💥 XAUUSD FOMC Sniper Plan – May 7, 2025

"We Don’t Chase Breakouts. We Build the Trap Before the Noise."

🌍 Macro & Geopolitical Context – What Really Matters Today

Markets are frozen in anticipation of tonight’s FOMC bombshell:

📌 20:00 UTC – FOMC Statement & Rate Decision

📌 20:30 UTC – Powell Speaks

Traders are split. Some expect a dovish tone to push gold through ATH. Others brace for a hawkish surprise.

But let’s get one thing straight:

Gold has already run thousands of pips. It doesn’t need help going higher — it needs a reason not to collapse.

That’s what Powell holds in his hands tonight.

Meanwhile, geopolitics stay hot in the background:

Middle East tensions simmer (again).

Trump pressure on Powell to step down adds political risk.

Global yields are compressing → gold remains macro-favored.

This is not a time for guessing. This is a time for traps.

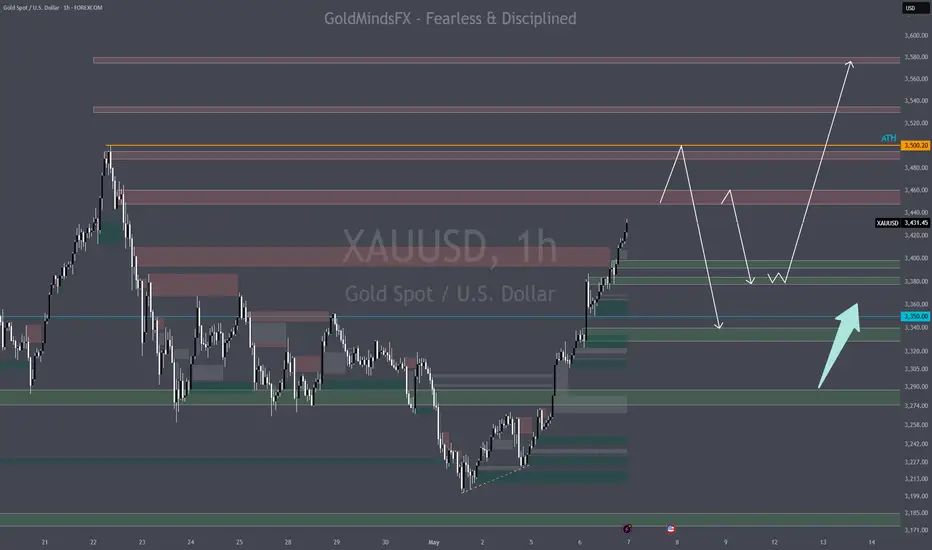

🧠 Current Structure Snapshot (Price: 3431)

HTF is still bullish, but we're extended.

Last confirmed HH = 3488, with ATH = 3500

We're in a short-term retrace under a H4 CHoCH → excellent sniper conditions.

🧱 Key Structural Levels

Zone Type Price Range Context

🔼 R2 3488–3495 Last HH OB + extension sweep trap

🔼 R1 3448–3455 H4 OB + liquidity pocket under HH

🔽 S1 3378–3384 H4 OB + FVG + EMA 50 confluence

🔽 S2 3333–3340 D1 OB + CHoCH + imbalance zone

We don't use FIBO extensions for guessing entries. We use them to target the crowd who does:

Extension Price Range Use

1.272 3530–3535 TP3 only

1.618 3575–3580 Final exhaustion area

🎯 Sniper Setups – Real, Refined, Ruthless

🟢 Buy #1 – 3378–3384

Valid H4 OB

FVG tail fill + internal liquidity

RSI around 40 + EMA 50 bounce

SL: 3365

TP1: 3405 | TP2: 3430 | TP3: 3455

🧠 Our first reaction zone before news madness.

🟢 Buy #2 – 3333–3340

D1 OB + imbalance

Clean internal liquidity from 3300–3330

Confluence with CHoCH base

SL: 3315

TP1: 3370 | TP2: 3405 | TP3: 3448

💎 This zone is invisible to retail — perfect trap before spike.

🔴 Sell #1 – 3448–3455

H4 OB at premium

EMA rejection + FVG close

Pre-news stop hunt ideal here

SL: 3462

TP1: 3430 | TP2: 3405 | TP3: 3385

🎯 Don’t short gold randomly — short it here, where retail longs trap themselves.

🔴 Sell #2 – 3488–3495

Last HH OB before ATH

Strong fibo ext confluence

Sweeps = liquidity + exhaustion

SL: 3504

TP1: 3465 | TP2: 3430 | TP3: 3395

If they want to break ATH before Powell, we’ll be waiting above it.

⚙ EMAs in Sync

EMA Signal

21 Tested from below — sell confluence at 3448

50 Lining up near Buy #1

200 Far below — macro still bullish

🧠 Execution Plan

Stay flat before FOMC unless setups trigger with PA confluence

Anticipate whipsaws → SLs must be respected

If price consolidates above 3455 = bullish continuation likely

If it sweeps 3448–3455 and rejects = sell of the week

Drop a 🚀 and follow us: if you’re not trading emotion — you’re trading execution.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

"We Don’t Chase Breakouts. We Build the Trap Before the Noise."

🌍 Macro & Geopolitical Context – What Really Matters Today

Markets are frozen in anticipation of tonight’s FOMC bombshell:

📌 20:00 UTC – FOMC Statement & Rate Decision

📌 20:30 UTC – Powell Speaks

Traders are split. Some expect a dovish tone to push gold through ATH. Others brace for a hawkish surprise.

But let’s get one thing straight:

Gold has already run thousands of pips. It doesn’t need help going higher — it needs a reason not to collapse.

That’s what Powell holds in his hands tonight.

Meanwhile, geopolitics stay hot in the background:

Middle East tensions simmer (again).

Trump pressure on Powell to step down adds political risk.

Global yields are compressing → gold remains macro-favored.

This is not a time for guessing. This is a time for traps.

🧠 Current Structure Snapshot (Price: 3431)

HTF is still bullish, but we're extended.

Last confirmed HH = 3488, with ATH = 3500

We're in a short-term retrace under a H4 CHoCH → excellent sniper conditions.

🧱 Key Structural Levels

Zone Type Price Range Context

🔼 R2 3488–3495 Last HH OB + extension sweep trap

🔼 R1 3448–3455 H4 OB + liquidity pocket under HH

🔽 S1 3378–3384 H4 OB + FVG + EMA 50 confluence

🔽 S2 3333–3340 D1 OB + CHoCH + imbalance zone

We don't use FIBO extensions for guessing entries. We use them to target the crowd who does:

Extension Price Range Use

1.272 3530–3535 TP3 only

1.618 3575–3580 Final exhaustion area

🎯 Sniper Setups – Real, Refined, Ruthless

🟢 Buy #1 – 3378–3384

Valid H4 OB

FVG tail fill + internal liquidity

RSI around 40 + EMA 50 bounce

SL: 3365

TP1: 3405 | TP2: 3430 | TP3: 3455

🧠 Our first reaction zone before news madness.

🟢 Buy #2 – 3333–3340

D1 OB + imbalance

Clean internal liquidity from 3300–3330

Confluence with CHoCH base

SL: 3315

TP1: 3370 | TP2: 3405 | TP3: 3448

💎 This zone is invisible to retail — perfect trap before spike.

🔴 Sell #1 – 3448–3455

H4 OB at premium

EMA rejection + FVG close

Pre-news stop hunt ideal here

SL: 3462

TP1: 3430 | TP2: 3405 | TP3: 3385

🎯 Don’t short gold randomly — short it here, where retail longs trap themselves.

🔴 Sell #2 – 3488–3495

Last HH OB before ATH

Strong fibo ext confluence

Sweeps = liquidity + exhaustion

SL: 3504

TP1: 3465 | TP2: 3430 | TP3: 3395

If they want to break ATH before Powell, we’ll be waiting above it.

⚙ EMAs in Sync

EMA Signal

21 Tested from below — sell confluence at 3448

50 Lining up near Buy #1

200 Far below — macro still bullish

🧠 Execution Plan

Stay flat before FOMC unless setups trigger with PA confluence

Anticipate whipsaws → SLs must be respected

If price consolidates above 3455 = bullish continuation likely

If it sweeps 3448–3455 and rejects = sell of the week

Drop a 🚀 and follow us: if you’re not trading emotion — you’re trading execution.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

Trade active

💥 XAUUSD Market Update – May 7, 2025 (FOMC Day Edition)

“This Isn’t Price Action. This Is War.” 💣🔫

🧠 MACRO CONTEXT – FOMC DAY 🔥

Today at 20:00 UTC, we get the Fed Funds Rate + FOMC Statement, followed by Powell’s Press Conference at 20:30 UTC.

Market expects the rate to hold at 4.50%,

But what matters is tone: if Powell leans hawkish → gold can dump hard.

If he’s dovish (hinting cuts) → gold could rip above ATH 3500.

Today is not a day to predict — it’s a day to trap.

🔎 TECHNICAL STRUCTURE (Current Price: 3387)

Price rejected cleanly from 3430 – a premium OB + internal CHoCH (H1)

We're now compressing just above 3384, the last broken bullish structure

M30–H1 showing bearish flow, but no clean BOS below 3366

Liquidity remains untouched above 3448, 3488, and 3500

Below, the imbalance from 3365–3340 remains a magnet

🗺 STRUCTURE ZONES

🔴 Valid Sell Zones (Premium)

3448–3455 → H4 OB + EMA 21 + rejection wick

3488–3495 → Last HH before ATH + breakout trap

Both are perfect pre-FOMC sweep setups.

🟢 Valid Buy Zones (Discount)

3375–3390 → H1 OB + 50% FIBO retrace + EMA 50 test

3333–3340 → D1 OB + unmitigated imbalance + 78.6% zone

Only trade if price sweeps and confirms on M15–M5.

📏 KEY LEVELS ABOVE

Level Type Purpose

3448–3455 Sell zone Pre-FOMC liquidity

3488–3495 Sell trap Breakout killers

3500 ATH Big magnet

3530–3535 1.272 ext TP only if ATH breaks

3575–3580 1.618 ext Blow-off exhaustion

📉 KEY LEVELS BELOW

Level Type Purpose

3375–3390 Buy zone 1 Structure + OB

3333–3340 Buy zone 2 CHoCH + D1 OB

3315–3320 Invalid zone Structure break if lost

3285–3300 Last stand Full sweep/reacc zone

⚙ TREND SNAPSHOT

TF Trend Notes

H4 Bullish As long as 3330 holds

H1 Bearish bias Below 3448 + CHoCH confirmed

M30 Bearish Lower highs, clean rejection wicks

🧠 WHAT TO EXPECT

Pre-FOMC: expect liquidity sweeps both ways

During FOMC: huge wicks possible — trade only confirmation, or wait post-news

If we hold above 3365 → bounce toward 3448

If we break 3333 → prepare for full reprice into 3300 or even 3285

🗣 CLOSING THOUGHTS

This isn’t about calling tops or bottoms.

It’s about positioning where others panic.

The trap is being set above 3448 and below 3340.

Let them run into it.

We wait. We strike. We exit.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

🔫 Drop a comment and follow if you’re sniping this FOMC.

⭐ VIP ACCESS & Coaching⭐ t.me/GoldMindsFX_A

⚡Join our Telegram Group at t.me/GoldMindsFX_AI ⚡

Daily Sniper Plans / Education step by step and personal guidance.

⚡Join our Telegram Group at t.me/GoldMindsFX_AI ⚡

Daily Sniper Plans / Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⭐ VIP ACCESS & Coaching⭐ t.me/GoldMindsFX_A

⚡Join our Telegram Group at t.me/GoldMindsFX_AI ⚡

Daily Sniper Plans / Education step by step and personal guidance.

⚡Join our Telegram Group at t.me/GoldMindsFX_AI ⚡

Daily Sniper Plans / Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.