🎓 XAUUSD Traders – The ONLY Timeframes That Matter

If you want to stop being a liquidity snack for the big players, you must know which timeframes actually reveal what the market makers are doing.

Here’s your complete educational guide for XAUUSD:

⸻

🔍 1️⃣ The 4-Hour (4H) – The Market Maker Blueprint

✅ Why Watch It?

This is where the real accumulation and distribution happens.

Market makers build and unwind positions over multiple sessions—London and New York.

If you want to see the big plan, this is your chart.

✅ What to Look For:

• Strong rejection candles near key resistance (3330–3350).

• Fake breakouts with no follow-through.

• EMA21 and SMA50 acting as dynamic resistance.

• High-volume candles marking where the big boys stepped in.

🎯 Tip: If the 4H chart is bearish, every bounce on smaller timeframes is suspect.

⸻

⏰ 2️⃣ The 1-Hour (1H) – Timing the Trap

✅ Why Watch It?

1H is perfect for seeing the moment the trap is set.

This is when price pumps into resistance or dumps below support—just enough to trigger stops.

✅ What to Look For:

• Quick rallies on low volume (pump phase).

• Reversal candles forming right after a breakout.

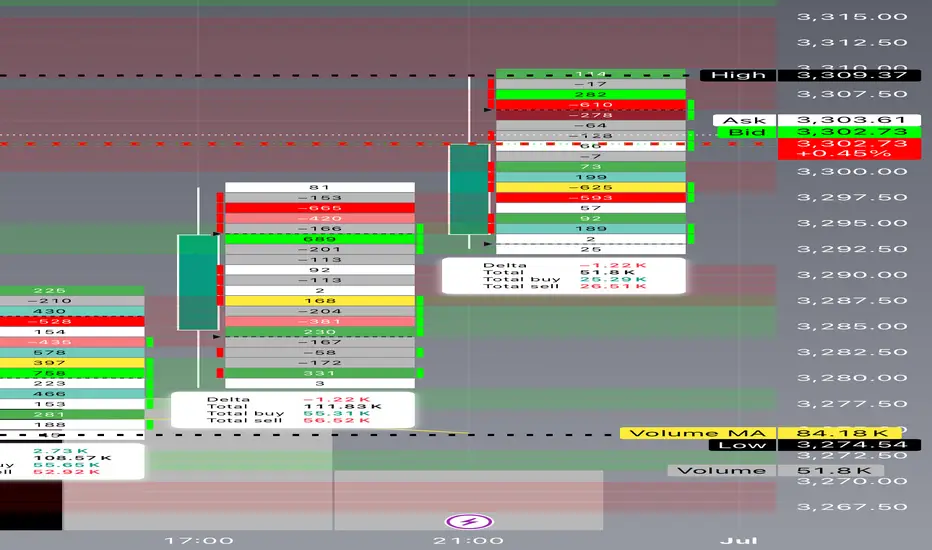

• Delta flipping negative as price pushes higher (hidden selling).

🎯 Tip: Combine 4H structure with 1H confirmation—this is where precision timing happens.

⸻

🎯 3️⃣ The 15-Minute (15M) – Entry Execution

✅ Why Watch It?

15M shows micro-structure and liquidity hunts.

This is where you confirm whether that big 1H candle was real—or just a head fake.

✅ What to Look For:

• Sharp wicks that stop out traders (liquidity flush).

• Tight consolidation after a failed breakout.

• Rejection patterns before price reverses.

🎯 Tip: Use the 15M to pull the trigger—not to overthink.

⸻

📅 4️⃣ The Daily – Bias Confirmation

✅ Why Watch It?

Daily sets the macro tone.

You must know whether you’re fighting the bigger wave.

✅ What to Look For:

• Where price closed relative to EMA21 and SMA50.

• Big bearish engulfing candles.

• Volatility expanding or contracting.

🎯 Tip: If daily is bearish, you have extra confirmation to fade pumps.

⸻

⚔️ How to Combine These Timeframes

Here’s the professional workflow:

1️⃣ Daily – Define bullish or bearish bias.

2️⃣ 4H – Spot the setup zone (accumulation or distribution).

3️⃣ 1H – Watch the trap unfold.

4️⃣ 15M – Execute your entry with surgical precision.

✅ This is how you stop chasing noise and start trading structure.

⸻

💡 Pro Wisdom:

“Retail traders react to price. Professionals react to price and context.”

— Technical Analysis and Stock Market Profits

⸻

🚀 Trade smart. Study structure. Outsmart the herd.

#XAUUSD #ForexEducation #PriceActionTrading #MarketMakerSecrets #LearnToTrade

If you want to stop being a liquidity snack for the big players, you must know which timeframes actually reveal what the market makers are doing.

Here’s your complete educational guide for XAUUSD:

⸻

🔍 1️⃣ The 4-Hour (4H) – The Market Maker Blueprint

✅ Why Watch It?

This is where the real accumulation and distribution happens.

Market makers build and unwind positions over multiple sessions—London and New York.

If you want to see the big plan, this is your chart.

✅ What to Look For:

• Strong rejection candles near key resistance (3330–3350).

• Fake breakouts with no follow-through.

• EMA21 and SMA50 acting as dynamic resistance.

• High-volume candles marking where the big boys stepped in.

🎯 Tip: If the 4H chart is bearish, every bounce on smaller timeframes is suspect.

⸻

⏰ 2️⃣ The 1-Hour (1H) – Timing the Trap

✅ Why Watch It?

1H is perfect for seeing the moment the trap is set.

This is when price pumps into resistance or dumps below support—just enough to trigger stops.

✅ What to Look For:

• Quick rallies on low volume (pump phase).

• Reversal candles forming right after a breakout.

• Delta flipping negative as price pushes higher (hidden selling).

🎯 Tip: Combine 4H structure with 1H confirmation—this is where precision timing happens.

⸻

🎯 3️⃣ The 15-Minute (15M) – Entry Execution

✅ Why Watch It?

15M shows micro-structure and liquidity hunts.

This is where you confirm whether that big 1H candle was real—or just a head fake.

✅ What to Look For:

• Sharp wicks that stop out traders (liquidity flush).

• Tight consolidation after a failed breakout.

• Rejection patterns before price reverses.

🎯 Tip: Use the 15M to pull the trigger—not to overthink.

⸻

📅 4️⃣ The Daily – Bias Confirmation

✅ Why Watch It?

Daily sets the macro tone.

You must know whether you’re fighting the bigger wave.

✅ What to Look For:

• Where price closed relative to EMA21 and SMA50.

• Big bearish engulfing candles.

• Volatility expanding or contracting.

🎯 Tip: If daily is bearish, you have extra confirmation to fade pumps.

⸻

⚔️ How to Combine These Timeframes

Here’s the professional workflow:

1️⃣ Daily – Define bullish or bearish bias.

2️⃣ 4H – Spot the setup zone (accumulation or distribution).

3️⃣ 1H – Watch the trap unfold.

4️⃣ 15M – Execute your entry with surgical precision.

✅ This is how you stop chasing noise and start trading structure.

⸻

💡 Pro Wisdom:

“Retail traders react to price. Professionals react to price and context.”

— Technical Analysis and Stock Market Profits

⸻

🚀 Trade smart. Study structure. Outsmart the herd.

#XAUUSD #ForexEducation #PriceActionTrading #MarketMakerSecrets #LearnToTrade

Mohamed

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Mohamed

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.