Good day traders 🌟

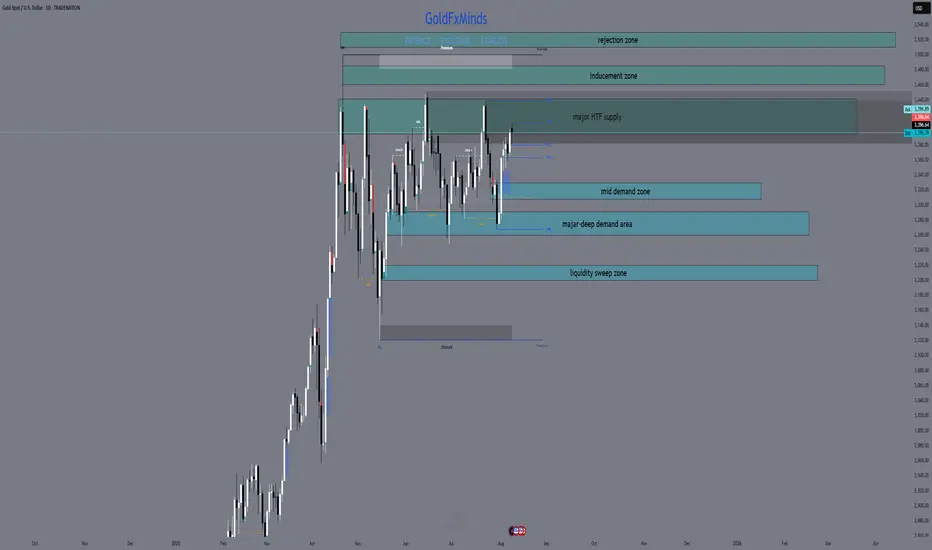

Gold opens today’s session still holding strong near the upper boundaries of its daily range, trading just beneath the dominant weekly supply zone. Buyers have kept control above the 3290 handle, while sellers continue to defend the ceiling around 3439. With a busy US data week ahead, the daily chart sets the stage for either a decisive breakout or a calculated pullback into fresh demand.

📌 Bias: Bullish — daily structure remains firmly intact above 3290, dynamic EMA flow is aligned for upside, and momentum is in buyers’ favor. Still, given we’re in premium pricing, waiting for confirmation is essential before entering fresh positions.

Macro Context

Markets are poised for volatility with US CPI, PPI, and retail sales lined up. Softer inflation data could give bulls the push to clear the 3439 ceiling, while stronger numbers may invite a retracement toward lower daily demand zones.

📊 Key Daily Zones

Immediate Resistance / Supply: 3395 – 3439 (HTF supply overlap + liquidity resting above).

Mid-Level Demand: 3330 – 3310 (recent bullish OB, intraday reload zone).

Major Daily Demand: 3290 – 3260 (untested breakout base).

📊 Key Zones

Above Current Price

Immediate Resistance / Supply: 3395 – 3439 (major HTF supply).

3460 – 3475 → H4/D1 imbalance + inducement zone.

3480 – 3490 → 1.618 Fibonacci extension from last weekly swing.

3510 – 3525 → minor HTF supply / wick rejection zone.

Below Current Price

Mid-Level Demand: 3330 – 3310 (recent bullish OB).

Major Daily Demand: 3290 – 3260 (untested breakout base).

3220 – 3200 → daily demand + liquidity sweep zone.

3155 – 3140 → daily OB + HTF BOS retest.

3100 – 3085 → HTF demand + liquidity shelf.

3040 – 3020 → deep daily demand + Fibo 0.786 retracement of May rally.

🚀 Bullish Scenario

A break and daily close above 3439 clears the path toward 3460 – 3475, with extension targets at 3480 – 3490 and 3510 – 3525.

Pullbacks into 3330 – 3310 or 3290 – 3260 with bullish confirmation may offer high-RR entries back toward the highs.

📉 Bearish Scenario

Rejection from 3439 could push price back toward 3330 – 3310 or 3290 – 3260.

A daily close below 3260 opens deeper targets at 3220 – 3200, 3155 – 3140, and potentially 3100 – 3085.

🔍 Confluence & Indicators

Dynamic EMA Flow: Bullish, price above all major EMAs.

RSI: Neutral-to-bullish, no divergence on D1.

FVGs: Unfilled gap above 3439 acts as liquidity magnet.

Fibonacci: Price near 1.272 extension, with 1.618 above at 3480–3490.

📌 Outlook Summary

Gold is coiled near the top of its range in a bullish structure. The best setups will come from either a confirmed breakout above 3439 toward higher HTF targets or a disciplined buy from demand after a healthy retracement.

💬 Your move — will gold finally push through the highs, or is a deeper pullback coming first? Share your thoughts below and let’s track the market together.

If you find these outlooks useful, hit like and follow for precision updates.

— GoldFxMinds

Disclosure: This analysis uses Trade Nation’s price feed and is for educational purposes only — not financial advice.

Gold opens today’s session still holding strong near the upper boundaries of its daily range, trading just beneath the dominant weekly supply zone. Buyers have kept control above the 3290 handle, while sellers continue to defend the ceiling around 3439. With a busy US data week ahead, the daily chart sets the stage for either a decisive breakout or a calculated pullback into fresh demand.

📌 Bias: Bullish — daily structure remains firmly intact above 3290, dynamic EMA flow is aligned for upside, and momentum is in buyers’ favor. Still, given we’re in premium pricing, waiting for confirmation is essential before entering fresh positions.

Macro Context

Markets are poised for volatility with US CPI, PPI, and retail sales lined up. Softer inflation data could give bulls the push to clear the 3439 ceiling, while stronger numbers may invite a retracement toward lower daily demand zones.

📊 Key Daily Zones

Immediate Resistance / Supply: 3395 – 3439 (HTF supply overlap + liquidity resting above).

Mid-Level Demand: 3330 – 3310 (recent bullish OB, intraday reload zone).

Major Daily Demand: 3290 – 3260 (untested breakout base).

📊 Key Zones

Above Current Price

Immediate Resistance / Supply: 3395 – 3439 (major HTF supply).

3460 – 3475 → H4/D1 imbalance + inducement zone.

3480 – 3490 → 1.618 Fibonacci extension from last weekly swing.

3510 – 3525 → minor HTF supply / wick rejection zone.

Below Current Price

Mid-Level Demand: 3330 – 3310 (recent bullish OB).

Major Daily Demand: 3290 – 3260 (untested breakout base).

3220 – 3200 → daily demand + liquidity sweep zone.

3155 – 3140 → daily OB + HTF BOS retest.

3100 – 3085 → HTF demand + liquidity shelf.

3040 – 3020 → deep daily demand + Fibo 0.786 retracement of May rally.

🚀 Bullish Scenario

A break and daily close above 3439 clears the path toward 3460 – 3475, with extension targets at 3480 – 3490 and 3510 – 3525.

Pullbacks into 3330 – 3310 or 3290 – 3260 with bullish confirmation may offer high-RR entries back toward the highs.

📉 Bearish Scenario

Rejection from 3439 could push price back toward 3330 – 3310 or 3290 – 3260.

A daily close below 3260 opens deeper targets at 3220 – 3200, 3155 – 3140, and potentially 3100 – 3085.

🔍 Confluence & Indicators

Dynamic EMA Flow: Bullish, price above all major EMAs.

RSI: Neutral-to-bullish, no divergence on D1.

FVGs: Unfilled gap above 3439 acts as liquidity magnet.

Fibonacci: Price near 1.272 extension, with 1.618 above at 3480–3490.

📌 Outlook Summary

Gold is coiled near the top of its range in a bullish structure. The best setups will come from either a confirmed breakout above 3439 toward higher HTF targets or a disciplined buy from demand after a healthy retracement.

💬 Your move — will gold finally push through the highs, or is a deeper pullback coming first? Share your thoughts below and let’s track the market together.

If you find these outlooks useful, hit like and follow for precision updates.

— GoldFxMinds

Disclosure: This analysis uses Trade Nation’s price feed and is for educational purposes only — not financial advice.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.