near 3350–3370, supports at 3300 & 3275, and a long-term magnet around 3150.

💡 What’s your outlook? Do you expect gold to revisit deeper supports before extending higher, or push directly into fresh highs?

👉 If you find this helpful, boost this idea🚀🚀🚀 & hit follow to stay updated with every sniper-level outlook. Let’s grow this community together ❤️📝🌍

Stay sharp,

GoldFxMinds

📌 Disclosure: Outlook based on Trade Nation charts. Educational purpose only — not financial advice.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.