From Cold Calling to Telegram

I’ve been in the markets for so long I feel like a dinosaur, and I’ve probably seen every scam out there.

The truth is, none of them are really new — they’re just adapted to the new social paradigm.

What was done in the 2000s through cold calling is now done through Telegram, Instagram, X, and other social platforms.

I didn’t really want to write this article, in case it gave someone ideas.

But since anyone who wants to be a scammer already knows how it works, maybe this article can warn those who still have no idea how the so-called account management scam operates — especially its most common form: the coin flip scam (50/50 scam, Opposite trades scam, Split-direction scam, Two-group margin call trick, as is also known)

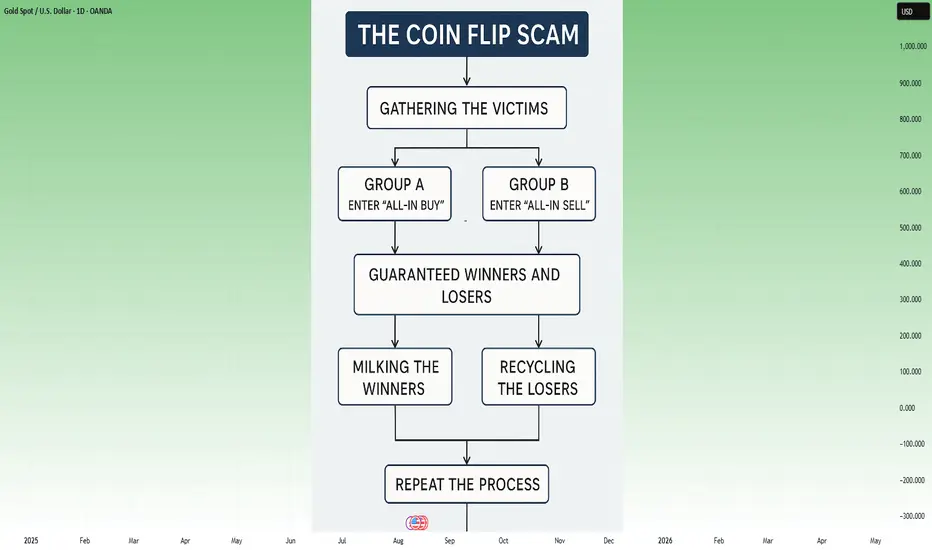

Step-by-Step: How the Coin Flip Scam Works

1. Gathering the victims

The scammer starts by fishing for victims through Telegram channels/groups, Instagram profiles, Facebook groups, or even X posts.

They present fabulous profits, post ads with guaranteed return offers, and flood the feed with so-called “proofs” — screenshots of winning trades, client testimonials, and account statements. Most of these are either fabricated or selectively chosen to show only the winning side.

Once someone shows interest, the scammer’s first move is to earn their trust.

They’ll tell you the broker doesn’t matter, that you can choose it, and that they have no access to your money — which is, technically, true.

Then comes the closer:

“You don’t have to pay me upfront. I only get paid if I make you money, so it’s in my best interest not to lose. You see? We’re on the same side.”

This combination of flashy results and “risk-free” terms makes you feel safe enough to hand them trading access.

________________________________________

2. Splitting into two groups

The accounts are divided into two equal batches:

• Group A → All-in BUY

• Group B → All-in SELL

With high leverage (e.g., 1:200), a 50-pip move means either doubling the account or wiping it out completely.

Note: I won’t go too deep into the details here, because the exact margin call level depends on the broker. But trust me, it’s easy for a scammer to plan the money split based on the different brokers’ rules. What we’re talking about here is just the general principle.

________________________________________

3. Guaranteed winners and losers

The market moves.

One group hits margin call and loses, while the other doubles or triples its capital (depending on broker's leverage, even more on 1:500).

The scammer now has perfect marketing material: “Look how I doubled my client’s account!”

________________________________________

4. Milking the winners

Clients who made a profit are celebrated and told something like:

“I only worked with low capital this time just to show you I can do it. I have big clients and serious strategies — now that you’ve seen the proof, deposit more so we can make real money.”

The scammer frames the initial gain as a “demo run” to gain the client’s confidence, pushing them to commit much larger sums next.

________________________________________

5. Recycling the losers

The wiped-out clients are told:

“It was an unusual market move. Deposit another $1,000 and we’ll recover it tomorrow.”

Some quit, but others fall for it again.

________________________________________

6. Repeat the process

The cycle continues. There’s always a “happy” group and real account statements to attract fresh victims, while the losers are quietly discarded or convinced to reinvest.

________________________________________

Why the scam works

• The proof are authentic – Screenshots and MT4/MT5 statements for the winners are real.

• Survivorship bias – Prospects only see the successes, never the failures.

• Hope psychology – Losers believe “next time” will be different (and it can be if they end up in the "winner group" next time

________________________________________

Final word

If someone promises to double your account quickly and safely — walk away.

Real trading is about risk management and long-term consistency, not betting your capital on a 50/50 gamble.

Don’t be the next screenshot in a scammer’s sales pitch. 🚀

P.S.

Stop believing they “made you money on purpose” at the beginning and then “lost it on purpose” after you deposited more.

If they truly had the skill to do that, they wouldn’t need to be scammers in the first place.

The reality is simple — once you put in more money, you just happened to land on the losing side of their scam.

I’ve been in the markets for so long I feel like a dinosaur, and I’ve probably seen every scam out there.

The truth is, none of them are really new — they’re just adapted to the new social paradigm.

What was done in the 2000s through cold calling is now done through Telegram, Instagram, X, and other social platforms.

I didn’t really want to write this article, in case it gave someone ideas.

But since anyone who wants to be a scammer already knows how it works, maybe this article can warn those who still have no idea how the so-called account management scam operates — especially its most common form: the coin flip scam (50/50 scam, Opposite trades scam, Split-direction scam, Two-group margin call trick, as is also known)

Step-by-Step: How the Coin Flip Scam Works

1. Gathering the victims

The scammer starts by fishing for victims through Telegram channels/groups, Instagram profiles, Facebook groups, or even X posts.

They present fabulous profits, post ads with guaranteed return offers, and flood the feed with so-called “proofs” — screenshots of winning trades, client testimonials, and account statements. Most of these are either fabricated or selectively chosen to show only the winning side.

Once someone shows interest, the scammer’s first move is to earn their trust.

They’ll tell you the broker doesn’t matter, that you can choose it, and that they have no access to your money — which is, technically, true.

Then comes the closer:

“You don’t have to pay me upfront. I only get paid if I make you money, so it’s in my best interest not to lose. You see? We’re on the same side.”

This combination of flashy results and “risk-free” terms makes you feel safe enough to hand them trading access.

________________________________________

2. Splitting into two groups

The accounts are divided into two equal batches:

• Group A → All-in BUY

• Group B → All-in SELL

With high leverage (e.g., 1:200), a 50-pip move means either doubling the account or wiping it out completely.

Note: I won’t go too deep into the details here, because the exact margin call level depends on the broker. But trust me, it’s easy for a scammer to plan the money split based on the different brokers’ rules. What we’re talking about here is just the general principle.

________________________________________

3. Guaranteed winners and losers

The market moves.

One group hits margin call and loses, while the other doubles or triples its capital (depending on broker's leverage, even more on 1:500).

The scammer now has perfect marketing material: “Look how I doubled my client’s account!”

________________________________________

4. Milking the winners

Clients who made a profit are celebrated and told something like:

“I only worked with low capital this time just to show you I can do it. I have big clients and serious strategies — now that you’ve seen the proof, deposit more so we can make real money.”

The scammer frames the initial gain as a “demo run” to gain the client’s confidence, pushing them to commit much larger sums next.

________________________________________

5. Recycling the losers

The wiped-out clients are told:

“It was an unusual market move. Deposit another $1,000 and we’ll recover it tomorrow.”

Some quit, but others fall for it again.

________________________________________

6. Repeat the process

The cycle continues. There’s always a “happy” group and real account statements to attract fresh victims, while the losers are quietly discarded or convinced to reinvest.

________________________________________

Why the scam works

• The proof are authentic – Screenshots and MT4/MT5 statements for the winners are real.

• Survivorship bias – Prospects only see the successes, never the failures.

• Hope psychology – Losers believe “next time” will be different (and it can be if they end up in the "winner group" next time

________________________________________

Final word

If someone promises to double your account quickly and safely — walk away.

Real trading is about risk management and long-term consistency, not betting your capital on a 50/50 gamble.

Don’t be the next screenshot in a scammer’s sales pitch. 🚀

P.S.

Stop believing they “made you money on purpose” at the beginning and then “lost it on purpose” after you deposited more.

If they truly had the skill to do that, they wouldn’t need to be scammers in the first place.

The reality is simple — once you put in more money, you just happened to land on the losing side of their scam.

📈 Forex & XAU/USD Channel:

t.me/intradaytradingsignals

💎 Crypto Channel:

t.me/FanCryptocurrency

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Forex & XAU/USD Channel:

t.me/intradaytradingsignals

💎 Crypto Channel:

t.me/FanCryptocurrency

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.