In addition, the US Senate has passed the OBBBA tax cut and spending bill proposed by President Donald Trump. While it helps prevent the risk of a short-term default, the bill could increase the US public debt by more than $3,000 billion over the next 10 years, putting pressure on the bond market and raising concerns about the increasing supply of government bonds while demand is weakening.

However, US economic data over the weekend put downward pressure on gold. Specifically, the June employment report showed that the number of non-farm jobs (NFP) reached 147,000, exceeding the forecast of 111,000. The unemployment rate fell to 4.1%, lower than the expected 4.3%. At the same time, NFP data for April and May were also adjusted up to 158,000 and 144,000 jobs, respectively.

These positive numbers almost erased the expectation that the FED would cut interest rates in July. The FED also reaffirmed its stance on maintaining the current policy due to rising inflationary pressures.

Overall, gold prices are still stuck in a range, and a clearer prospect of interest rate cuts from the FED is needed to make a strong breakthrough in the near future.

![GOLD MARKET ANALYSIS AND COMMENTARY - [Jun 30 - Jul 04]](https://tradingview.sweetlogin.com/proxy-s3/v/V6ZrwKap_mid.png)

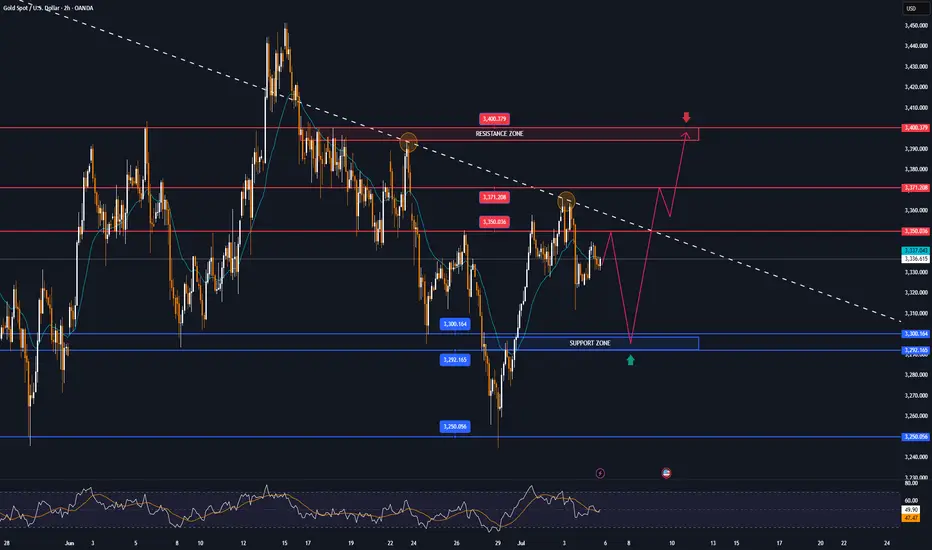

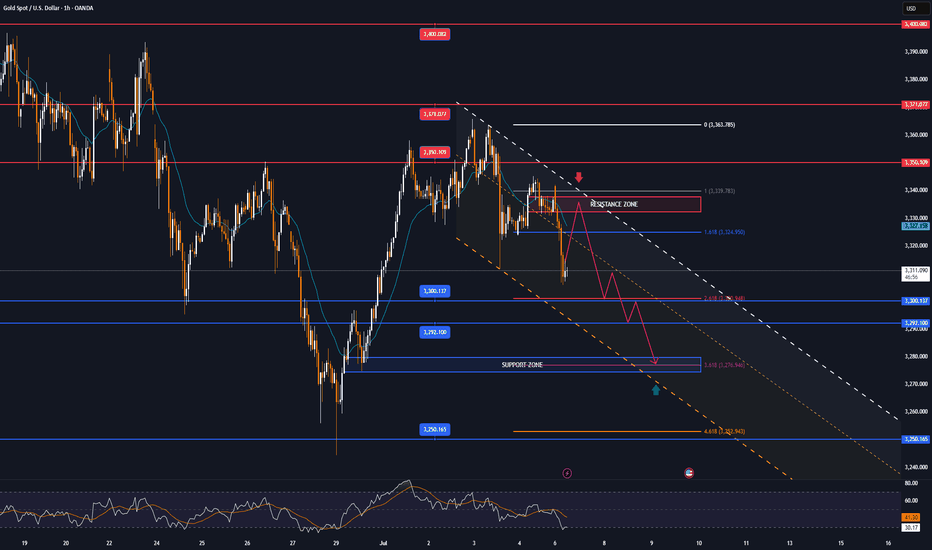

📌Technically, the $3,310/oz level is now acting as an important support zone for gold prices next week. If this level is broken, prices may continue to fall further to the $3,245/oz area or even lower.

On the other hand, the $3,365/oz level is a strong resistance. If gold prices break through this area, there is a high possibility that they will approach the $3,400/oz mark. However, the upward momentum may be restrained afterwards due to profit-taking pressure from investors, especially when the US-China trade negotiations are still ongoing and have not reached a final agreement. Investors tend to be cautious, waiting for clearer signals before opening new positions.

Notable technical levels are listed below.

Support: 3,300 – 3,292 – 3,250USD

Resistance: 3,350 – 3,371 – 3,400USD

SELL XAUUSD PRICE 3401 - 3399⚡️

↠↠ Stop Loss 3405

BUY XAUUSD PRICE 3294 - 3296⚡️

↠↠ Stop Loss 3290

Note

🔴Spot gold hits $3,310On July 7, spot gold continued to fall, down to $3,310/ounce, down 0.83% on the day.

Note

Spot gold has reached the important position of 3331-3336, which is easy to attract great attention from funds, and can pay attention to the contentious situation here.Note

🔴 Spot gold falls below $3,290 Spot gold touched $3,290 an ounce, down 0.35% on the day.

Note

▫️The US Dollar Index DXY briefly fell 10 points, currently at 97.54.Note

🔴Spot gold price surpassed the $3,360/ounce mark, up 1.07% on the day.Note

🔴Gold price exceeds 3370 USD/oz thanks to trade tensions, this week awaits "judgment" from US CPIToday, gold prices continued to increase, reaching 3372.65 USD/oz - the highest level since late June, thanks to increased safe-haven flows after President Trump announced a 30% tax on EU and Mexican goods from August 1.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.