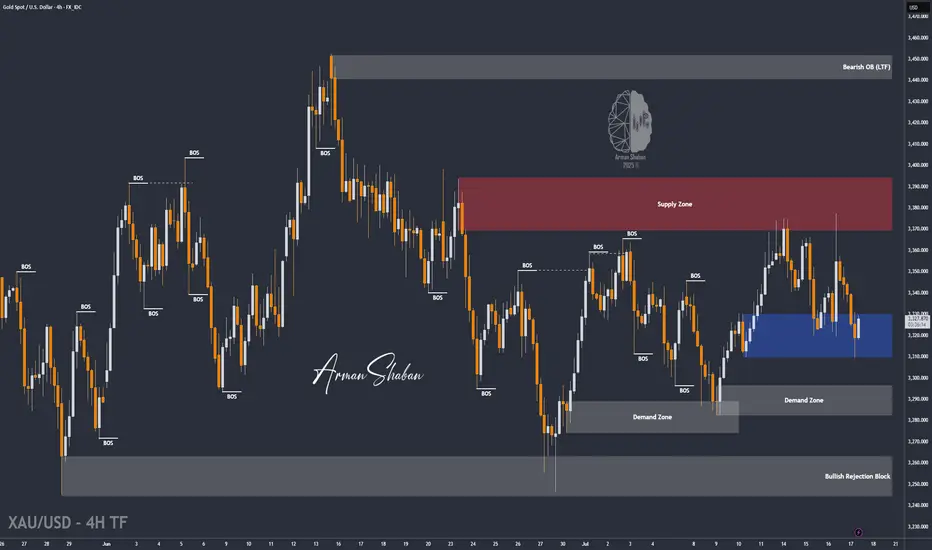

By analyzing the gold chart on the 4-hour timeframe, we can see that last night the price first tapped into the $3340 level, showing an initial push up to $3352. However, the drop intensified soon after, breaking the $3340 resistance and, according to the second scenario, falling to $3310. Upon reaching this key demand level, buying pressure kicked in, pushing the price back up to $3325. Now, the key question is whether gold can hold the $3310 support. If this level holds, we can expect a rise toward $3331 as the first target and $3345 as the second. After this move, a rejection from the $3345 area could trigger another drop, possibly pushing gold below $3300. So, first LONG, then SHORT!

THE LATEST VIDEO ANALYSIS :

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

THE LATEST VIDEO ANALYSIS :

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Trade active

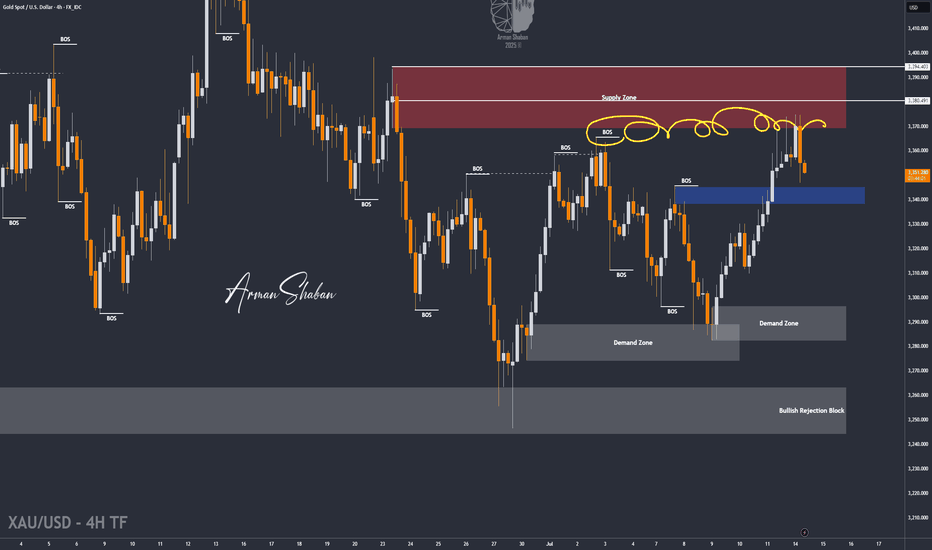

↗️ Result Update – GOLD (XAUUSD)✅ As expected, the BUY setup played out perfectly! Gold successfully hit both targets:

• TP1: $3331 ✅

• TP2: $3345 ✅

Great reaction from the $3310 demand zone, delivering a clean bullish move before any potential reversal! Hope you all made the most of this move, mates! 💪🔥

Stay tuned – more updates coming!

Trade closed: target reached

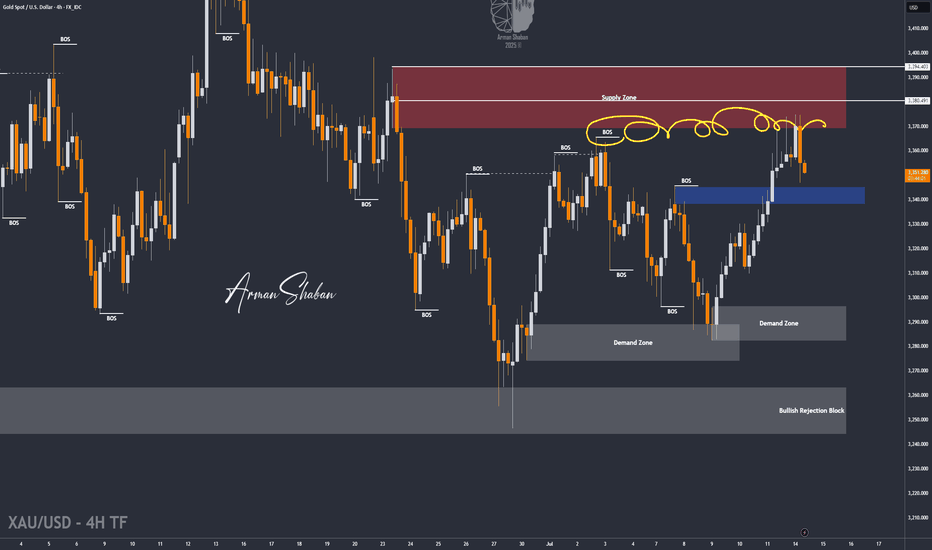

By analyzing the gold chart on the 4-hour timeframe, we can see that, as expected, the price started to rise and beautifully hit both $3331 and $3345 targets. After reaching $3345, it faced a rejection and dropped back to $3331 (you see how perfectly these key levels work as both resistance and support!). When the price touched $3331, strong buying pressure pushed it up to $3361. With just a few hours left before the market closes, if gold holds above $3353, we can expect further upside potential. However, if $3353 is lost, a strong rejection toward $3345 is likely. Both scenarios are tradable, so keep an eye on price reactions at these key levels. Thanks for your strong support — you keep me motivated to share multiple solid analyses every day!⚜️ Free Telegram Channel : t.me/PriceAction_ICT

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

💥Join BitMart Exchange – Ultra Low Fees : bitmart.com/invite/c5JVJK/en-US

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

💥Join BitMart Exchange – Ultra Low Fees : bitmart.com/invite/c5JVJK/en-US

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚜️ Free Telegram Channel : t.me/PriceAction_ICT

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

💥Join BitMart Exchange – Ultra Low Fees : bitmart.com/invite/c5JVJK/en-US

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

💥Join BitMart Exchange – Ultra Low Fees : bitmart.com/invite/c5JVJK/en-US

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.