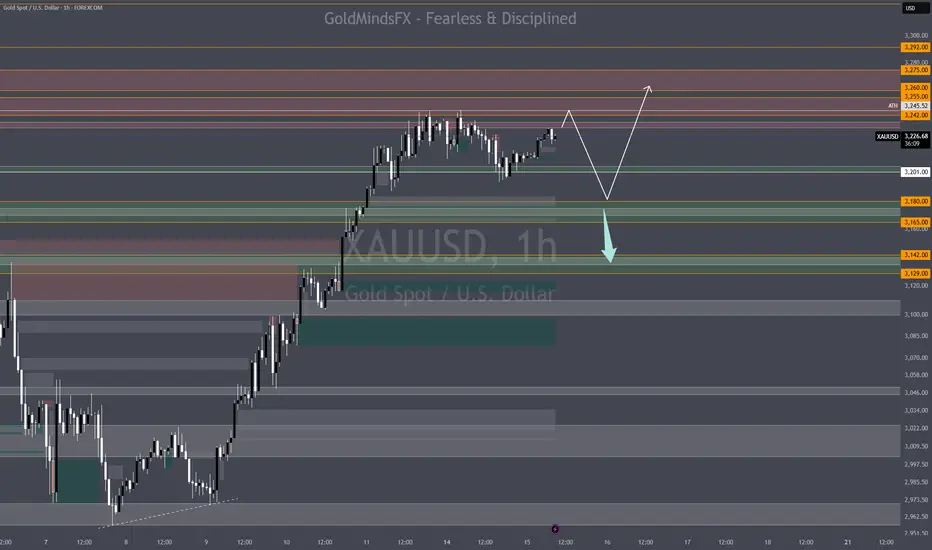

Trend Context: Bullish but showing signs of exhaustion near 3247.

Focus: liquidity grab + intraday rejection potential.

🔍 Market Structure Overview

HTF (H4–12H): Bullish structure holding after the impulsive move 3120 → 3248. Current premium zone tested around 3233–3247 (H4 OB + FVG).

LTF (M15–H1): Reaccumulation structure between 3172–3247. BOS confirmed on M15 from 3180. Current PA shows early rejection wicks near 3230–3240.

🧠 Liquidity Zones & Imbalances

🔴 Supply Zone: 3233–3247 → H1–H4 OB confluence with premium FVG. Still unmitigated.

🟠 Demand Zone 1: 3172–3180 → Daily imbalance + H1 demand + fib 61.8%.

🟢 Demand Zone 2: 3120–3130 → Only valid on deeper correction sweep (low probability today).

⚠️ Liquidity Trap: 3215–3220 → May induce late buyers into supply rejection.

📍 Trade Setups

SELL ZONE

Entry: 3233–3247

SL: 3252

TP1: 3210

TP2: 3180

TP3: 3145

📌 Reason: HTF OB + FVG + premium level. Look for M5/M15 CHoCH confirmation only.

BUY ZONE

Entry: 3172–3180

SL: 3160

TP1: 3205

TP2: 3230

TP3: 3245

📌 Reason: Daily imbalance + H1 demand confluence + clean internal liquidity sweep expected.

🧭 Summary

Price is consolidating between 3172–3247. Upside capped by unmitigated OBs while downside is protected by a strong daily imbalance. NY may attempt a sweep into one zone before real move unfolds. Use patience — wait for CHoCH or BOS confirmation on LTF before entering.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

Focus: liquidity grab + intraday rejection potential.

🔍 Market Structure Overview

HTF (H4–12H): Bullish structure holding after the impulsive move 3120 → 3248. Current premium zone tested around 3233–3247 (H4 OB + FVG).

LTF (M15–H1): Reaccumulation structure between 3172–3247. BOS confirmed on M15 from 3180. Current PA shows early rejection wicks near 3230–3240.

🧠 Liquidity Zones & Imbalances

🔴 Supply Zone: 3233–3247 → H1–H4 OB confluence with premium FVG. Still unmitigated.

🟠 Demand Zone 1: 3172–3180 → Daily imbalance + H1 demand + fib 61.8%.

🟢 Demand Zone 2: 3120–3130 → Only valid on deeper correction sweep (low probability today).

⚠️ Liquidity Trap: 3215–3220 → May induce late buyers into supply rejection.

📍 Trade Setups

SELL ZONE

Entry: 3233–3247

SL: 3252

TP1: 3210

TP2: 3180

TP3: 3145

📌 Reason: HTF OB + FVG + premium level. Look for M5/M15 CHoCH confirmation only.

BUY ZONE

Entry: 3172–3180

SL: 3160

TP1: 3205

TP2: 3230

TP3: 3245

📌 Reason: Daily imbalance + H1 demand confluence + clean internal liquidity sweep expected.

🧭 Summary

Price is consolidating between 3172–3247. Upside capped by unmitigated OBs while downside is protected by a strong daily imbalance. NY may attempt a sweep into one zone before real move unfolds. Use patience — wait for CHoCH or BOS confirmation on LTF before entering.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

Telegram t.me/GoldMindsFX_AI ⭐

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Telegram t.me/GoldMindsFX_AI ⭐

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.