Gold prices started the new week at a mild level and fluctuated within a range below multi-day peaks. Important US inflation data reaffirms market expectations that the Federal Reserve (Fed) may cut interest rates in September and again in December. This, in turn, will pull the Dollar The US dollar (USD) is off the peak reached last week and this is the main factor acting as support for the commodity.

Persistent geopolitical tensions and uncertainty about the final outcome of France's shock election have provided some support for safe-haven Gold prices. Meanwhile, the Fed is expected to cut interest rates only once in 2024, while officials still argue in favor of keeping rates higher for longer. This lifted US Treasury yields to multi-week highs and capped the yellow metal's yield.

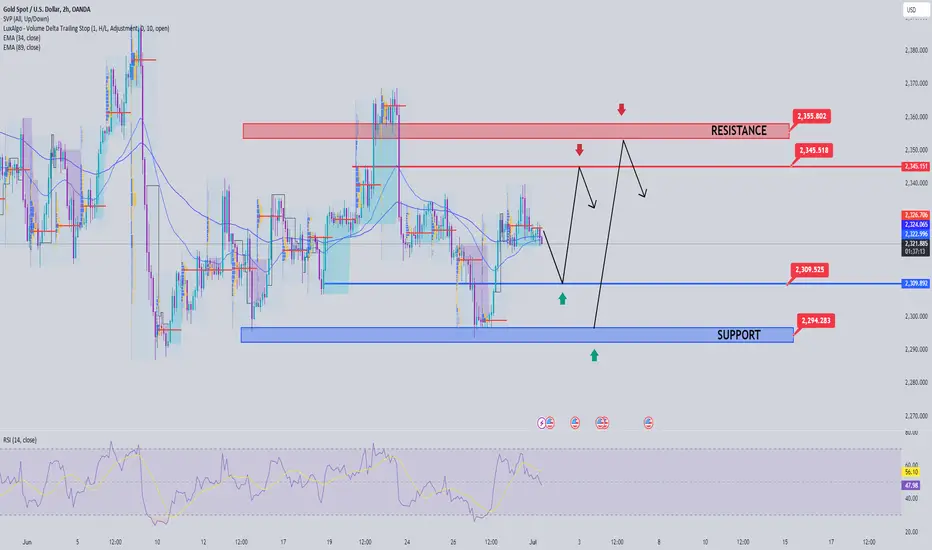

Gold is still trading between the EMA 34 and EMA 89 of the h4 frame, showing that gold is hesitant around the 2320-2330 border. A sustained strength beyond this narrow price band has the potential to push Gold prices back to the 2344-2345 resistance area, which if overcome, would allow buyers to reclaim the $2,355 break out mark. Momentum could extend further to reclaim the 2400 key mark once last month's peak resistance of 2385 was broken.

On the downside, any slippage from the tight range is likely to find some support near 2310. A convincing break below that threshold would be seen as a fresh trigger for bearish traders and pull prices. Gold down to 2295. The round support area of 2300 has almost no meaning anymore to support gold price.

Support: 2310-2295

Resistance: 2344-2355

Trading signals

SELL GOLD 2355-2357 SL 2360

BUY GOLD 2295-2293 SL 2290

Persistent geopolitical tensions and uncertainty about the final outcome of France's shock election have provided some support for safe-haven Gold prices. Meanwhile, the Fed is expected to cut interest rates only once in 2024, while officials still argue in favor of keeping rates higher for longer. This lifted US Treasury yields to multi-week highs and capped the yellow metal's yield.

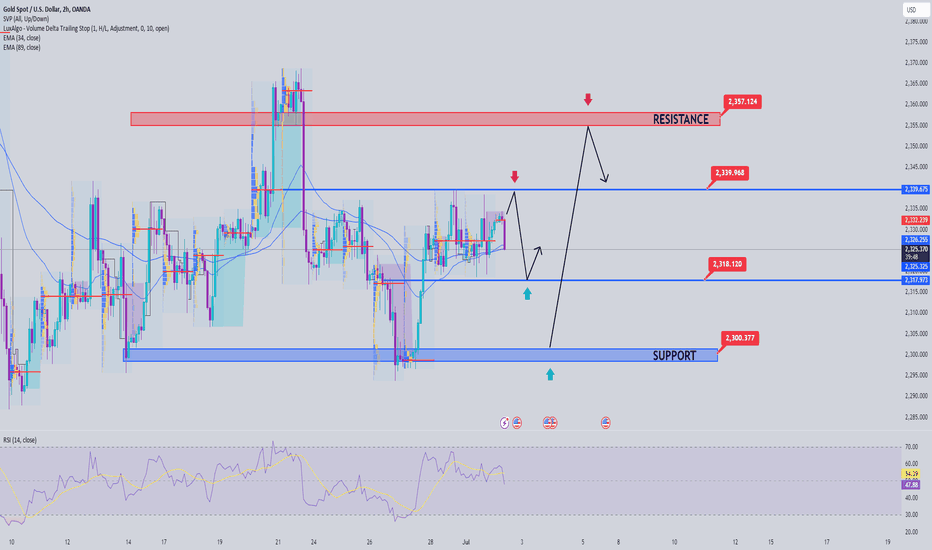

Gold is still trading between the EMA 34 and EMA 89 of the h4 frame, showing that gold is hesitant around the 2320-2330 border. A sustained strength beyond this narrow price band has the potential to push Gold prices back to the 2344-2345 resistance area, which if overcome, would allow buyers to reclaim the $2,355 break out mark. Momentum could extend further to reclaim the 2400 key mark once last month's peak resistance of 2385 was broken.

On the downside, any slippage from the tight range is likely to find some support near 2310. A convincing break below that threshold would be seen as a fresh trigger for bearish traders and pull prices. Gold down to 2295. The round support area of 2300 has almost no meaning anymore to support gold price.

Support: 2310-2295

Resistance: 2344-2355

Trading signals

SELL GOLD 2355-2357 SL 2360

BUY GOLD 2295-2293 SL 2290

Trade active

Note

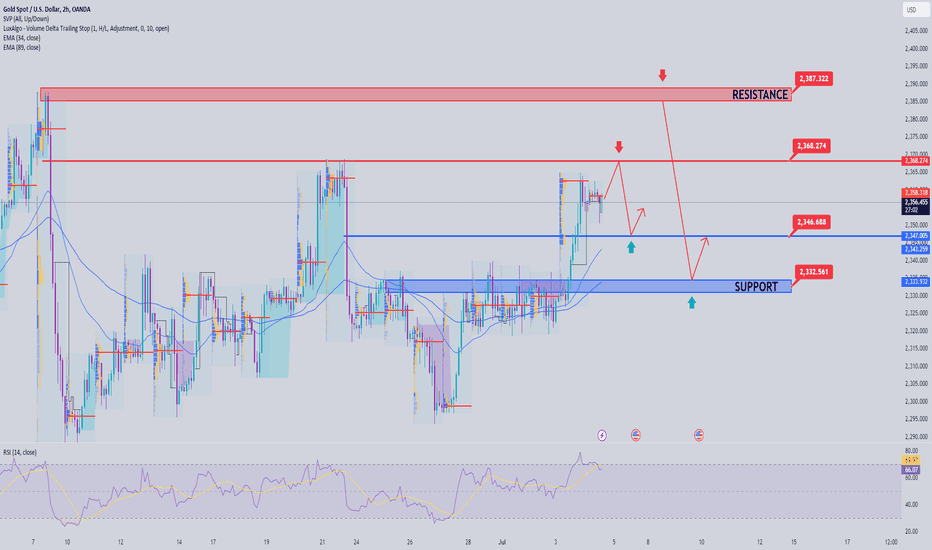

Gold stabilizes above $2,330 as markets await US dataGold clings to modest daily gains and fluctuates above $2,330 on the first trading day of the week. The benchmark 10-year US Treasury bond yield stays near 4.4% following last week's rally, limiting XAU/USD's upside ahead of US data.

Note

Gold prices are struggling to capitalize on Monday's gains amid some USD buying.The Fed's interest rate hike in September could help limit the metal's decline.

Fed Chairman Powell's speech is expected to provide momentum ahead of the FOMC meeting minutes on Wednesday.

Note

Gold continues positive run as investors foresee lower interest ratesGold rises on Friday, continuing its run of positive days as investors become increasingly optimistic the Fed will lower interest rates sooner than previously thought, and the US Dollar softens, adding a lift to Gold which is predominantly bought and sold in Dollars.

JOIN OUR FREE TELEGRAM GROUP t.me/+7rqP7ECMjpUxMzBl

MESSAGE US FOR VIP SIGNALS🏆 t.me/Leilani8597

MESSAGE US FOR VIP SIGNALS🏆 t.me/Leilani8597

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

JOIN OUR FREE TELEGRAM GROUP t.me/+7rqP7ECMjpUxMzBl

MESSAGE US FOR VIP SIGNALS🏆 t.me/Leilani8597

MESSAGE US FOR VIP SIGNALS🏆 t.me/Leilani8597

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.