Technical Analysis

Key Confluences Supporting the Buy Setup:

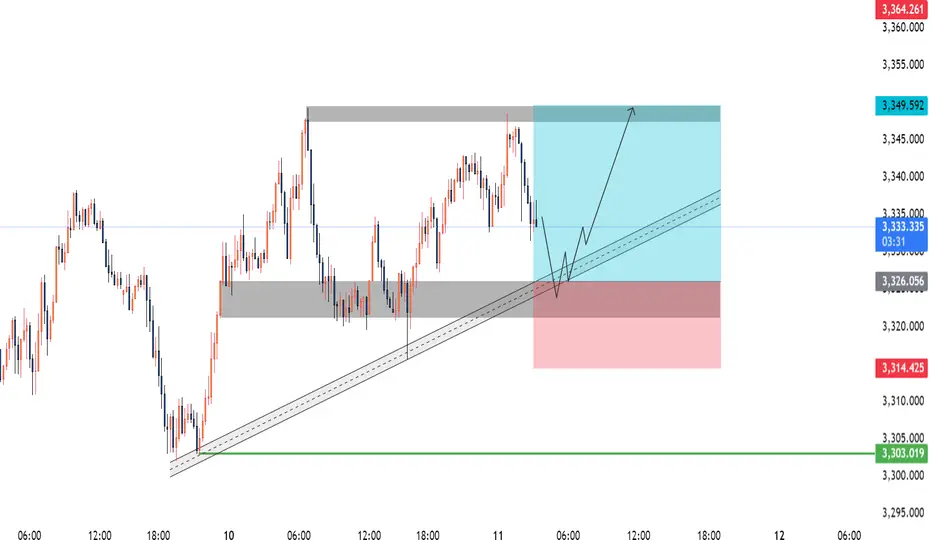

Trendline Support

The gold shows a well-respected ascending trendline, which has been tested multiple times. This provides a dynamic level of support.

Horizontal Support Zone (3323–3326)

This area previously acted as resistance and has now flipped to support. The consolidation here suggests a demand zone.

Bullish Market Structure

The market is forming higher highs and higher lows, indicating a bullish structure. The current pullback may serve as a liquidity grab before continuation.

Liquidity Below 3320

There is likely a liquidity pocket just below 3320. Price could sweep below support to trap sellers before reversing upward.

CPI News Catalyst

CPI data release can cause volatility. The stop-loss below 3314 is well-placed to allow for a spike without invalidating the bullish structure.

Trade Setup Summary

Bias: Bullish

Entry Zone: 3323–3326

Confirmation: Reaction from the trendline and horizontal support after CPI release

Take Profit (TP): 3335/3349 (targeting the recent high and potential double top liquidity)

Stop Loss (SL): Below 3314

Risk-Reward Ratio (RRR): Approximately 1:2

Entry Trigger: Look for a strong bullish rejection or engulfing pattern at the 3323–3326 zone to confirm entry.

Management: Consider partial profit booking near 3340 if volatility increases or if price shows signs of rejection before the target.

Key Confluences Supporting the Buy Setup:

Trendline Support

The gold shows a well-respected ascending trendline, which has been tested multiple times. This provides a dynamic level of support.

Horizontal Support Zone (3323–3326)

This area previously acted as resistance and has now flipped to support. The consolidation here suggests a demand zone.

Bullish Market Structure

The market is forming higher highs and higher lows, indicating a bullish structure. The current pullback may serve as a liquidity grab before continuation.

Liquidity Below 3320

There is likely a liquidity pocket just below 3320. Price could sweep below support to trap sellers before reversing upward.

CPI News Catalyst

CPI data release can cause volatility. The stop-loss below 3314 is well-placed to allow for a spike without invalidating the bullish structure.

Trade Setup Summary

Bias: Bullish

Entry Zone: 3323–3326

Confirmation: Reaction from the trendline and horizontal support after CPI release

Take Profit (TP): 3335/3349 (targeting the recent high and potential double top liquidity)

Stop Loss (SL): Below 3314

Risk-Reward Ratio (RRR): Approximately 1:2

Entry Trigger: Look for a strong bullish rejection or engulfing pattern at the 3323–3326 zone to confirm entry.

Management: Consider partial profit booking near 3340 if volatility increases or if price shows signs of rejection before the target.

✅Free Telegram

t.me/+6YQX9c4-BiQ2M2M8

Twitter 👇

twitter.com/QuinnGoldTrader

t.me/+6YQX9c4-BiQ2M2M8

Twitter 👇

twitter.com/QuinnGoldTrader

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅Free Telegram

t.me/+6YQX9c4-BiQ2M2M8

Twitter 👇

twitter.com/QuinnGoldTrader

t.me/+6YQX9c4-BiQ2M2M8

Twitter 👇

twitter.com/QuinnGoldTrader

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.