Bloomberg reported that gold prices fell for the fourth consecutive day as the market digested news that a US trade court had blocked Trump's global tariff program. Gold prices fell 2% in the previous three trading days.

On Wednesday local time, a US federal court blocked the tariff policy announced by US President Trump on April 2, "Liberation Day", and ruled that Trump exceeded his authority and imposed comprehensive tariffs on countries that export more to the United States than they import.

The Court of International Trade in Manhattan said the US Constitution gives Congress the exclusive power to regulate trade with other countries, and the emergency powers the president declared to protect the US economy do not override those powers.

The lawsuit was filed by the Liberty Center for Justice, a non-profit, nonpartisan litigation organization in the United States, on behalf of small American businesses affected by the tariffs. It is the first major legal challenge to Trump’s tariff policies.

The U.S. Court of International Trade has ruled that most of Trump’s tariffs are illegal, sending the dollar even higher. A stronger dollar makes gold less attractive to buyers of safe-haven assets.

The Trump administration has filed a notice to appeal the ruling. The US Supreme Court is likely to have the final say in the landmark case, which could affect trillions of dollars in global trade.

The court's ruling dealt a blow to a pillar of the Republican Party's economic agenda and could reduce gold's appeal as a safe-haven asset.

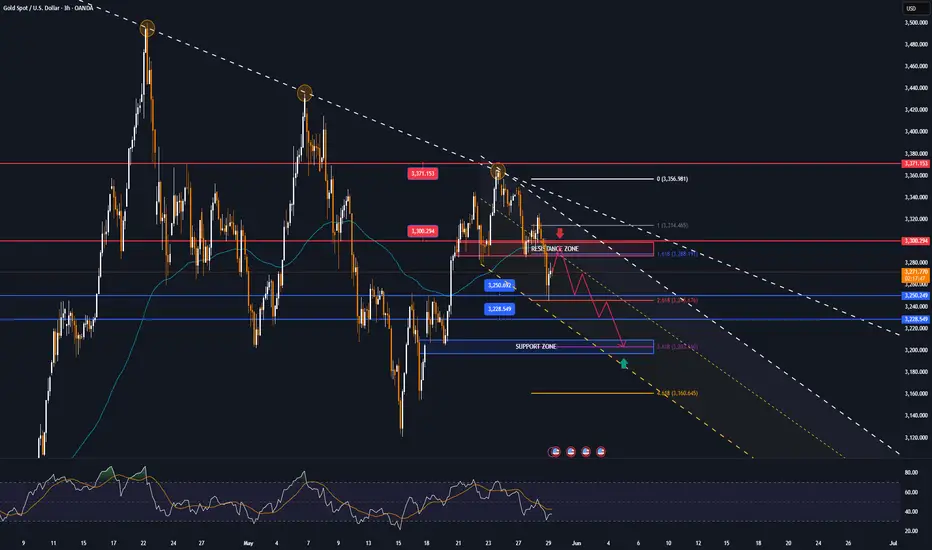

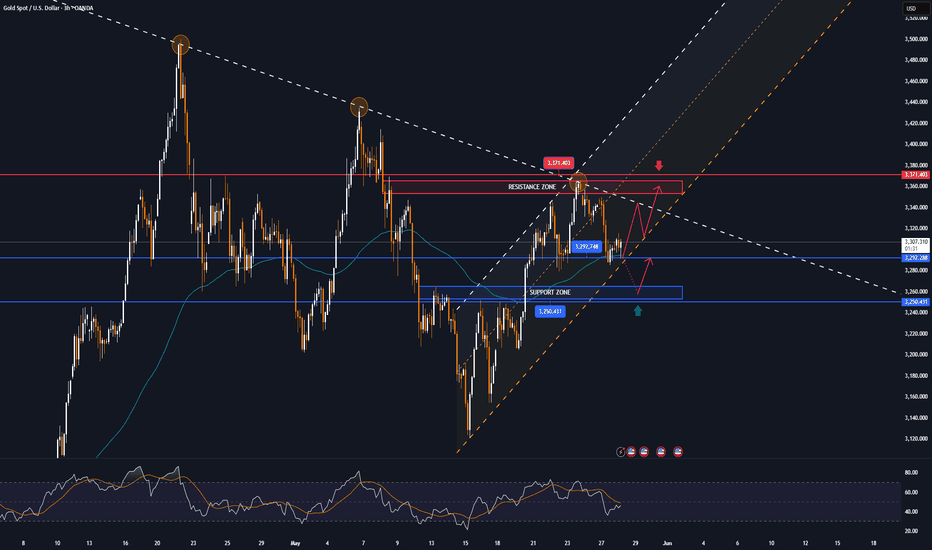

Technical Outlook Analysis

On the daily chart, gold will recover soon after falling to the important support level of 3,250 USD, note that you have read in the previous issues. However, falling below the Fibonacci 0.382% level with EMA21 is a negative signal for bullish expectations as this area becomes the nearest resistance.

But overall, gold is still in an uptrend with the channel as the main trend. Meanwhile, the Relative Strength Index (RSI) is approaching the nearest support at 50, an upward bend from this level would be considered a positive signal in terms of momentum.

As long as gold remains in/above the channel, I remain bullish and the notable positions are listed below.

Support: 3,250 – 3,228 USD

Resistance: 3,392 – 3,300 – 3,371 USD

SELL XAUUSD PRICE 3292 - 3290⚡️

↠↠ Stop Loss 3296

→Take Profit 1 3284

↨

→Take Profit 2 3278

BUY XAUUSD PRICE 3203 - 3205⚡️

↠↠ Stop Loss 3199

→Take Profit 1 3211

↨

→Take Profit 2 3217

Note

Dollar rally stalls as traders assess next step on Trump tariffsNote

🔴Spot gold prices fell below $3,300/ounce, down 0.53% on the day.Note

Gold accumulates around $3,295/ozNote

Spot gold prices fell below $3,360 an ounce, down 0.64% on the day.Note

Spot gold prices fell more than 1.00% on the day and are currently trading at $3,347.21 an ounce.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.