Tools Used: Volume Profile, Gann Levels, Cumulative Volume Delta (CVD) + ADX

1. Key Observations (Volume, Gann & CVD + ADX Focused)

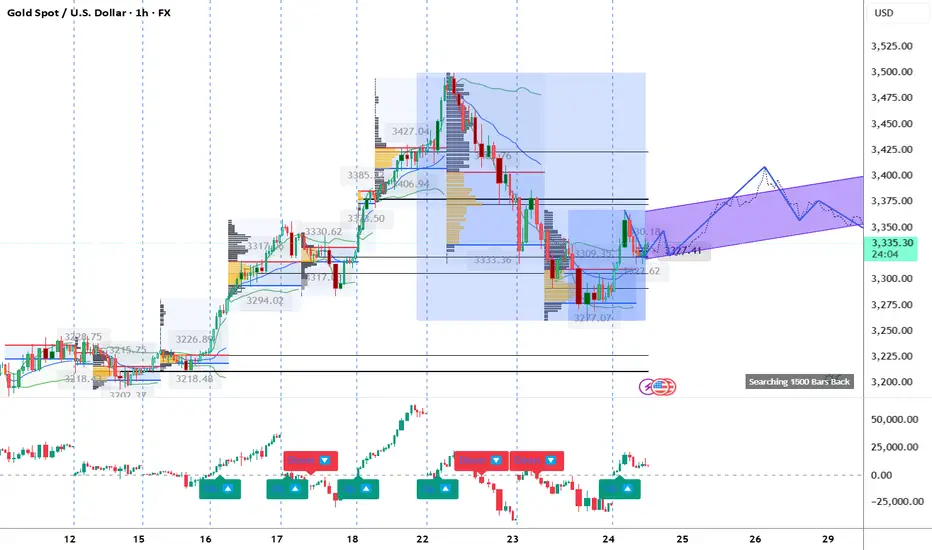

a) Volume Profile Insights:

Value Area High (VAH): 3,390.67

Value Area Low (VAL): 3,277.14

Point of Control (POC): 3,309.96

High-volume nodes: Prominent between 3,300–3,340 zone, where price consolidated and re-accumulated.

Low-volume gaps: Seen between 3,365–3,385 and under 3,277, ideal for fast moves if broken.

b) Liquidity Zones:

Stops Likely Clustered:

Above 3,390 (last high).

Below 3,277 (recent low and VAL).

Absorption Zones (based on delta volume):

Notable order absorption around POC (3,309.96) – heavy trade activity and hold in down move.

c) Volume-Based Swing Highs/Lows:

High-volume swing low: 3,277.07 – price bounced with demand pick-up.

High-volume swing high: 3,427.04 – volume faded after breakout, leading to rejection.

d) CVD + ADX Indicator Analysis:

Trend Direction: Currently uptrend forming, CVD rising slightly with bullish structure.

ADX Strength:

ADX ~22 and DI+ > DI-: Confirms beginning of a potential uptrend.

CVD Confirmation:

Rising CVD + bullish candles: Demand increasing, especially around POC reclaim.

2. Support & Resistance Levels

a) Volume-Based Levels:

Support:

VAL: 3,277.14

POC: 3,309.96

Swing low: 3,277.07

Resistance:

VAH: 3,390.67

Recent rejection zone: 3,342–3,350

b) Gann-Based Levels:

Confirmed Gann High: 3,427.04

Confirmed Gann Low: 3,277.07

Key Retracement Levels:

1/3 retrace: ~3,335

1/2 retrace: ~3,352

2/3 retrace: ~3,370

3. Chart Patterns & Market Structure

a) Trend:

Bullish, supported by ADX > 20 and rising CVD confirming new leg up.

b) Notable Patterns:

Falling wedge breakout confirmed from 3,277 support.

Channel projection points to potential continuation toward 3,370–3,390.

POC retest success showing strong reaccumulation.

4. Trade Setup & Risk Management

a) Bullish Entry (If CVD + ADX confirm uptrend):

Entry Zone: 3,310–3,320

Targets:

T1: 3,350

T2: 3,390

Stop-Loss: Below 3,277

RR: Minimum 1:2

b) Bearish Entry (If trend invalidates):

Entry Zone: 3,390–3,400 (retest rejection)

Target:

T1: 3,310

Stop-Loss: Above 3,427

RR: Minimum 1:2

c) Position Sizing:

Risk only 1–2% of total capital per trade.

1. Key Observations (Volume, Gann & CVD + ADX Focused)

a) Volume Profile Insights:

Value Area High (VAH): 3,390.67

Value Area Low (VAL): 3,277.14

Point of Control (POC): 3,309.96

High-volume nodes: Prominent between 3,300–3,340 zone, where price consolidated and re-accumulated.

Low-volume gaps: Seen between 3,365–3,385 and under 3,277, ideal for fast moves if broken.

b) Liquidity Zones:

Stops Likely Clustered:

Above 3,390 (last high).

Below 3,277 (recent low and VAL).

Absorption Zones (based on delta volume):

Notable order absorption around POC (3,309.96) – heavy trade activity and hold in down move.

c) Volume-Based Swing Highs/Lows:

High-volume swing low: 3,277.07 – price bounced with demand pick-up.

High-volume swing high: 3,427.04 – volume faded after breakout, leading to rejection.

d) CVD + ADX Indicator Analysis:

Trend Direction: Currently uptrend forming, CVD rising slightly with bullish structure.

ADX Strength:

ADX ~22 and DI+ > DI-: Confirms beginning of a potential uptrend.

CVD Confirmation:

Rising CVD + bullish candles: Demand increasing, especially around POC reclaim.

2. Support & Resistance Levels

a) Volume-Based Levels:

Support:

VAL: 3,277.14

POC: 3,309.96

Swing low: 3,277.07

Resistance:

VAH: 3,390.67

Recent rejection zone: 3,342–3,350

b) Gann-Based Levels:

Confirmed Gann High: 3,427.04

Confirmed Gann Low: 3,277.07

Key Retracement Levels:

1/3 retrace: ~3,335

1/2 retrace: ~3,352

2/3 retrace: ~3,370

3. Chart Patterns & Market Structure

a) Trend:

Bullish, supported by ADX > 20 and rising CVD confirming new leg up.

b) Notable Patterns:

Falling wedge breakout confirmed from 3,277 support.

Channel projection points to potential continuation toward 3,370–3,390.

POC retest success showing strong reaccumulation.

4. Trade Setup & Risk Management

a) Bullish Entry (If CVD + ADX confirm uptrend):

Entry Zone: 3,310–3,320

Targets:

T1: 3,350

T2: 3,390

Stop-Loss: Below 3,277

RR: Minimum 1:2

b) Bearish Entry (If trend invalidates):

Entry Zone: 3,390–3,400 (retest rejection)

Target:

T1: 3,310

Stop-Loss: Above 3,427

RR: Minimum 1:2

c) Position Sizing:

Risk only 1–2% of total capital per trade.

Bharat Pandya @ProspireWealth

+91 9624044866

pandyabn76@gmail.com

+91 9624044866

pandyabn76@gmail.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Bharat Pandya @ProspireWealth

+91 9624044866

pandyabn76@gmail.com

+91 9624044866

pandyabn76@gmail.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.