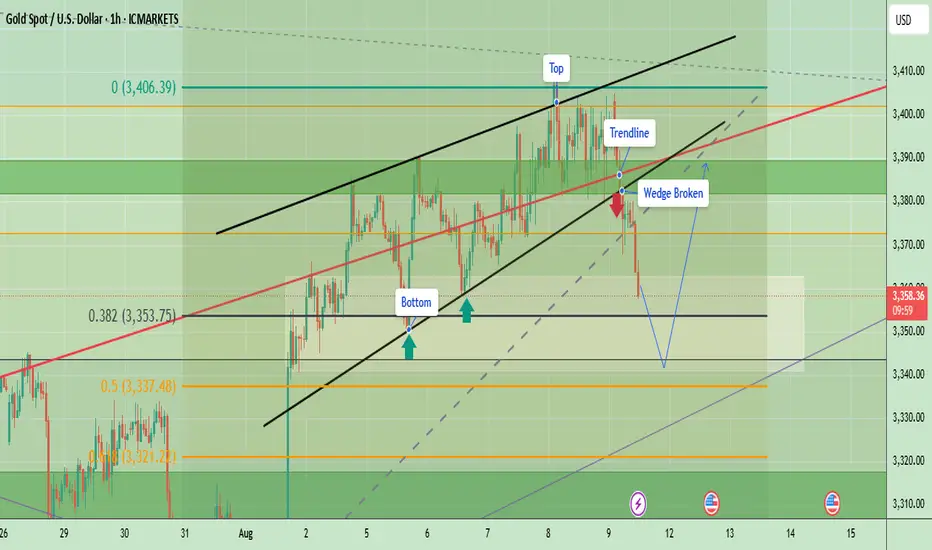

Gold recently broke down from a rising wedge pattern near the $3,385–$3,390 area, signaling potential bearish momentum. Price is currently trading around $3,360, staying below the broken wedge support and also below the main trendline. This breakdown aligns with a shift from short-term bullish to corrective/bearish movement. The trend has shifted bearish unless it reclaims $3,375–$3,388. Short-term bias favors more downside toward $3,350 and $3,342

Key Levels to Watch

- Immediate Resistance: $3,370 – $3,375 (wedge breakdown retest zone)

- Major Resistance: $3,388 – $3,395 (trendline and previous supply zone)

- Immediate Support: $3,350 – $3,352 (short-term Fib and horizontal support)

- Major Support: $3,335 – $3,340 (next demand area)

- Extended Downside Target: $3,322 (Fib 0.22 level)

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Key Levels to Watch

- Immediate Resistance: $3,370 – $3,375 (wedge breakdown retest zone)

- Major Resistance: $3,388 – $3,395 (trendline and previous supply zone)

- Immediate Support: $3,350 – $3,352 (short-term Fib and horizontal support)

- Major Support: $3,335 – $3,340 (next demand area)

- Extended Downside Target: $3,322 (Fib 0.22 level)

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Trade active

Gold has entered a strong demand zone after breaking the wedge, where buyers previously stepped in. If this zone holds, a relief rally could push prices back toward $3,368–$3,372, and a breakout above that level may invite further bullish momentum toward $3,380+.🔑 Key Levels to Watch

- Resistance 1: $3,368 – $3,372

- Resistance 2: $3,380 – $3,384

- Support 1: $3,352 – $3,348 (demand zone)

- Support 2: $3,340 – $3,334

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.