Gold Slides Further as Market Risk Eases and Inflation Looms

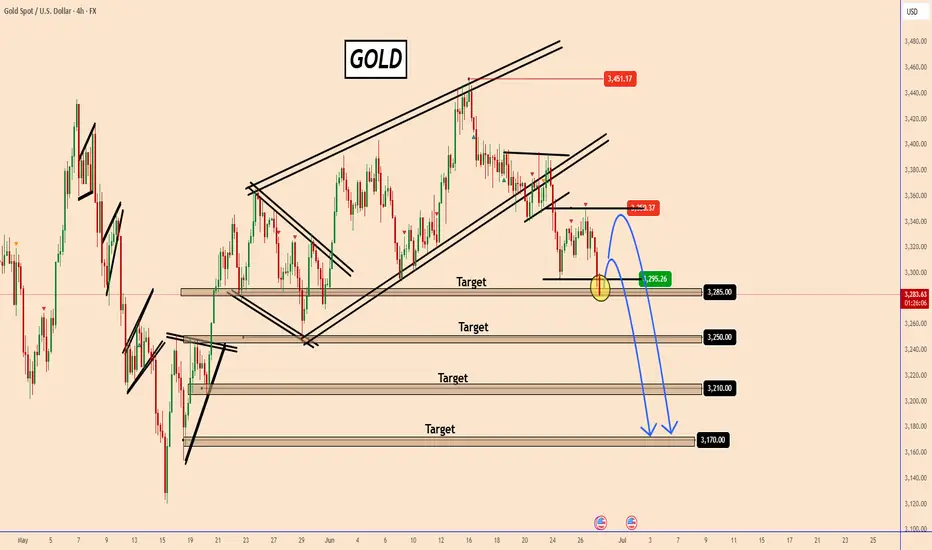

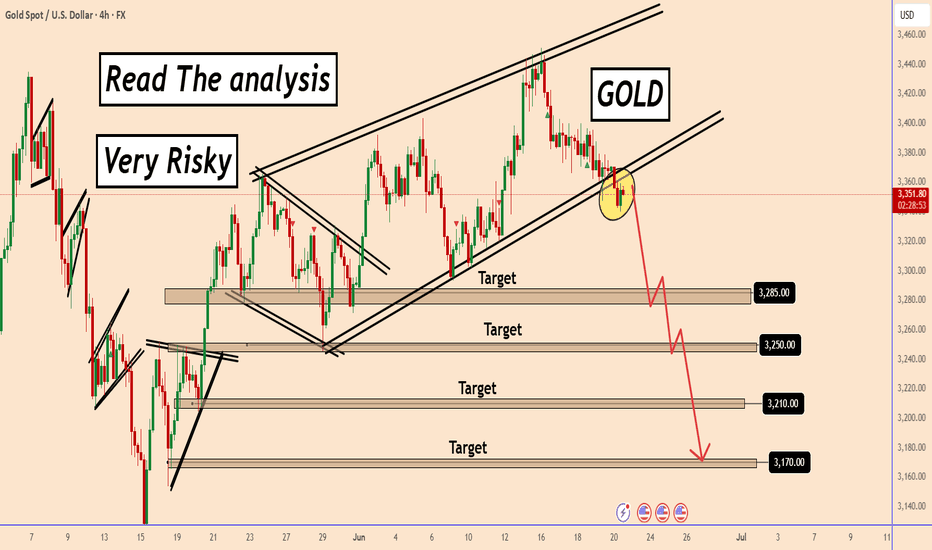

Gold continues to extend its downward momentum for the second consecutive week, sliding from 3451 to 3283—a decline of nearly 4.85% in just 10 days.

Today, all eyes are on the U.S. inflation data. While the broader market reaction remains uncertain, gold appears particularly vulnerable to further downside pressure.

The temporary ceasefire between Israel and Iran, coupled with advances in the U.S.-China trade talks, has eased geopolitical tensions, diminishing the immediate appeal of safe-haven assets like gold.

Even if prices rebound toward 3300 or even 3350 in a deeper pullback, the overall trend remains bearish.

PS: This analysis assumes normal market conditions and excludes the influence of potential manipulation.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Previous analysis:

Gold continues to extend its downward momentum for the second consecutive week, sliding from 3451 to 3283—a decline of nearly 4.85% in just 10 days.

Today, all eyes are on the U.S. inflation data. While the broader market reaction remains uncertain, gold appears particularly vulnerable to further downside pressure.

The temporary ceasefire between Israel and Iran, coupled with advances in the U.S.-China trade talks, has eased geopolitical tensions, diminishing the immediate appeal of safe-haven assets like gold.

Even if prices rebound toward 3300 or even 3350 in a deeper pullback, the overall trend remains bearish.

PS: This analysis assumes normal market conditions and excludes the influence of potential manipulation.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Previous analysis:

✅MY Free Signals

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅MY Free Signals

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.