The revised second-quarter real gross domestic product (GDP) figure is expected to come in at today (Thursday), with an expected annualized quarterly growth rate of 3.1%, up from the previous reading of 3.0%. The US Bureau of Economic Analysis (BEA) will release its second-quarter GDP data. The BEA said in its preliminary estimate that the US economy grew at an annualized rate of 3%. A downward revision to the GDP data could hurt the dollar and help strengthen gold prices, while an upward revision could have the opposite effect.

Market attention will remain focused on US political tensions and trade war-related news. Following the release of US Q2 GDP data, the trading week will conclude with the release of the personal consumption expenditure (PCE) price index on Friday. The PCE index is the Federal Reserve’s preferred inflation measure and could influence market sentiment regarding a September rate cut.

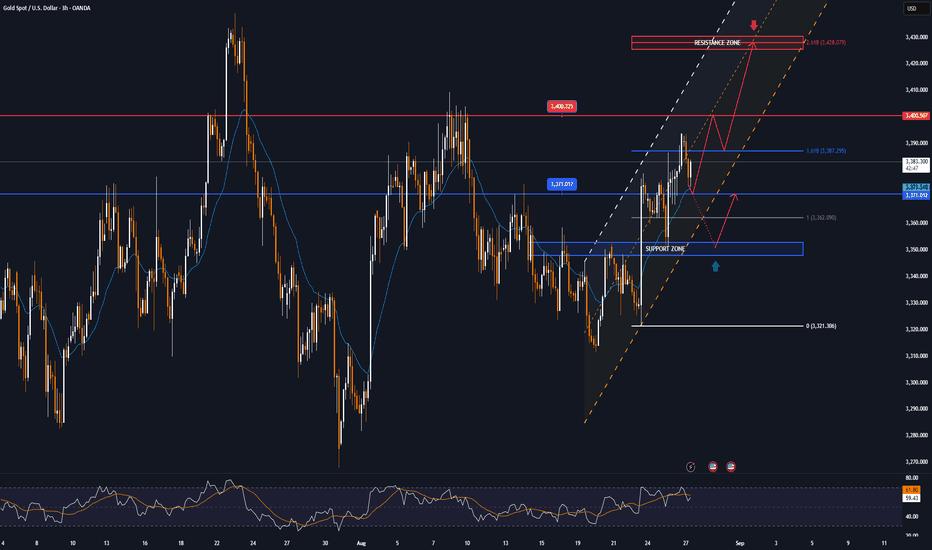

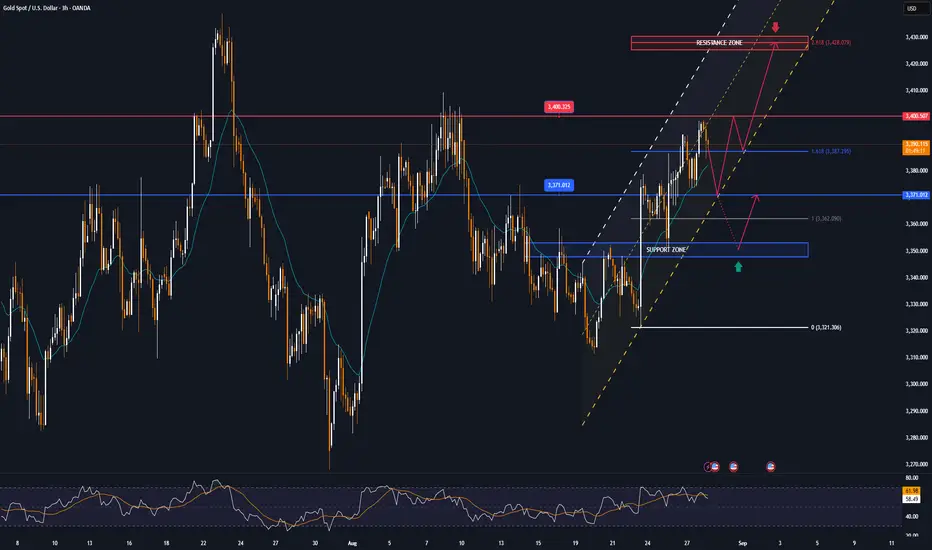

Technical Outlook Analysis

Gold has not been able to break above $3,400 after two sessions of testing, and it is currently retreating slightly from this level with a possible short-term target of $3,371, the 0.236% Fibonacci retracement point, as this is the closest support level currently.

Although gold may fall in the short term, it has also achieved the initial conditions for a possible increase, namely the price action maintained above the EMA21 followed by the RSI maintaining above the 50 mark but the slope is not significant, indicating that the upward momentum is not too strong.

As mentioned to readers, gold is in a sideways accumulation trend, while achieving some of the above short-term bullish conditions. Once gold breaks through the $3,400 mark, it will have the conditions to open a new bullish cycle, with the target then being around $3,430 to $3,450.

During the day, the technical outlook is more inclined towards short-term bullishness, and the notable points will be listed as follows.

Support: $3,371 – $3,350

Resistance: $3,400 – $3,430 – $3,450

SELL XAUUSD PRICE 3430 - 3428⚡️

↠↠ Stop Loss 3434

→Take Profit 1 3322

↨

→Take Profit 2 3316

BUY XAUUSD PRICE 3350 - 3352⚡️

↠↠ Stop Loss 3346

→Take Profit 1 3358

↨

→Take Profit 2 3364

Note

▫️Spot gold lost the $3,440/ounce mark, down 0.23% on the day.Note

Gold hit a record high of $3,578 an ounce on Wednesday before retreating to $3,550 on profit-taking and concerns ahead of the U.S. jobs report. Recent weak jobs data reinforced expectations of an early Fed rate cut, supporting safe-haven demand for gold.Note

▫️Spot gold price reached 3590 USD/ounce, up 0.10% on the day.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

![GOLD MARKET ANALYSIS AND COMMENTARY - [Sep 01 - Sep 05]](https://tradingview.sweetlogin.com/proxy-s3/s/ShElOYpH_mid.png)