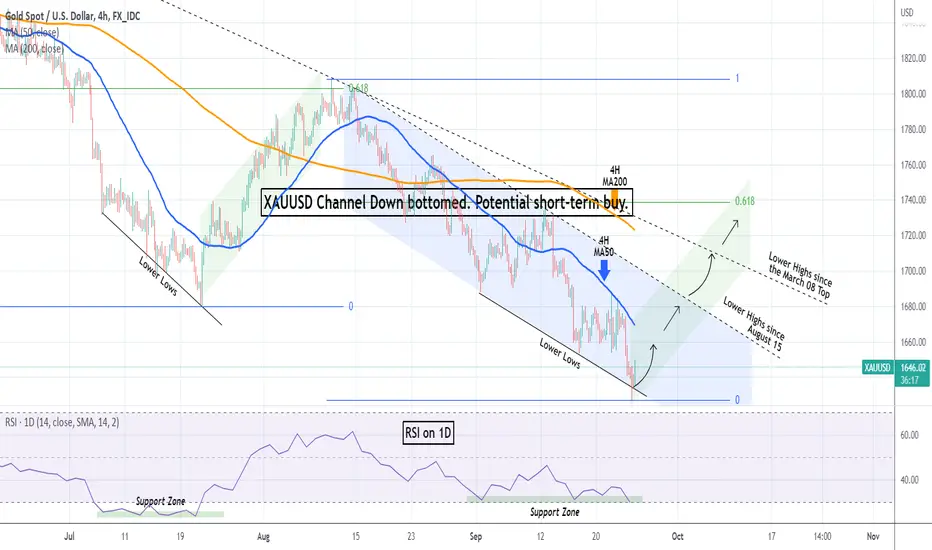

Gold (XAUUSD) following the rejection on the 4H MA50 (blue trend-line), which is the short-term Resistance, hit and even marginally broke today, the bottom (Lower Lows trend-line) of the Channel Down since the August 10 High, which technically defines the medium-term bearish trend.

The recent Lower Lows though have been formed while the RSI on the 1D time-frame has been holding its Support Zone. The last time we saw that pattern was during the July 06 - July 21 Lower Lows. The RSI then bounced on its Support Zone and Gold rallied to its 0.618 Fibonacci level that was eventually the August 10 High.

As a result, we are willing to buy today's bottom rebound on what seems to be the early stages of a short-term rally. We are setting short-term targets and only if broken we're willing to move to the next one as the long-term trend remains bearish. As such the first would be the 4H MA50 (blue trend-line), following by the top (Lower Highs trend-line) of the Channel Down. If we close a day above it, then we can move to the 4H MA200 (orange trend-line) and the 0.618 Fib (1738.50) in extension.

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoyed this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant and support me and allow the idea to reach as many people as possible. **

------------------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

------------------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

👇 👇 👇 👇 👇 👇

👇 👇 👇 👇 👇 👇

The recent Lower Lows though have been formed while the RSI on the 1D time-frame has been holding its Support Zone. The last time we saw that pattern was during the July 06 - July 21 Lower Lows. The RSI then bounced on its Support Zone and Gold rallied to its 0.618 Fibonacci level that was eventually the August 10 High.

As a result, we are willing to buy today's bottom rebound on what seems to be the early stages of a short-term rally. We are setting short-term targets and only if broken we're willing to move to the next one as the long-term trend remains bearish. As such the first would be the 4H MA50 (blue trend-line), following by the top (Lower Highs trend-line) of the Channel Down. If we close a day above it, then we can move to the 4H MA200 (orange trend-line) and the 0.618 Fib (1738.50) in extension.

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoyed this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant and support me and allow the idea to reach as many people as possible. **

------------------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

------------------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

👇 👇 👇 👇 👇 👇

👇 👇 👇 👇 👇 👇

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.