Gold Trend Analysis for Next Week

Fundamental Analysis

Friday (July 4th) marks the U.S. Independence Day holiday, with gold oscillating narrowly near 3333 in early European trading 📊. The metal fell nearly 1% on Thursday (July 3rd) to close at 3325.87, weighed by unexpectedly strong June nonfarm payrolls 💪. This boosted the dollar and Treasury yields, dimming Fed rate-cut hopes and curbing gold’s appeal.

Additionally, the U.S. Congress passed the Trump administration’s major tax cuts and spending bill, adding economic complexity 🔄. No key data is due today; markets will close early for the holiday, limiting volatility. Profit-taking on yesterday’s short positions may halt declines, leaving today’s trend likely range-bound or slightly rebounding 📈.

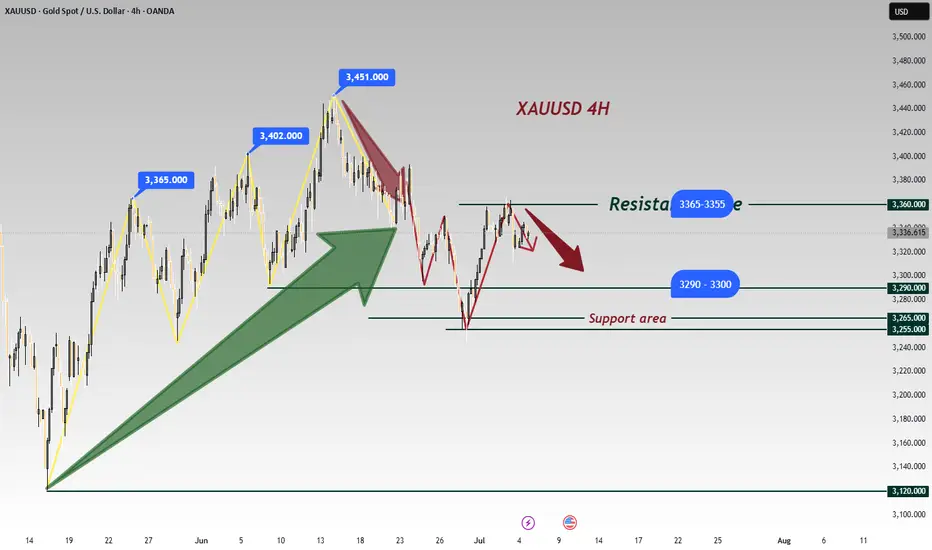

Technical Analysis

Gold rebounded from lows this week, with three straight bullish daily candles breaking above the middle Bollinger Band, signaling short-term strength 🐂. However, dual bearish triggers (nonfarm data and jobless claims) sparked a pullback Thursday, likely forming a bearish candle with a long lower shadow—a correction after three gains 🔄.

The daily chart shows high-range consolidation, lacking sustained momentum. Dollar volatility has capped gold’s moves, with repeated tests of highs failing to break through and pullbacks lacking downside conviction. The daily Bollinger Band is contracting, with gold swinging between middle and lower bands; 3360 acts as resistance 🛑.

Last night’s nonfarm data caused a nearly $40 drop, but markets stabilized, and gold has recovered half those losses, with bearish momentum ebbing 🐻. A secondary support base formed at 3322, and after overnight consolidation, gold is showing rally signs with higher lows 🔄

Strategy:

🚀 Sell3355 - 3345

🚀 TP 3335 - 3325 - 3315

🚀 Buy@3290 - 3300

🚀 TP 3310 - 3320 - 3330

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Fundamental Analysis

Friday (July 4th) marks the U.S. Independence Day holiday, with gold oscillating narrowly near 3333 in early European trading 📊. The metal fell nearly 1% on Thursday (July 3rd) to close at 3325.87, weighed by unexpectedly strong June nonfarm payrolls 💪. This boosted the dollar and Treasury yields, dimming Fed rate-cut hopes and curbing gold’s appeal.

Additionally, the U.S. Congress passed the Trump administration’s major tax cuts and spending bill, adding economic complexity 🔄. No key data is due today; markets will close early for the holiday, limiting volatility. Profit-taking on yesterday’s short positions may halt declines, leaving today’s trend likely range-bound or slightly rebounding 📈.

Technical Analysis

Gold rebounded from lows this week, with three straight bullish daily candles breaking above the middle Bollinger Band, signaling short-term strength 🐂. However, dual bearish triggers (nonfarm data and jobless claims) sparked a pullback Thursday, likely forming a bearish candle with a long lower shadow—a correction after three gains 🔄.

The daily chart shows high-range consolidation, lacking sustained momentum. Dollar volatility has capped gold’s moves, with repeated tests of highs failing to break through and pullbacks lacking downside conviction. The daily Bollinger Band is contracting, with gold swinging between middle and lower bands; 3360 acts as resistance 🛑.

Last night’s nonfarm data caused a nearly $40 drop, but markets stabilized, and gold has recovered half those losses, with bearish momentum ebbing 🐻. A secondary support base formed at 3322, and after overnight consolidation, gold is showing rally signs with higher lows 🔄

Strategy:

🚀 Sell3355 - 3345

🚀 TP 3335 - 3325 - 3315

🚀 Buy@3290 - 3300

🚀 TP 3310 - 3320 - 3330

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

📈Daily Free Trading Signals:t.me/+HXsu5PoOpi4yNGVk

📊Daily Free Market Analysis:t.me/+HXsu5PoOpi4yNGVk

📊Daily Free Market Analysis:t.me/+HXsu5PoOpi4yNGVk

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈Daily Free Trading Signals:t.me/+HXsu5PoOpi4yNGVk

📊Daily Free Market Analysis:t.me/+HXsu5PoOpi4yNGVk

📊Daily Free Market Analysis:t.me/+HXsu5PoOpi4yNGVk

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.