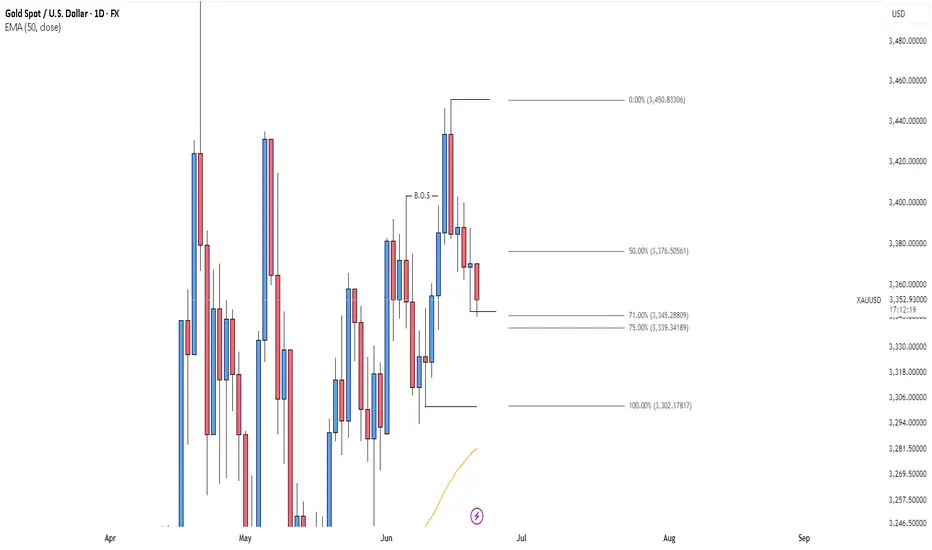

🧠 Current Context on Daily (1D):

🔸 Price is currently in a clear short-term bearish structure following a Break of Structure (BOS).

🔸 It’s dropping towards a zone where a bullish order block begins, around the 75%-100% Fibonacci retracement.

📌 The 50 EMA on the daily chart (around 3,281) is still below price, indicating the overall macro trend remains bullish, but the current move is a healthy bearish correction.

📉 What to expect in the next few hours/days:

🔻 Scenario 1 – Continuation of the drop (likely in the short term):

Price could continue falling toward:

75% retracement zone (~3,339)

100% retracement zone (~3,302), which aligns with a previous demand zone and is close to the 50 EMA

✅ In that area, we could expect:

Mitigation of the daily OB

Bullish reaction if there's a liquidity sweep or confirmation on H4/H1

📈 Scenario 2 – Reversal from current level (less likely without confirmation):

Price is close to the 71% Fib level, so a small bounce may occur, but without liquidity being taken or clear reversal signals, it’s likely to be weak or temporary.

🔥 Conclusion:

It's not yet time to buy impulsively. The price is dropping in an orderly fashion and hasn’t reached a key liquidity zone or the 50 EMA.

👉 Wait for price to reach the 3,339 – 3,302 zone and show PA (price action) confirmation of a reversal.

That could offer a high-probability long opportunity.

🔸 Price is currently in a clear short-term bearish structure following a Break of Structure (BOS).

🔸 It’s dropping towards a zone where a bullish order block begins, around the 75%-100% Fibonacci retracement.

📌 The 50 EMA on the daily chart (around 3,281) is still below price, indicating the overall macro trend remains bullish, but the current move is a healthy bearish correction.

📉 What to expect in the next few hours/days:

🔻 Scenario 1 – Continuation of the drop (likely in the short term):

Price could continue falling toward:

75% retracement zone (~3,339)

100% retracement zone (~3,302), which aligns with a previous demand zone and is close to the 50 EMA

✅ In that area, we could expect:

Mitigation of the daily OB

Bullish reaction if there's a liquidity sweep or confirmation on H4/H1

📈 Scenario 2 – Reversal from current level (less likely without confirmation):

Price is close to the 71% Fib level, so a small bounce may occur, but without liquidity being taken or clear reversal signals, it’s likely to be weak or temporary.

🔥 Conclusion:

It's not yet time to buy impulsively. The price is dropping in an orderly fashion and hasn’t reached a key liquidity zone or the 50 EMA.

👉 Wait for price to reach the 3,339 – 3,302 zone and show PA (price action) confirmation of a reversal.

That could offer a high-probability long opportunity.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.