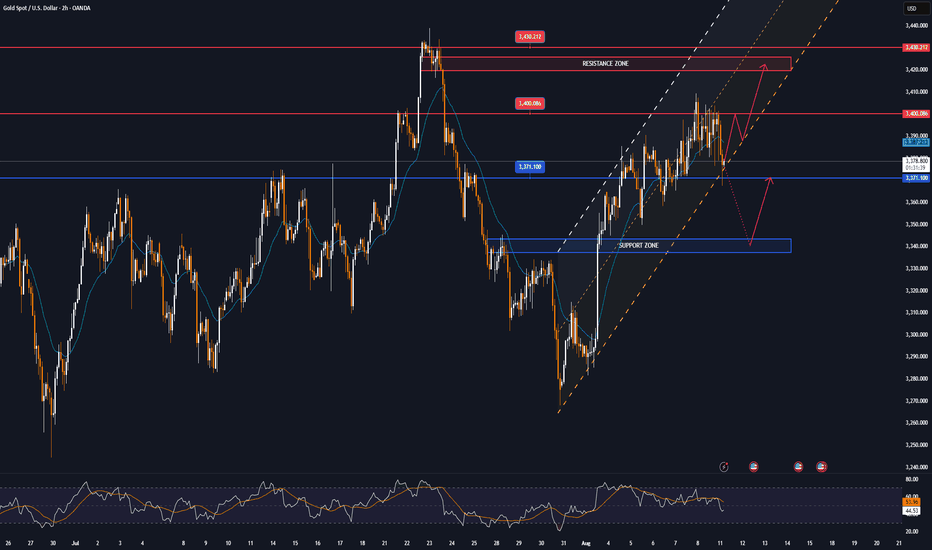

This week, the international  XAUUSD price has been almost flat, fluctuating only within the range of 3,345 USD/oz to 3,408 USD/oz. Notably, every time the gold price exceeds 3,400 USD/oz, it is pushed down below this level by profit-taking pressure.

XAUUSD price has been almost flat, fluctuating only within the range of 3,345 USD/oz to 3,408 USD/oz. Notably, every time the gold price exceeds 3,400 USD/oz, it is pushed down below this level by profit-taking pressure.

Next week, the US Bureau of Labor Statistics will release its July Consumer Price Index (CPI) on Tuesday. Accordingly, the CPI in July is forecast to increase to 2.8% compared to the same period last year, from 2.7% in June. According to many experts, this increase in inflation is not strong enough to make the Fed delay cutting interest rates at its meeting in September. Therefore, strong fluctuations in the annual CPI figures will strongly affect the Fed's interest rate cut expectations.

If the CPI in July rises above the 3% threshold, it will reduce expectations of the FED cutting interest rates in September, helping the USD increase, pushing gold prices down next week. Conversely, if the CPI in July falls below forecasts, it will push gold prices up sharply next week.

In addition to CPI data, the US also announced retail sales for July. The US economy is driven by consumption, so if retail sales decline sharply, it will also negatively impact the USD, thereby pushing gold prices up next week and vice versa.

With the current context and the above economic data, it is likely that gold prices next week will continue to move sideways, with no strong fluctuations.

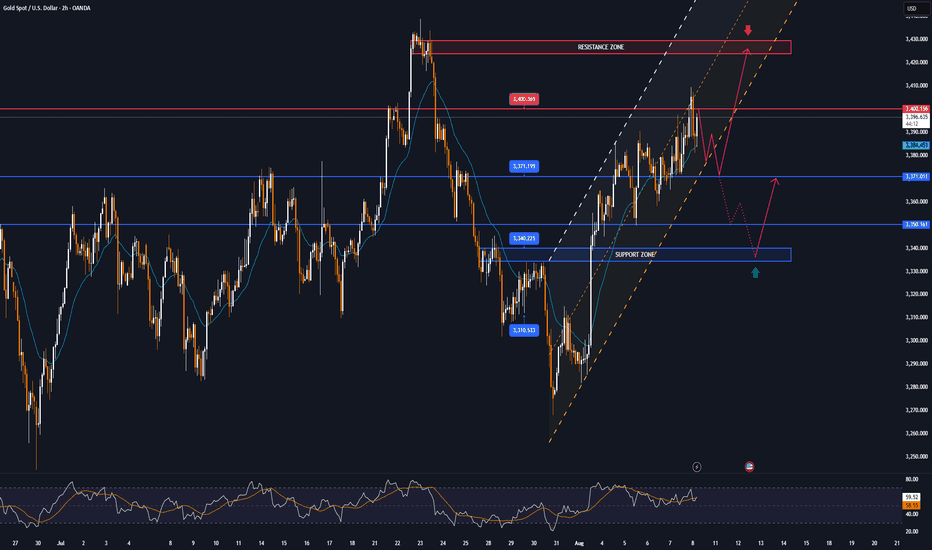

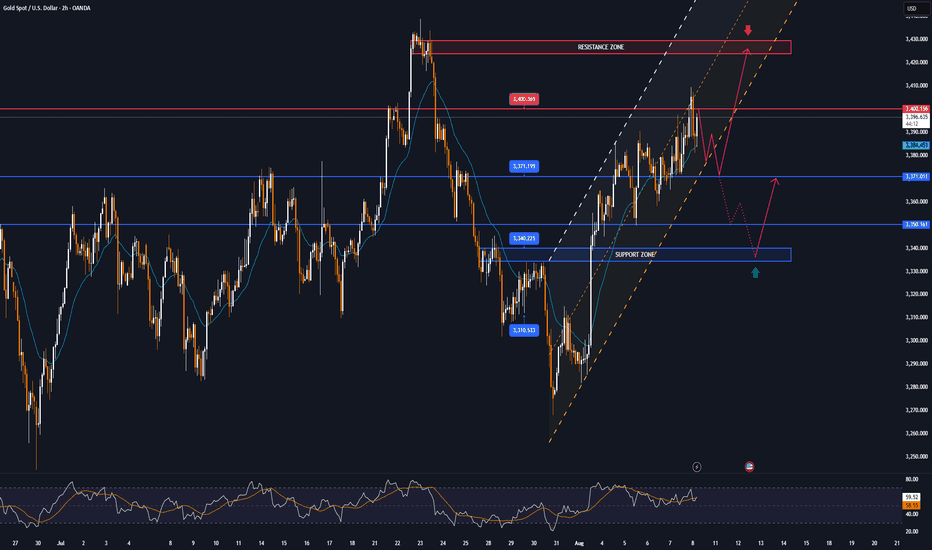

📌In terms of technical analysis, the level of 3,350 USD/oz is the first support level, followed by the area of 3,285 - 3,300 USD/oz. Meanwhile, the level of 3,450 USD/oz is a strong resistance level, surpassing this level, the gold price next week has the opportunity to challenge 3,500 USD/oz. However, this possibility is not highly appreciated.

Notable technical levels are listed below.

Support: 3,371 – 3,350 – 3,340USD

Resistance: 3,400 – 3,430 – 3,350USD

SELL XAUUSD PRICE 3452 - 3450⚡️

↠↠ Stop Loss 3456

BUY XAUUSD PRICE 3349 - 3351⚡️

↠↠ Stop Loss 3345

Next week, the US Bureau of Labor Statistics will release its July Consumer Price Index (CPI) on Tuesday. Accordingly, the CPI in July is forecast to increase to 2.8% compared to the same period last year, from 2.7% in June. According to many experts, this increase in inflation is not strong enough to make the Fed delay cutting interest rates at its meeting in September. Therefore, strong fluctuations in the annual CPI figures will strongly affect the Fed's interest rate cut expectations.

If the CPI in July rises above the 3% threshold, it will reduce expectations of the FED cutting interest rates in September, helping the USD increase, pushing gold prices down next week. Conversely, if the CPI in July falls below forecasts, it will push gold prices up sharply next week.

In addition to CPI data, the US also announced retail sales for July. The US economy is driven by consumption, so if retail sales decline sharply, it will also negatively impact the USD, thereby pushing gold prices up next week and vice versa.

With the current context and the above economic data, it is likely that gold prices next week will continue to move sideways, with no strong fluctuations.

📌In terms of technical analysis, the level of 3,350 USD/oz is the first support level, followed by the area of 3,285 - 3,300 USD/oz. Meanwhile, the level of 3,450 USD/oz is a strong resistance level, surpassing this level, the gold price next week has the opportunity to challenge 3,500 USD/oz. However, this possibility is not highly appreciated.

Notable technical levels are listed below.

Support: 3,371 – 3,350 – 3,340USD

Resistance: 3,400 – 3,430 – 3,350USD

SELL XAUUSD PRICE 3452 - 3450⚡️

↠↠ Stop Loss 3456

BUY XAUUSD PRICE 3349 - 3351⚡️

↠↠ Stop Loss 3345

Note

🔴Spot gold price dropped a total of 16 USD in 15 minutes, down below 3370 USD/ounce, down 0.8% on the day, currently at 3369.38 USD/ounce.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.