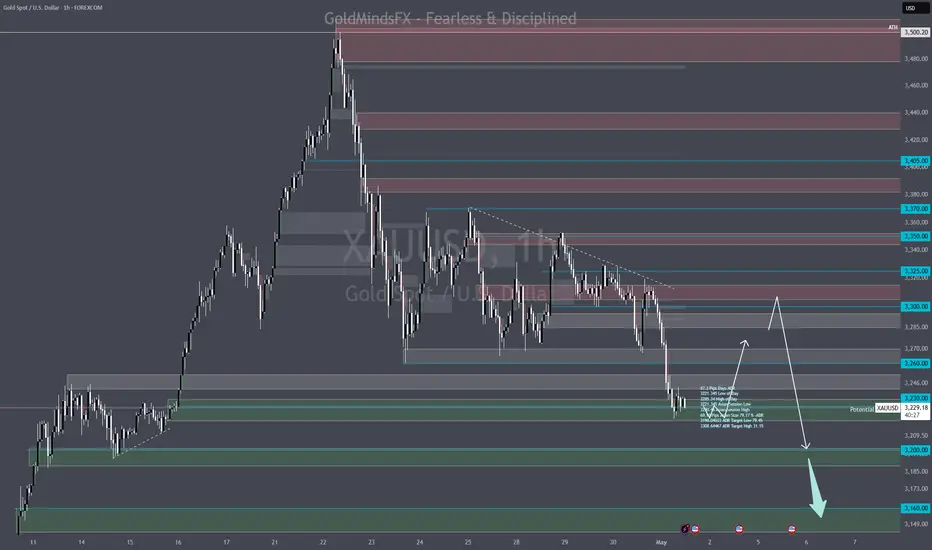

🔍 Gold Route Map – Updated May 1st | Macro Levels & Bias

📊 Today’s Key News (May 1st):

• 🕒 14:30 – Unemployment Claims (USD) • 🏭 14:45 – Final Manufacturing PMI • 🏭 15:00 – ISM Manufacturing PMI + Prices

Expect high volatility and whipsaws.

Gold continues its ruthless selloff, slicing through level after level with institutional precision. As we enter May, structure is loud and clear: bulls are out cold unless price proves otherwise.

👁🗨 Key Zones to Watch:

🔻 Resistance 3385 – HTF FVG zone / reversal risk

🔻 Resistance 3350 – Clean target above breakout

🔻 Resistance 3325 – Final barrier before shift

⚔️ 3315–3320 = Flip Zone

→ Flip = reclaim structure

→ Rejection = continuation sell

🔁 Retest 3308–3312 – Last OB Rejection

⚖️ 3286–3292 = Retest Range

→ Internal structure test

→ Weak support unless reinforced

🟩 3260–3270 = Reaction Zone

→ Confirmed demand

→ Last week’s sniper buy played from here

🟢 3252–3244 = Fresh Buy Zone

→ Strong OB + inefficiency

→ Eyes on reaction

🟢 3220–3235 = Major Discount Range

→ ⏳ Multi-timeframe OB + weekly FVG

🧊 3190–3205 = Daily Demand Shelf

→ If price nukes, this is where blood meets buyers

🧊 3160–3175 = April’s Demand Base

→ Mid-range accumulation shelf

📉 Current Bias

• HTF Trend: Bearish under ATH, clean lower highs • LTF Flow: Still bearish unless we flip above 3315 • Market Context: News-heavy week + low liquidity zones triggered this meltdown

🧠 Pro Tip: Don’t trade every bounce. Trade the right structure with proper confirmation. Most of the breakout noise is bait — only a few zones are true sniper setups.

Gold plays games. We play levels.

GoldMindsFX 🙏

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

🖊️ If these insights help you refine your trading plans, give us a boost and follow GoldMindsFX on TradingView. Let's grow together!

📊 Today’s Key News (May 1st):

• 🕒 14:30 – Unemployment Claims (USD) • 🏭 14:45 – Final Manufacturing PMI • 🏭 15:00 – ISM Manufacturing PMI + Prices

Expect high volatility and whipsaws.

Gold continues its ruthless selloff, slicing through level after level with institutional precision. As we enter May, structure is loud and clear: bulls are out cold unless price proves otherwise.

👁🗨 Key Zones to Watch:

🔻 Resistance 3385 – HTF FVG zone / reversal risk

🔻 Resistance 3350 – Clean target above breakout

🔻 Resistance 3325 – Final barrier before shift

⚔️ 3315–3320 = Flip Zone

→ Flip = reclaim structure

→ Rejection = continuation sell

🔁 Retest 3308–3312 – Last OB Rejection

⚖️ 3286–3292 = Retest Range

→ Internal structure test

→ Weak support unless reinforced

🟩 3260–3270 = Reaction Zone

→ Confirmed demand

→ Last week’s sniper buy played from here

🟢 3252–3244 = Fresh Buy Zone

→ Strong OB + inefficiency

→ Eyes on reaction

🟢 3220–3235 = Major Discount Range

→ ⏳ Multi-timeframe OB + weekly FVG

🧊 3190–3205 = Daily Demand Shelf

→ If price nukes, this is where blood meets buyers

🧊 3160–3175 = April’s Demand Base

→ Mid-range accumulation shelf

📉 Current Bias

• HTF Trend: Bearish under ATH, clean lower highs • LTF Flow: Still bearish unless we flip above 3315 • Market Context: News-heavy week + low liquidity zones triggered this meltdown

🧠 Pro Tip: Don’t trade every bounce. Trade the right structure with proper confirmation. Most of the breakout noise is bait — only a few zones are true sniper setups.

Gold plays games. We play levels.

GoldMindsFX 🙏

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

🖊️ If these insights help you refine your trading plans, give us a boost and follow GoldMindsFX on TradingView. Let's grow together!

Trade active

📍 GOLDMindsFX Trade Logic — 3226 + 3215 BuysBoth buys were part of our plan and observed.

🔷 First Buy @ 3226

Taken early from the top of the 3220–3235 OB zone, anticipating reaction off internal liquidity. Partial profits secured.

🔷 Second Buy @ 3215

Not a “rescue entry” — this was the precise target of the bearish path scenario we mapped last week:

“Crash toward 3235 and 3210” if 3380–3395 failed.

It did. Price delivered. We executed.

This re-entry wasn’t reactive.

It was responsive — to our own macro playbook.

✅ 100+ PIPS PROFIT SECURED

🧠 Structure. Plan. Precision. 🙏

Telegram t.me/GoldMindsFX_AI ⭐

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Telegram t.me/GoldMindsFX_AI ⭐

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.