🔸 News Update: Geopolitical Turmoil Boosts Gold’s Appeal 🔸

The Russian Ministry of Defense reported missile strikes on Ukrainian SBU and special operations units, further escalating tensions in Eastern Europe. This, combined with China’s continued gold hoarding and a weaker USD, has kept gold’s bullish momentum intact.

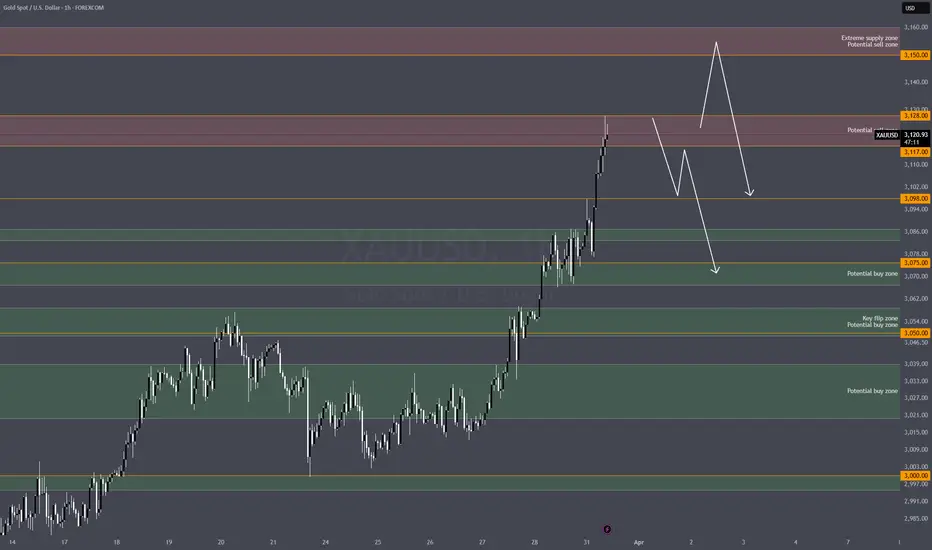

🟥 Sell Setup (Liquidity Trap Short)

Entry Zone: $3,121 – $3,125 (Liquidity Grab + HTF Supply)

Trigger: M5/M15 Bearish CHoCH + Weak Bullish Reaction

SL: Above $3,130 (Invalidation Level)

TP1: $3,100 (First Target)

TP2: $3,085 (Deep Profit Zone)

TP3: $3,074 (Full Breakdown)

📌 Why?

Liquidity Hunt Potential → Market may fake out longs before reversal

Bearish Order Flow Zone → Major supply area where sellers are active

HTF Expansion Exhaustion → Price needs to cool off before further gains

🟥 Sell Setup 2 (Momentum Reversal – Only If Confirmed)

Entry Zone: 3,150 – 3,155 (Extreme Supply Zone)

Trigger: Bearish CHoCH + FVG reaction

SL: Above 3,160

TP1: 3,120

TP2: 3,100

TP3: 3,073

📌 Reasoning:

Extreme premium level where HTF supply could react

Only valid if price extends to this level without pullback

Ideal for a larger reversal if bullish momentum fades

🟢 Buy Setup 3 (Intraday Continuation Play – If $3,100 Rejects)

Entry: $3,092 – $3,094 (LQ sweep + minor demand zone)

Trigger: M1/M5 CHoCH + bullish rejection wick

SL: Below $3,090

TP1: $3,100

TP2: $3,108

TP3: $3,117

📌 Why This Zone?

If NY sweeps $3,100 liquidity and retraces, $3,092 – $3,094 could be a quick buy-the-dip area.

Only valid if the previous demand structure remains intact.

Ideal for short-term scalps rather than a deep retrace buy.

⚠ If price drops aggressively below $3,090, don’t force the buy—$3,083 – $3,087 is the next stronger zone.

🟢 Next Fresh Buy Setup (If Price Dips Again)

Entry Zone: $3,067 – $3,070 (Untapped demand + imbalance fill)

Trigger: M1/M5 CHoCH + bullish confirmation

SL: Below $3,064 (Liquidity protection)

TP1: $3,090 (Reaction level)

TP2: $3,108 (Liquidity grab target)

TP3: $3,120+ (Continuation move)

📌 Why This Zone?

Previous NY session left unmitigated demand here.

If price pulls back, smart money will likely buy from this area.

Gold still bullish – this is the next potential buy-the-dip zone.

⚠️ If $3,067 fails, deeper support at $3,055 – watch for a strong reaction there!!

✅ Key Takeaways

✔ Gold remains bullish above $3,074 – buy dips, but avoid FOMO.

✔ A liquidity grab below $3,080 could be the next major long opportunity.

✔ Sells are scalps only – favor longs unless $3,067 breaks.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your own plan and wait for confirmation before taking action.

Good luck on the market today.

The Russian Ministry of Defense reported missile strikes on Ukrainian SBU and special operations units, further escalating tensions in Eastern Europe. This, combined with China’s continued gold hoarding and a weaker USD, has kept gold’s bullish momentum intact.

🟥 Sell Setup (Liquidity Trap Short)

Entry Zone: $3,121 – $3,125 (Liquidity Grab + HTF Supply)

Trigger: M5/M15 Bearish CHoCH + Weak Bullish Reaction

SL: Above $3,130 (Invalidation Level)

TP1: $3,100 (First Target)

TP2: $3,085 (Deep Profit Zone)

TP3: $3,074 (Full Breakdown)

📌 Why?

Liquidity Hunt Potential → Market may fake out longs before reversal

Bearish Order Flow Zone → Major supply area where sellers are active

HTF Expansion Exhaustion → Price needs to cool off before further gains

🟥 Sell Setup 2 (Momentum Reversal – Only If Confirmed)

Entry Zone: 3,150 – 3,155 (Extreme Supply Zone)

Trigger: Bearish CHoCH + FVG reaction

SL: Above 3,160

TP1: 3,120

TP2: 3,100

TP3: 3,073

📌 Reasoning:

Extreme premium level where HTF supply could react

Only valid if price extends to this level without pullback

Ideal for a larger reversal if bullish momentum fades

🟢 Buy Setup 3 (Intraday Continuation Play – If $3,100 Rejects)

Entry: $3,092 – $3,094 (LQ sweep + minor demand zone)

Trigger: M1/M5 CHoCH + bullish rejection wick

SL: Below $3,090

TP1: $3,100

TP2: $3,108

TP3: $3,117

📌 Why This Zone?

If NY sweeps $3,100 liquidity and retraces, $3,092 – $3,094 could be a quick buy-the-dip area.

Only valid if the previous demand structure remains intact.

Ideal for short-term scalps rather than a deep retrace buy.

⚠ If price drops aggressively below $3,090, don’t force the buy—$3,083 – $3,087 is the next stronger zone.

🟢 Next Fresh Buy Setup (If Price Dips Again)

Entry Zone: $3,067 – $3,070 (Untapped demand + imbalance fill)

Trigger: M1/M5 CHoCH + bullish confirmation

SL: Below $3,064 (Liquidity protection)

TP1: $3,090 (Reaction level)

TP2: $3,108 (Liquidity grab target)

TP3: $3,120+ (Continuation move)

📌 Why This Zone?

Previous NY session left unmitigated demand here.

If price pulls back, smart money will likely buy from this area.

Gold still bullish – this is the next potential buy-the-dip zone.

⚠️ If $3,067 fails, deeper support at $3,055 – watch for a strong reaction there!!

✅ Key Takeaways

✔ Gold remains bullish above $3,074 – buy dips, but avoid FOMO.

✔ A liquidity grab below $3,080 could be the next major long opportunity.

✔ Sells are scalps only – favor longs unless $3,067 breaks.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your own plan and wait for confirmation before taking action.

Good luck on the market today.

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.