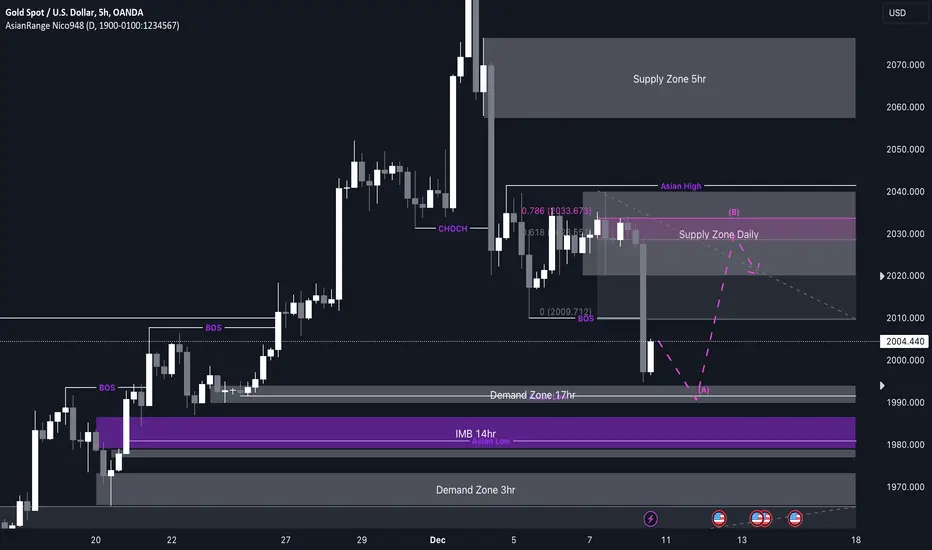

With gold reaching all-time highs (ATHs), we now anticipate a robust bearish reaction due to the substantial liquidity it has absorbed on the upside. This is evident from the long wick at the top, signifying a liquidity grab on the higher time frame. Additionally, the price has been exhibiting highly impulsive movements, indicating an impending retracement.

To capitalize on this outlook, I will be seeking selling opportunities around the daily supply zone at 2020, intending to execute sells further downward toward the liquidity points at the bottom. Furthermore, our identified zone has triggered a significant downward break, creating an opportunity for a redistribution phase, enabling us to continue with further sell positions.

Confluences for GOLD sells are as follows:

- Price has CHOCH & broke structure to the downside on the higher time frames.

- Recent bullish movement is due for a retracement as price action has been very impulsive.

- Lots of liquidity has been swept to the upside including the all-time highs (ATHs).

- Dollar has risen so can expect a continuation in which gold will start a bearish trend.

- Daily supply zone was left which has caused a BOS and has left an imbalance.

- There is a refined POI inside my daily supply which makes the sell opportunity in that region more probable.

- There are barely any reversal magnets on top of the recent highs and there is lots of liquidity below that will attract price to come pick up.

P.S. Despite the price reaching all-time highs (ATHs), my overall outlook on gold remains bullish, and I anticipate the price trajectory to surpass the previous high. However, at present, we base our trades on current market conditions. I am expecting a correction around 2020, with the expectation that the price will interact with the defined supply within the 0.78 Fibonacci range. Subsequently, I will be searching for favourable selling opportunities in that region. However, it is plausible that the price may opt to decrease before initiating the retracement, potentially addressing imbalances beneath our current position.

To capitalize on this outlook, I will be seeking selling opportunities around the daily supply zone at 2020, intending to execute sells further downward toward the liquidity points at the bottom. Furthermore, our identified zone has triggered a significant downward break, creating an opportunity for a redistribution phase, enabling us to continue with further sell positions.

Confluences for GOLD sells are as follows:

- Price has CHOCH & broke structure to the downside on the higher time frames.

- Recent bullish movement is due for a retracement as price action has been very impulsive.

- Lots of liquidity has been swept to the upside including the all-time highs (ATHs).

- Dollar has risen so can expect a continuation in which gold will start a bearish trend.

- Daily supply zone was left which has caused a BOS and has left an imbalance.

- There is a refined POI inside my daily supply which makes the sell opportunity in that region more probable.

- There are barely any reversal magnets on top of the recent highs and there is lots of liquidity below that will attract price to come pick up.

P.S. Despite the price reaching all-time highs (ATHs), my overall outlook on gold remains bullish, and I anticipate the price trajectory to surpass the previous high. However, at present, we base our trades on current market conditions. I am expecting a correction around 2020, with the expectation that the price will interact with the defined supply within the 0.78 Fibonacci range. Subsequently, I will be searching for favourable selling opportunities in that region. However, it is plausible that the price may opt to decrease before initiating the retracement, potentially addressing imbalances beneath our current position.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.