👋 Hello gold tacticians — we’ve entered a key battlefield.

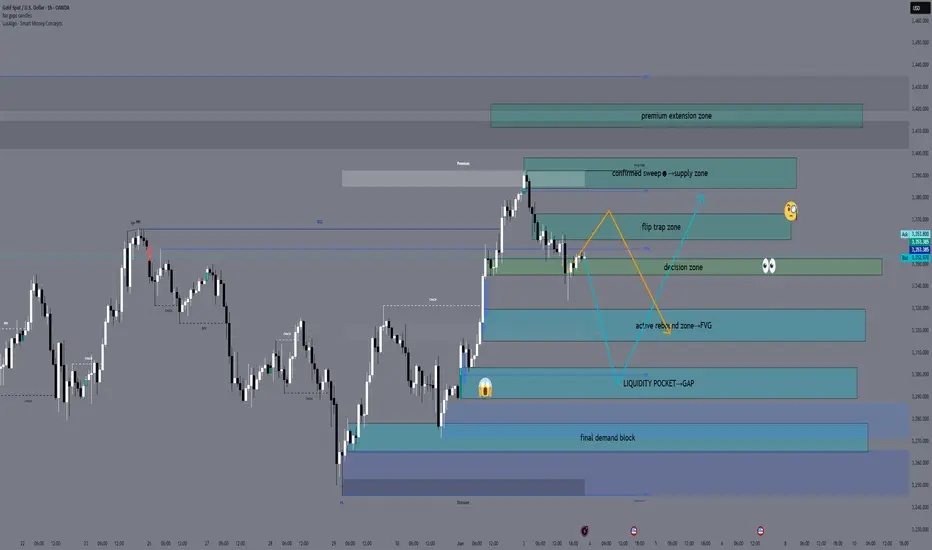

Price is hovering in a critical flip zone after a sweep of 3395, and with ADP Non-Farm + ISM Services PMI coming up, the market won’t stay neutral for long.

This is not a time for random trades. Let’s lock in real zones and prepare for both traps and confirmations. 🎯

🟡 Neutral Bias

Price is in a flip zone (3345–3352) → Not clearly bullish or bearish.

We’ve seen both buying pressure from 3320s and strong rejection from 3395.

Market is ranging between premium and discount — no confirmed trend.

⚠️ Bearish Weight (Slight Tilt)

3384–3395 sweep confirms liquidity trap.

RSI divergence + price rejected from premium supply.

FVG gap under price (3303–3289) remains unfilled — likely draw.

Big news (ADP + ISM) may trigger stop hunts — downside has better structure for continuation.

✅ Conclusion:

We are neutral, but leaning bearish unless price confirms a clean break and hold above 3395.

You should follow structure shifts on M15/H1 after ADP before committing fully to either side.

🟡 Neutral Decision Zone – The Flip Battlefield

3345 – 3352

→ Previously acted as resistance — now tested as support

→ This is neutral ground — confirmation will decide if we bounce or dump

→ Use only with clear M15 PA

🧠 Wait here — bulls and bears will fight it out.

🔻 SELL ZONES – Premium Traps

Zone Key Levels Why it Matters

🔺 Main Rejection Block 3384 – 3395 Sweep + FVG + OB cluster — price was rejected here. If tapped again → watch for M15 bearish shift.

🔺 Flip Trap Extension 3368 – 3375 Previous broken high. If price fails to stay above → good place for fakeout sell.

🔺 Ultimate Premium Trap 3412 – 3422 Extreme liquidity grab if market spikes after ADP. Use only if FOMO buyers get trapped.

🟢 BUY ZONES – Smart Demand Levels

Zone Key Levels Why it Matters

🟢 Active Rebound Zone 3330 – 3320 OB + FVG + current HL reaction. Great sniper long if price holds.

🟢 Reload Buy Pocket 3303 – 3289 Fresh NY FVG + EMA confluence + liquidity. If ADP gives downside wick, this is the reload zone.

🟢 Final Demand Block 3265 – 3278 Deep sweep zone from H4. If hit → expect strong reaction. HL or M15 BOS confirms.

🔍 Strategy Scenarios

📉 Sell Plan A → Spike into 3384–3395 → M15/M30 bearish shift → short to 3352 → then 3320

📉 Sell Plan B → Flip rejection from 3368–3375 → short scalp to 3330

📉 Sell Plan C → FOMO sweep into 3412+ → wait for reversal wick → high-RR short

📈 Buy Plan A → Bounce from 3330–3320 → confirm HL → long toward 3368

📈 Buy Plan B → Flush into 3303–3289 → watch for OB reaction + PA → long scalp toward 3345

📈 Buy Plan C → Extreme dip to 3265 → reversal PA → long to 3300+

⚙️ Market Context

EMA 5/21/50 bullish but stretched

Price is compressing under a sweep — not trending

ADP + ISM = volatility trap window

RSI showing bearish divergence in premium

💬 Final Words from GoldFxMinds

Gold is standing in the middle of a flip battlefield. It doesn’t matter if you’re bullish or bearish — what matters is structure and reaction. Let the market reveal its hand.

🎯 Stay out of noise. Wait for the trigger. Act with clarity.

If this breakdown helped you today:

❤️ Drop a LIKE

🧠 Leave a COMMENT on what you’re watching

📌 And FOLLOW GoldFxMinds for clean, structured daily plans

Let’s dominate June with patience and precision.

— GoldFxMinds

Price is hovering in a critical flip zone after a sweep of 3395, and with ADP Non-Farm + ISM Services PMI coming up, the market won’t stay neutral for long.

This is not a time for random trades. Let’s lock in real zones and prepare for both traps and confirmations. 🎯

🟡 Neutral Bias

Price is in a flip zone (3345–3352) → Not clearly bullish or bearish.

We’ve seen both buying pressure from 3320s and strong rejection from 3395.

Market is ranging between premium and discount — no confirmed trend.

⚠️ Bearish Weight (Slight Tilt)

3384–3395 sweep confirms liquidity trap.

RSI divergence + price rejected from premium supply.

FVG gap under price (3303–3289) remains unfilled — likely draw.

Big news (ADP + ISM) may trigger stop hunts — downside has better structure for continuation.

✅ Conclusion:

We are neutral, but leaning bearish unless price confirms a clean break and hold above 3395.

You should follow structure shifts on M15/H1 after ADP before committing fully to either side.

🟡 Neutral Decision Zone – The Flip Battlefield

3345 – 3352

→ Previously acted as resistance — now tested as support

→ This is neutral ground — confirmation will decide if we bounce or dump

→ Use only with clear M15 PA

🧠 Wait here — bulls and bears will fight it out.

🔻 SELL ZONES – Premium Traps

Zone Key Levels Why it Matters

🔺 Main Rejection Block 3384 – 3395 Sweep + FVG + OB cluster — price was rejected here. If tapped again → watch for M15 bearish shift.

🔺 Flip Trap Extension 3368 – 3375 Previous broken high. If price fails to stay above → good place for fakeout sell.

🔺 Ultimate Premium Trap 3412 – 3422 Extreme liquidity grab if market spikes after ADP. Use only if FOMO buyers get trapped.

🟢 BUY ZONES – Smart Demand Levels

Zone Key Levels Why it Matters

🟢 Active Rebound Zone 3330 – 3320 OB + FVG + current HL reaction. Great sniper long if price holds.

🟢 Reload Buy Pocket 3303 – 3289 Fresh NY FVG + EMA confluence + liquidity. If ADP gives downside wick, this is the reload zone.

🟢 Final Demand Block 3265 – 3278 Deep sweep zone from H4. If hit → expect strong reaction. HL or M15 BOS confirms.

🔍 Strategy Scenarios

📉 Sell Plan A → Spike into 3384–3395 → M15/M30 bearish shift → short to 3352 → then 3320

📉 Sell Plan B → Flip rejection from 3368–3375 → short scalp to 3330

📉 Sell Plan C → FOMO sweep into 3412+ → wait for reversal wick → high-RR short

📈 Buy Plan A → Bounce from 3330–3320 → confirm HL → long toward 3368

📈 Buy Plan B → Flush into 3303–3289 → watch for OB reaction + PA → long scalp toward 3345

📈 Buy Plan C → Extreme dip to 3265 → reversal PA → long to 3300+

⚙️ Market Context

EMA 5/21/50 bullish but stretched

Price is compressing under a sweep — not trending

ADP + ISM = volatility trap window

RSI showing bearish divergence in premium

💬 Final Words from GoldFxMinds

Gold is standing in the middle of a flip battlefield. It doesn’t matter if you’re bullish or bearish — what matters is structure and reaction. Let the market reveal its hand.

🎯 Stay out of noise. Wait for the trigger. Act with clarity.

If this breakdown helped you today:

❤️ Drop a LIKE

🧠 Leave a COMMENT on what you’re watching

📌 And FOLLOW GoldFxMinds for clean, structured daily plans

Let’s dominate June with patience and precision.

— GoldFxMinds

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.