US President Trump once again used tariffs and the market's risk-off sentiment suddenly heated up.  XAUUSD jumped nearly 2% on Friday and the weekly gain reached nearly 5%.

XAUUSD jumped nearly 2% on Friday and the weekly gain reached nearly 5%.

XAUUSD has grown impressively after a sharp decline in mid-May, taking advantage of safe-haven flows, the recovery was mainly due to growing investor concerns about the sustainability of US government debt. The market will likely continue to react to headlines surrounding the difficult US fiscal situation, trade relations and geopolitics.

XAUUSD has grown impressively after a sharp decline in mid-May, taking advantage of safe-haven flows, the recovery was mainly due to growing investor concerns about the sustainability of US government debt. The market will likely continue to react to headlines surrounding the difficult US fiscal situation, trade relations and geopolitics.

On Friday local time, US President Trump said on his social media platform "Real Social" that he proposed to impose a 50% tariff on the European Union from June 1. Trump wrote that the main purpose of the establishment of the European Union was to "take advantage of the United States on trade". In addition, on Friday local time, Trump posted on "Real Social" that he had long told Apple CEO Tim Cook that he expected Apple's iPhones sold in the United States to be produced and manufactured in the United States, not in India or anywhere else. Trump said that otherwise, Apple would have to pay at least a 25% tariff to the United States.

Assessing the situation surrounding Trump

"Trump has been vocal in the past 24 hours, threatening to impose 50% tariffs on the European Union starting June 1, imposing major sanctions on Apple and taking on Harvard University, all of which have weighed on stocks but boosted gold prices.

Recurrent tariff concerns, coupled with low liquidity ahead of the long weekend, could exacerbate volatility."

![GOLD MARKET ANALYSIS AND COMMENTARY - [May 26 - May 30]](https://tradingview.sweetlogin.com/proxy-s3/i/IYfYtLR9_mid.png)

Technical Outlook Analysis XAUUSD

XAUUSD

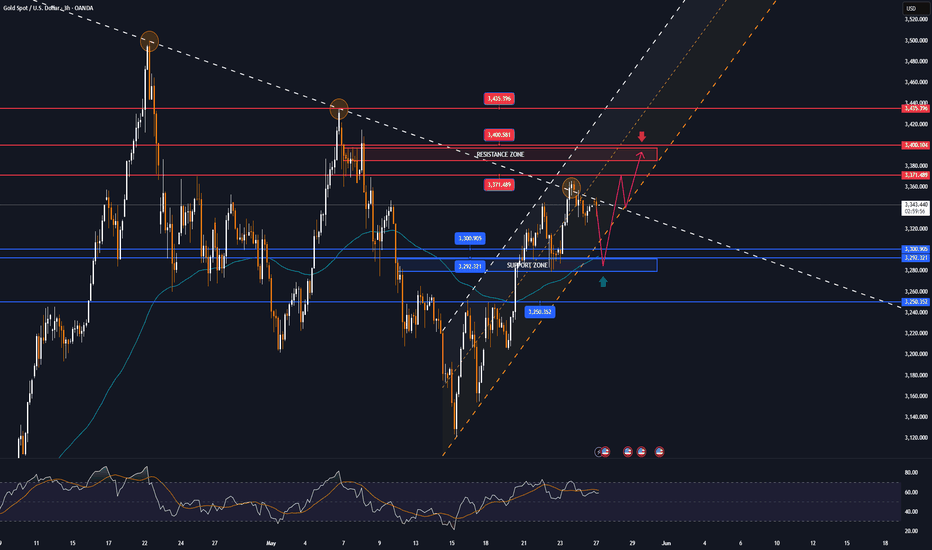

On the daily chart, gold has achieved its initial upside target at $3,371 which is the technical confluence of the 0.236% Fibonacci retracement with the upper edge of the price channel after receiving support from the confluence of the EMA21 with the 0.382% Fibonacci retracement.

In the short term, if gold breaks $3,371 it will tend to continue its bullish trend with the next target being $3,400 in the short term, more so than the last $3,435 which is the all-time high of $3,500.

As long as gold remains within/above the channel, the overall trend outlook is bullish, and the immediate support is currently around the $3,300 raw price point area with the 0.382% Fibonacci retracement level and EMA21. In case of a sell-off below $3,292, gold could still find short-term support at the $3,250 technical point and the 0.50% Fibonacci retracement level.

In terms of momentum, the Relative Strength Index (RSI) is pointing up from around the 50 mark, with the RSI still well above the overbought zone, suggesting room for further upside.

Looking ahead, the overall technical outlook for gold is bullish, with key points to watch out for as follows.

Support: $3,300 – $3,292 – $3,250

Resistance: $3,371 – $3,400 – $3,435

SELL XAUUSD PRICE 3391 - 3389⚡️

↠↠ Stop Loss 3395

→Take Profit 1 3383

↨

→Take Profit 2 3377

BUY XAUUSD PRICE 3299 - 3301⚡️

↠↠ Stop Loss 3295

→Take Profit 1 3307

↨

→Take Profit 2 3313

On Friday local time, US President Trump said on his social media platform "Real Social" that he proposed to impose a 50% tariff on the European Union from June 1. Trump wrote that the main purpose of the establishment of the European Union was to "take advantage of the United States on trade". In addition, on Friday local time, Trump posted on "Real Social" that he had long told Apple CEO Tim Cook that he expected Apple's iPhones sold in the United States to be produced and manufactured in the United States, not in India or anywhere else. Trump said that otherwise, Apple would have to pay at least a 25% tariff to the United States.

Assessing the situation surrounding Trump

"Trump has been vocal in the past 24 hours, threatening to impose 50% tariffs on the European Union starting June 1, imposing major sanctions on Apple and taking on Harvard University, all of which have weighed on stocks but boosted gold prices.

Recurrent tariff concerns, coupled with low liquidity ahead of the long weekend, could exacerbate volatility."

![GOLD MARKET ANALYSIS AND COMMENTARY - [May 26 - May 30]](https://tradingview.sweetlogin.com/proxy-s3/i/IYfYtLR9_mid.png)

Technical Outlook Analysis

On the daily chart, gold has achieved its initial upside target at $3,371 which is the technical confluence of the 0.236% Fibonacci retracement with the upper edge of the price channel after receiving support from the confluence of the EMA21 with the 0.382% Fibonacci retracement.

In the short term, if gold breaks $3,371 it will tend to continue its bullish trend with the next target being $3,400 in the short term, more so than the last $3,435 which is the all-time high of $3,500.

As long as gold remains within/above the channel, the overall trend outlook is bullish, and the immediate support is currently around the $3,300 raw price point area with the 0.382% Fibonacci retracement level and EMA21. In case of a sell-off below $3,292, gold could still find short-term support at the $3,250 technical point and the 0.50% Fibonacci retracement level.

In terms of momentum, the Relative Strength Index (RSI) is pointing up from around the 50 mark, with the RSI still well above the overbought zone, suggesting room for further upside.

Looking ahead, the overall technical outlook for gold is bullish, with key points to watch out for as follows.

Support: $3,300 – $3,292 – $3,250

Resistance: $3,371 – $3,400 – $3,435

SELL XAUUSD PRICE 3391 - 3389⚡️

↠↠ Stop Loss 3395

→Take Profit 1 3383

↨

→Take Profit 2 3377

BUY XAUUSD PRICE 3299 - 3301⚡️

↠↠ Stop Loss 3295

→Take Profit 1 3307

↨

→Take Profit 2 3313

Note

Gold prices fluctuate around 3,330 USD/ozNote

Spot gold prices continued to fall, down $5 in the short term to $3,340 an ounce.Note

Gold continues to weaken to 3,285 USD/ozNote

Gold prices suddenly plummeted early on May 28, falling to $3,285.25/ounce due to the temporary easing of US-EU trade tensions after Trump delayed imposing a 50% tax, causing demand for safe havens to decline.Note

🔴Spot gold prices fell below $3,290/ounce, down 0.30% on the day.Note

Gold price recovers slightly to above 3,270 USD/ozNote

Dollar rally stalls as traders assess next step on Trump tariffsNote

🔴Spot gold prices fell below $3,300/ounce, down 0.53% on the day.Note

Gold accumulates around $3,295/oz🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.