Spot ended Friday with bullish momentum, primarily driven by a Risk OFF sentiment in financial markets due to the Israel-Iran conflict, we also had fundamentals like CPI & PPI, US-China talk during the week which supported the bullish momentum.

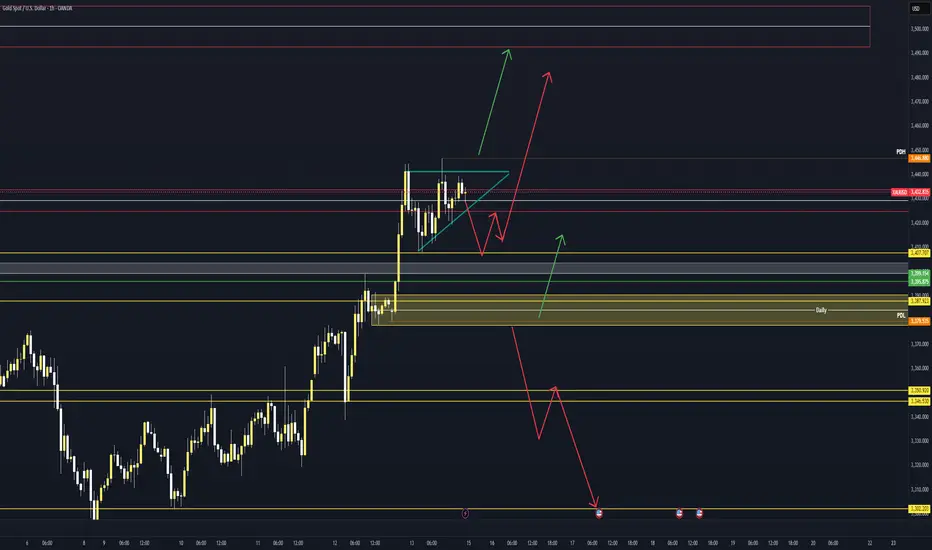

With escalations over the weekend, Israel has continued its attack on key military and nuclear facilities as well as Oil Infrastructure including Iran's South Pars gas field, these escalations could lead to more safe heaven inflows and a RISK OFF sentiment when market opens, which could point to higher targets of 3450-3500, above 3430, the next resistance is 3500, which with such instability can easily be broken through.

However Iran has communicated to the US that if Israel stops their attacks, they will also consider the same, Trump has drawn a red line and said they will not get involved unless American Lives are directly targeted, this is in spite of Israel requesting them to join the war multiple times as Israel does not have the equipment and armaments to complete the job. Trump wants them to make a deal and become the hero that accomplished it, this remains to be seen , but if talks do happen, expect a Risk ON environment where a drop below 3450 will find support/ bounce at 3350, 3304 and below that opens the floor to 3275 and below.

We also have Monetary Policy this week with Pappa Powell speaking mid week, I believe rates will stay the same, with cautious Fed Policy, No rate change in June with inflation fears due to Tariffs. As always risk management should be No 1, combined with Tech and Funda knowledge, Trade Safe, this week will be very interesting.

The next down move on Gold will depend on whether we get de-escalation headlines and if so then RISK ON with money moving into Risk Assets like the Stock Markets

Trade closed: target reached

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.