📰 Fundamental News

The world’s largest gold ETF, SPDR Gold Trust, increased its holdings by 1.44 tons, reaching 948.81 tons, a sign of rising institutional interest.

Market expectations of a rate cut in September are growing, but the pricing in futures markets is still incomplete.

Global risk sentiment remains cautious, making gold a preferred safe haven amid economic uncertainty.

📉 Technical Analysis

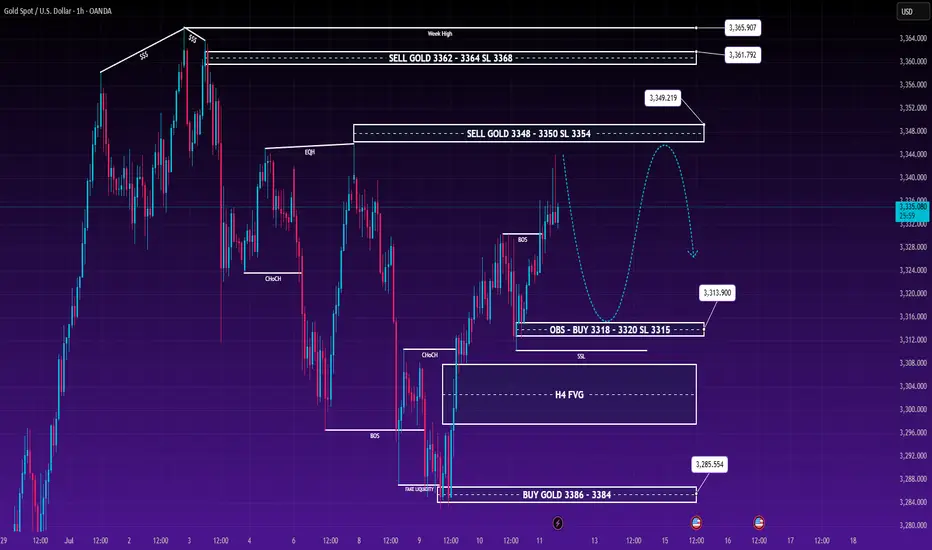

Gold has broken through the descending trendline, confirming bullish momentum and rejecting deep pullbacks during the Asian session.

A sharp fake-out move (liquidity grab) occurred around the 3284–3286 zone, after which the market rallied and formed a BOS (Break of Structure) and CHoCH confirmation on lower timeframes.

The current price action respects the Wyckoff accumulation model, and Wave (5) might be in its final stages as seen on M15–H1.

Liquidity zones are forming around key psychological levels: 3318–3319 and 3334–3340, where short-term corrective moves may happen before further bullish continuation.

🔍 Key Levels to Watch

Zone Type Price Range Notes

🟢 Buy Zone 3315 – 3318 Optimal Buy Limit (OBS + SSL Zone)

🛑 Stop Loss Below 3315.5 For aggressive buyers

🔵 Resistance 3334 – 3340 Potential reaction / pullback zone

🔴 Sell Zone 3348 – 3350 Scalp Sell area with SL at 3354

🟠 Major Sell 3362 – 3364 Institutional level – Week High zone

📊 Trading Scenarios

BUY SCENARIO – High Probability

Buy Limit: 3315 – 3318

SL: 3310 – 3315 (based on risk tolerance)

TP1: 3320

TP2: 3334

TP3: 3348 – 3350 (partial exit or scale-out)

SELL SCALP SCENARIO – Short-Term

Sell Zone: 3348 – 3350

SL: 3354

TP: 3344 - 3334 zone (quick pullback)

SELL HOLD SETUP

Sell Zone: 3362 – 3364 (Week High)

SL: 3368

TP: 3340 and trail further if momentum shifts

🧠 Note for Traders

Gold remains in a bullish structure, and as long as price holds above 3315, the bias remains to the upside. Watch for liquidity reactions at 3334 and 3340 for potential pullbacks. Avoid chasing price and wait for cleaner entries near liquidity zones.

The world’s largest gold ETF, SPDR Gold Trust, increased its holdings by 1.44 tons, reaching 948.81 tons, a sign of rising institutional interest.

Market expectations of a rate cut in September are growing, but the pricing in futures markets is still incomplete.

Global risk sentiment remains cautious, making gold a preferred safe haven amid economic uncertainty.

📉 Technical Analysis

Gold has broken through the descending trendline, confirming bullish momentum and rejecting deep pullbacks during the Asian session.

A sharp fake-out move (liquidity grab) occurred around the 3284–3286 zone, after which the market rallied and formed a BOS (Break of Structure) and CHoCH confirmation on lower timeframes.

The current price action respects the Wyckoff accumulation model, and Wave (5) might be in its final stages as seen on M15–H1.

Liquidity zones are forming around key psychological levels: 3318–3319 and 3334–3340, where short-term corrective moves may happen before further bullish continuation.

🔍 Key Levels to Watch

Zone Type Price Range Notes

🟢 Buy Zone 3315 – 3318 Optimal Buy Limit (OBS + SSL Zone)

🛑 Stop Loss Below 3315.5 For aggressive buyers

🔵 Resistance 3334 – 3340 Potential reaction / pullback zone

🔴 Sell Zone 3348 – 3350 Scalp Sell area with SL at 3354

🟠 Major Sell 3362 – 3364 Institutional level – Week High zone

📊 Trading Scenarios

BUY SCENARIO – High Probability

Buy Limit: 3315 – 3318

SL: 3310 – 3315 (based on risk tolerance)

TP1: 3320

TP2: 3334

TP3: 3348 – 3350 (partial exit or scale-out)

SELL SCALP SCENARIO – Short-Term

Sell Zone: 3348 – 3350

SL: 3354

TP: 3344 - 3334 zone (quick pullback)

SELL HOLD SETUP

Sell Zone: 3362 – 3364 (Week High)

SL: 3368

TP: 3340 and trail further if momentum shifts

🧠 Note for Traders

Gold remains in a bullish structure, and as long as price holds above 3315, the bias remains to the upside. Watch for liquidity reactions at 3334 and 3340 for potential pullbacks. Avoid chasing price and wait for cleaner entries near liquidity zones.

🔱 Trade with Smart Money – ICT Concepts & Price Action

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔱 Trade with Smart Money – ICT Concepts & Price Action

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.