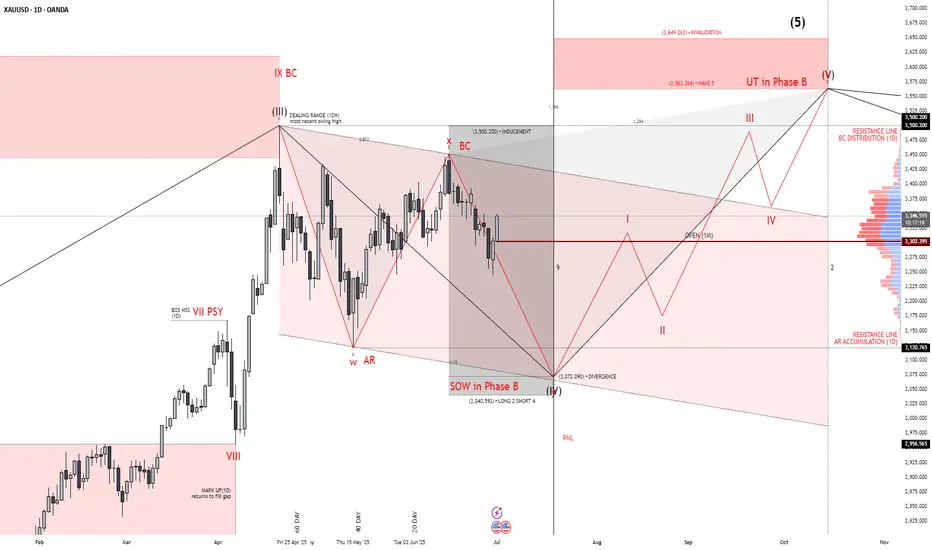

🔴 1. UT in Phase B (Upthrust = Trap)

This move above the previous high was likely a liquidity grab, not a real breakout.

Price action showed rejection without follow-through — classic Wyckoff distribution behavior.

→ 📉 Smart money sells into retail buying.

🔴 2. SOW (Sign of Weakness)

After the UT, price dumped aggressively and broke short-term support.

This creates lower confidence in bullish continuation.

→ 📉 Weak hands shaken, structure looks heavy.

🔴 3. Bearish Structure (Waves i–ii–iii setting up)

Wave I = first drop after the UT.

Wave II = current bounce — looks corrective, not impulsive.

Expecting Wave III = the next strong sell leg.

→ 🎯 Target: revisit 3,072 → 3,040 → PML (3,010) → even 2,955.

🔴 4. Volume Profile Confirmation

Price is failing to hold the high-volume node (3,303–3,327).

Below this = thin volume zone, which price tends to drop through quickly.

→ 🚨 Liquidity vacuum below.

🔴 5. Resistance Cluster Above

Multiple key levels between 3,500–3,563 = heavy resistance.

Also aligns with the invalidation zone for the bearish count.

→ ❌ If price moves above here with strength = bias invalidated.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.