Welcome to today’s lesson.

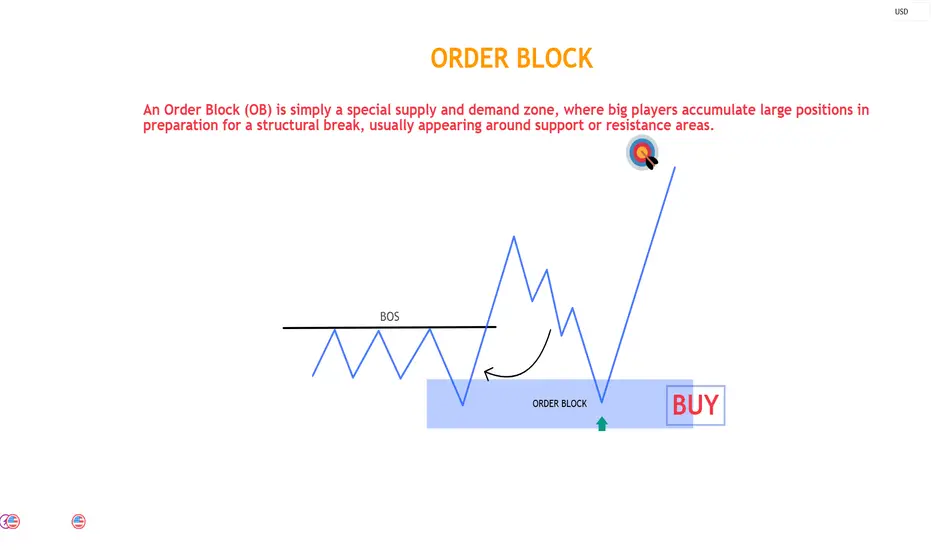

Have you ever wondered what an Order Block is? Maybe you’ve heard it mentioned in some analyses on TradingView, and yes, that’s exactly the topic I will answer today. It plays the role of a foundation and a catalyst for stronger trends. Let’s dive in!

What is an Order Block?

In my view: An Order Block (OB) is a block of orders or an important price zone on the chart, where banks and large financial institutions (called Smart Money) have placed massive buy or sell orders in the past.

Their actions create an imbalance between supply and demand, pushing price to move strongly and leaving a “footprint” on the chart.

That price zone becomes an attractive point for Smart Money in the future. They expect that when price revisits this area, a similar buy or sell force will appear, driving the market in the same direction.

Characteristics of an Order Block

An Order Block typically has three main characteristics:

- A Strong Candlestick: This represents aggressive buying or selling by institutions. Usually, it is a candlestick with a large body and little or no wick.

- A Strong Momentum Shift: Immediately after that candle, price moves very strongly and quickly, creating a new trend or a significant price move. This shows that Smart Money orders have been executed and pushed price away.

- A Defined Price Range: An OB is not a single price point but a zone, often defined by the range of that strong candlestick (from open to close, or the full body of the candle).

Types of Order Blocks

There are two main types of OB:

Bullish Order Block

- Role: Support, buy zone.

- Identification: A strong bullish (green) candlestick that appears right before a strong upward move. When price retraces to this zone, it’s highly likely to bounce back up.

Bearish Order Block

- Role: Resistance, sell zone.

- Identification: A strong bearish (red) candlestick that appears right before a strong downward move. When price retraces to this zone, it’s highly likely to drop again.

How to Trade with Order Blocks

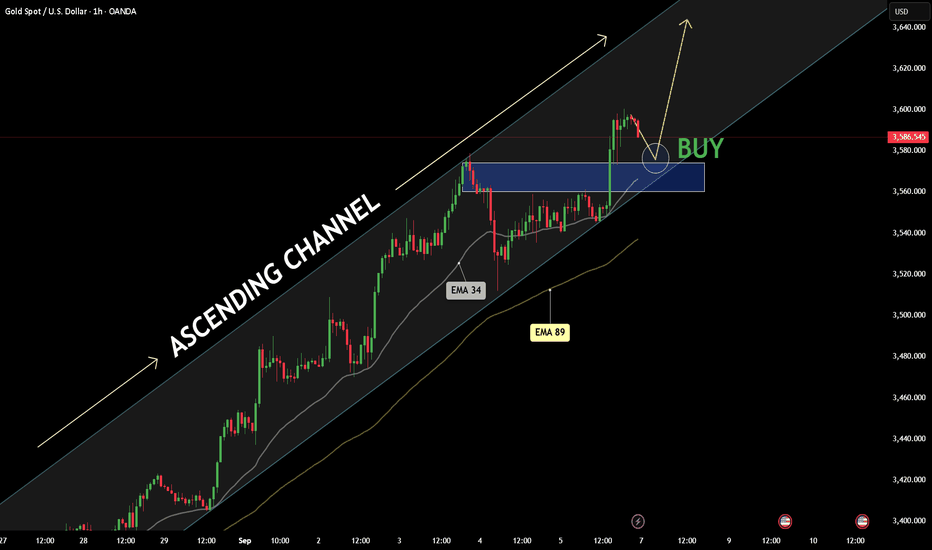

- Identify the Trend: Determine the main trend (Uptrend or Downtrend).

- Find Historical OBs: Look on the chart for strong candlesticks that triggered significant moves in line with the trend. Mark those zones.

- Wait for Price to Retest: Be patient for price to retrace and test the OB.

- Entry: Look for confirmation signals (reversal candlestick patterns like Pin Bar, Engulfing, Bullish/Bearish Divergence...) within the OB.

Enter a BUY when price revisits a Bullish OB with bullish confirmation.

Enter a SELL when price revisits a Bearish OB with bearish confirmation.

- Stop Loss: Place below the OB (for buys) or above the OB (for sells).

- Take Profit: At the next key support/resistance zones, or using a Risk:Reward ratio (e.g. 1:2, 1:3).

Important Notes

- Order Blocks are not a magic bullet: Price doesn’t always react perfectly at OBs. Always combine with other tools (trend, support/resistance, volume) and apply strict risk management.

- Timeframes matter: OBs on higher timeframes (H4, D1, W1) are stronger and more reliable than those on lower timeframes (M5, M15).

- Market Context: An OB is only effective when aligned with the main trend. Trading OBs against the trend is very risky.

Summary

Order Blocks are price zones where Smart Money placed large orders, creating strong price moves. These zones become attractive areas for future entries when price returns, and retail traders can use them to identify higher-probability trading opportunities.

I hope this explanation helps you understand this concept clearly.

Wishing you successful trading!

Have you ever wondered what an Order Block is? Maybe you’ve heard it mentioned in some analyses on TradingView, and yes, that’s exactly the topic I will answer today. It plays the role of a foundation and a catalyst for stronger trends. Let’s dive in!

What is an Order Block?

In my view: An Order Block (OB) is a block of orders or an important price zone on the chart, where banks and large financial institutions (called Smart Money) have placed massive buy or sell orders in the past.

Their actions create an imbalance between supply and demand, pushing price to move strongly and leaving a “footprint” on the chart.

That price zone becomes an attractive point for Smart Money in the future. They expect that when price revisits this area, a similar buy or sell force will appear, driving the market in the same direction.

Characteristics of an Order Block

An Order Block typically has three main characteristics:

- A Strong Candlestick: This represents aggressive buying or selling by institutions. Usually, it is a candlestick with a large body and little or no wick.

- A Strong Momentum Shift: Immediately after that candle, price moves very strongly and quickly, creating a new trend or a significant price move. This shows that Smart Money orders have been executed and pushed price away.

- A Defined Price Range: An OB is not a single price point but a zone, often defined by the range of that strong candlestick (from open to close, or the full body of the candle).

Types of Order Blocks

There are two main types of OB:

Bullish Order Block

- Role: Support, buy zone.

- Identification: A strong bullish (green) candlestick that appears right before a strong upward move. When price retraces to this zone, it’s highly likely to bounce back up.

Bearish Order Block

- Role: Resistance, sell zone.

- Identification: A strong bearish (red) candlestick that appears right before a strong downward move. When price retraces to this zone, it’s highly likely to drop again.

How to Trade with Order Blocks

- Identify the Trend: Determine the main trend (Uptrend or Downtrend).

- Find Historical OBs: Look on the chart for strong candlesticks that triggered significant moves in line with the trend. Mark those zones.

- Wait for Price to Retest: Be patient for price to retrace and test the OB.

- Entry: Look for confirmation signals (reversal candlestick patterns like Pin Bar, Engulfing, Bullish/Bearish Divergence...) within the OB.

Enter a BUY when price revisits a Bullish OB with bullish confirmation.

Enter a SELL when price revisits a Bearish OB with bearish confirmation.

- Stop Loss: Place below the OB (for buys) or above the OB (for sells).

- Take Profit: At the next key support/resistance zones, or using a Risk:Reward ratio (e.g. 1:2, 1:3).

Important Notes

- Order Blocks are not a magic bullet: Price doesn’t always react perfectly at OBs. Always combine with other tools (trend, support/resistance, volume) and apply strict risk management.

- Timeframes matter: OBs on higher timeframes (H4, D1, W1) are stronger and more reliable than those on lower timeframes (M5, M15).

- Market Context: An OB is only effective when aligned with the main trend. Trading OBs against the trend is very risky.

Summary

Order Blocks are price zones where Smart Money placed large orders, creating strong price moves. These zones become attractive areas for future entries when price returns, and retail traders can use them to identify higher-probability trading opportunities.

I hope this explanation helps you understand this concept clearly.

Wishing you successful trading!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.