The price increase was supported by expectations of a soft Fed policy after moderate July CPI data (2.7% y/y, 0.2% m/m, core 0.3%), which led to a decline in bond yields and a weakening of the dollar. However, demand for safe assets is declining amid optimism in global markets, fueled by the US-China trade truce, a possible meeting between Trump and Putin, and bets on a Fed rate cut in September. In the long term, gold could be supported by purchases by the Chinese central bank and a recovery in jewelry demand in India.

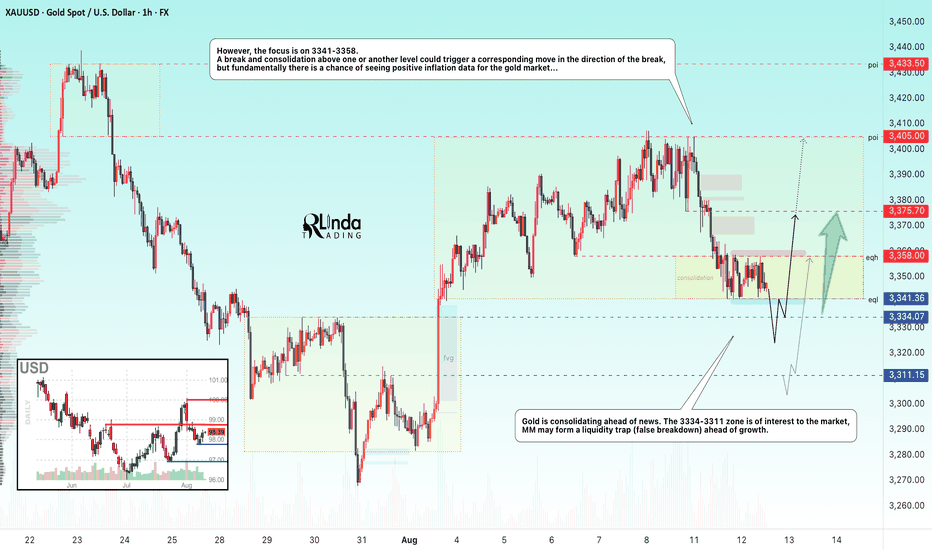

Technically, the focus is on the zone of interest ahead at 3370-3373, with a possible rebound before growth, as well as on the support zone at 3359. I do not rule out that the market may test the liquidity zone...

Resistance levels: 3370, 3380, 3400

Support levels: 3358, 3341, 3334

There is considerable potential within the consolidation, and the rally may be directed towards the resistance range of 3400. However, pullbacks are possible before growth, which could give us a good entry point.

Best regards, R. Linda!

🌹TRADING is a CASINO💔!?

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🌹TRADING is a CASINO💔!?

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.