Welcome to August — and welcome to the top of the macro ladder. Gold is not just rising. It’s rewriting structure.

🔸 Macro & Fundamentals

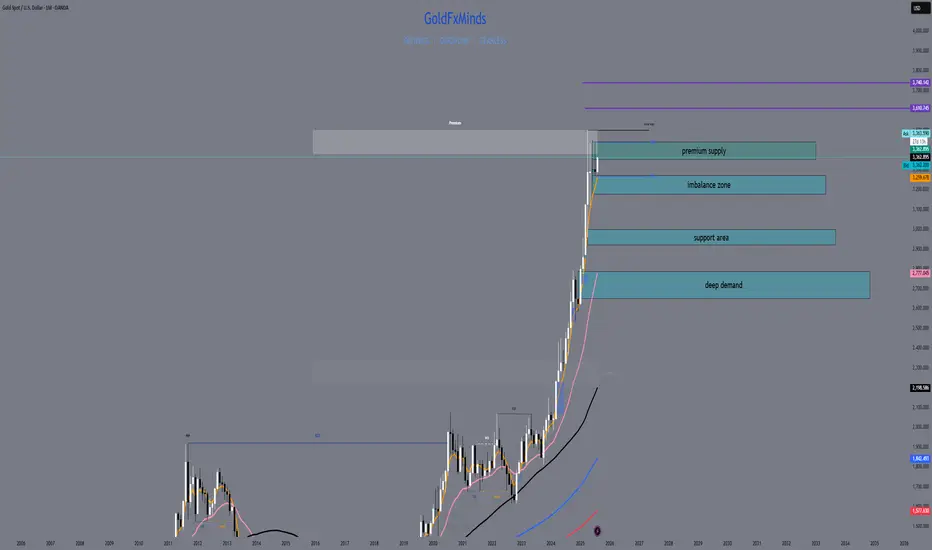

Gold opens August with a fresh impulsive breakout above $3360, fuelled by a weaker USD, rising global risk sentiment, and continued speculative positioning from institutional buyers. The upcoming Jackson Hole meeting and shifting Federal Reserve expectations create the perfect climate for volatility. All eyes are now on the premium structure top — but will gold expand beyond it or retrace to refill?

🔸 Monthly Trend & Bias (HTF Overview)

🔹 Structure: Clean bullish BOS, continuation leg in progress

🔹 Last CHoCH: April 2023 → Confirmed full trend shift bullish

🔹 Current Monthly Candle: Explosive push into supply with top wick rejection beginning to show

🔹 Bias: Still bullish but in extreme premium — watch for cooling/rebalancing

🔸 EMA Structure

| EMA Type | Status | Signal |

| ----------- | -------------- | ------------------------------------- |

| EMA 5 / 21 | Strong Bullish | Dynamic expansion, steep angle upward

| EMA 50 | Below | Clean breakout from range

| EMA 100/200 | Far below | Long-term uptrend deeply intact

🔸 Key HTF Levels (Wick-to-Wick Mapping)

Zone Type Price Range Confluences

🔴 Premium Supply 3350 – 3439 Monthly FVG + Wick exhaustion + RSI 80+

🔵 Bullish Imbalance 3180 – 3270 Monthly FVG + old BOS + EMA5 baseline

🔵 Mid-Level Support 2920 – 3000 Monthly OB + FVG + structure base

🔵 Deep Demand 2670 – 2780 HTF equilibrium zone + RSI support

✅ The current candle has pierced into the final wick supply, but with clear signs of loss in momentum.

⚠️ If 3439 breaks cleanly, next expansion zone opens toward 3505 → 3610 (Fibonacci projection). Otherwise, expect cooling to 3270–3180 first.

🔸 Fibonacci Context

🔻 Swing Low: 1810

🔺 Swing High: 3439

🎯 Current price ($3363) sits just below the 100% Fibonacci projection, with the 1.272 and 1.618 extensions at 3610 and 3740.

This confirms we are in a macro premium, and any long positions from here forward must be built only on strong LTF confirmation or clean pullbacks into value.

🔸 August Scenarios

🟢 Scenario 1 – Breakout + Price Discovery

If bulls break 3439 with strong volume and close:

New leg toward 3505 → 3610 opens

Watch for LTF continuation on H4–D1 with bullish OB reentry

Only valid if 3350 holds as new support

🔻 Scenario 2 – Rejection + Healthy Pullback

If price holds below 3439 and monthly wick exhausts:

Clean retracement toward 3270 → 3180 expected

EMA5/21 rebalancing will support bullish structure

Deeper rejection could retest 3070 zone if volatility spikes

🔸 Conclusion & Action Plan

We open August fully inside the last monthly supply zone. Trend is still bullish, but RSI, FVGs, and EMA distance warn us: this is not the time to chase — it’s time to wait for structure to speak.

📌 Key pivot = 3439.

Above it → Expansion.

Below it → Retracement.

Let August unfold — but stay sharp. The next big move will be born from this compression.

—

What’s your take — are we just getting started or about to cool off?

Drop your thoughts, chart it out, and stay ready for what August brings. ⚔️

—

❤️ Like if you enjoy clean, actionable updates🚀🚀🚀

🔁 Share with traders who love structure over noise

With clarity, confidence, and control,

GoldFxMinds

🔸 Macro & Fundamentals

Gold opens August with a fresh impulsive breakout above $3360, fuelled by a weaker USD, rising global risk sentiment, and continued speculative positioning from institutional buyers. The upcoming Jackson Hole meeting and shifting Federal Reserve expectations create the perfect climate for volatility. All eyes are now on the premium structure top — but will gold expand beyond it or retrace to refill?

🔸 Monthly Trend & Bias (HTF Overview)

🔹 Structure: Clean bullish BOS, continuation leg in progress

🔹 Last CHoCH: April 2023 → Confirmed full trend shift bullish

🔹 Current Monthly Candle: Explosive push into supply with top wick rejection beginning to show

🔹 Bias: Still bullish but in extreme premium — watch for cooling/rebalancing

🔸 EMA Structure

| EMA Type | Status | Signal |

| ----------- | -------------- | ------------------------------------- |

| EMA 5 / 21 | Strong Bullish | Dynamic expansion, steep angle upward

| EMA 50 | Below | Clean breakout from range

| EMA 100/200 | Far below | Long-term uptrend deeply intact

🔸 Key HTF Levels (Wick-to-Wick Mapping)

Zone Type Price Range Confluences

🔴 Premium Supply 3350 – 3439 Monthly FVG + Wick exhaustion + RSI 80+

🔵 Bullish Imbalance 3180 – 3270 Monthly FVG + old BOS + EMA5 baseline

🔵 Mid-Level Support 2920 – 3000 Monthly OB + FVG + structure base

🔵 Deep Demand 2670 – 2780 HTF equilibrium zone + RSI support

✅ The current candle has pierced into the final wick supply, but with clear signs of loss in momentum.

⚠️ If 3439 breaks cleanly, next expansion zone opens toward 3505 → 3610 (Fibonacci projection). Otherwise, expect cooling to 3270–3180 first.

🔸 Fibonacci Context

🔻 Swing Low: 1810

🔺 Swing High: 3439

🎯 Current price ($3363) sits just below the 100% Fibonacci projection, with the 1.272 and 1.618 extensions at 3610 and 3740.

This confirms we are in a macro premium, and any long positions from here forward must be built only on strong LTF confirmation or clean pullbacks into value.

🔸 August Scenarios

🟢 Scenario 1 – Breakout + Price Discovery

If bulls break 3439 with strong volume and close:

New leg toward 3505 → 3610 opens

Watch for LTF continuation on H4–D1 with bullish OB reentry

Only valid if 3350 holds as new support

🔻 Scenario 2 – Rejection + Healthy Pullback

If price holds below 3439 and monthly wick exhausts:

Clean retracement toward 3270 → 3180 expected

EMA5/21 rebalancing will support bullish structure

Deeper rejection could retest 3070 zone if volatility spikes

🔸 Conclusion & Action Plan

We open August fully inside the last monthly supply zone. Trend is still bullish, but RSI, FVGs, and EMA distance warn us: this is not the time to chase — it’s time to wait for structure to speak.

📌 Key pivot = 3439.

Above it → Expansion.

Below it → Retracement.

Let August unfold — but stay sharp. The next big move will be born from this compression.

—

What’s your take — are we just getting started or about to cool off?

Drop your thoughts, chart it out, and stay ready for what August brings. ⚔️

—

❤️ Like if you enjoy clean, actionable updates🚀🚀🚀

🔁 Share with traders who love structure over noise

With clarity, confidence, and control,

GoldFxMinds

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.