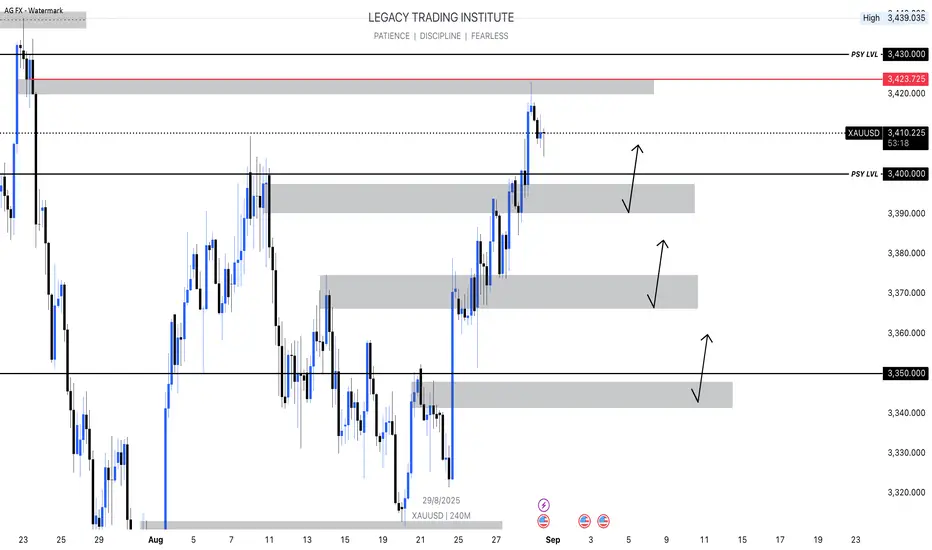

these all buying levels as per my expectations, because fundamental's factors will push gold like FED rate cut news....

Summary of the News (Professional & Clear):

This data release is important because:

1. Fed’s focus: Core PCE is the most important inflation metric for the Federal Reserve’s policy decisions.

2. Market expectations: Despite this uptick, markets broadly expect the Fed to cut interest rates by 25 bps in September.

3. Key drivers: Services inflation accelerated, while food and energy remained weak. Personal spending is forecast to rise 0.5%, showing consumer resilience.

4. Policy signals: At Jackson Hole, Fed Chair Jerome Powell kept a dovish tone, acknowledging risks to the labor market and suggesting tariff-driven inflation pressures could be temporary.

📌 Implication for Markets:

* If Core PCE comes in above 2.9% → Fed rate cut expectations may weaken → USD bullish, Gold bearish.

* If Core PCE comes in below forecast (≤2.8%) → Rate cut bets strengthen → USD bearish, Gold bullish

Recommendation This release is high-impact. Traders should expect volatility in USD pairs, Gold (XAU/USD), and US yields.

Summary of the News (Professional & Clear):

This data release is important because:

1. Fed’s focus: Core PCE is the most important inflation metric for the Federal Reserve’s policy decisions.

2. Market expectations: Despite this uptick, markets broadly expect the Fed to cut interest rates by 25 bps in September.

3. Key drivers: Services inflation accelerated, while food and energy remained weak. Personal spending is forecast to rise 0.5%, showing consumer resilience.

4. Policy signals: At Jackson Hole, Fed Chair Jerome Powell kept a dovish tone, acknowledging risks to the labor market and suggesting tariff-driven inflation pressures could be temporary.

📌 Implication for Markets:

* If Core PCE comes in above 2.9% → Fed rate cut expectations may weaken → USD bullish, Gold bearish.

* If Core PCE comes in below forecast (≤2.8%) → Rate cut bets strengthen → USD bearish, Gold bullish

Recommendation This release is high-impact. Traders should expect volatility in USD pairs, Gold (XAU/USD), and US yields.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.