Gold prices rose and held above $3,300 an ounce as traders grew increasingly concerned about the US tax reform vote and escalating tensions in the Middle East. In addition, Moody's downgrade of the US credit rating and the depreciation of the US dollar also boosted safe-haven demand for gold.

CNN reported Tuesday, citing multiple sources, that the latest intelligence suggests Israel is preparing to launch airstrikes on Iranian nuclear facilities, even as negotiations between the Trump administration and Iran over the country's uranium enrichment program continue. Axios, a prominent U.S. news website, reported Wednesday local time that two Israeli sources with knowledge of the negotiations told Axios that Israel is preparing to strike Iran's nuclear facilities quickly if negotiations between the United States and Iran fall apart.

Israeli intelligence has shifted in recent days from believing a nuclear deal was imminent to believing that talks could soon collapse, sources said.

Gold, considered a safe investment amid economic and geopolitical uncertainty, hit a record high of $3,500.05 an ounce last month.

US stocks plunged on Wednesday and US Treasury yields jumped as investors focused on congressional debate over President Trump’s proposed tax reform, raising concerns that the country’s massive debt will continue to rise.

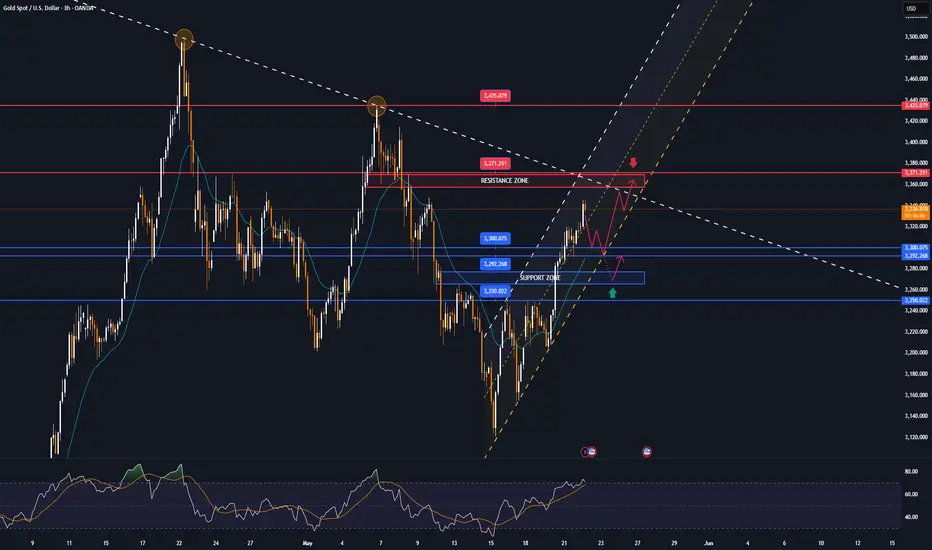

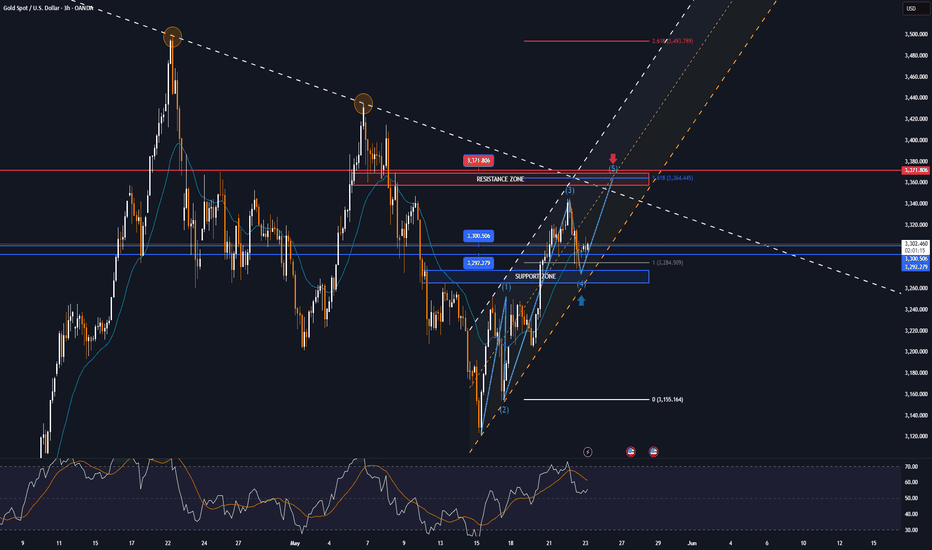

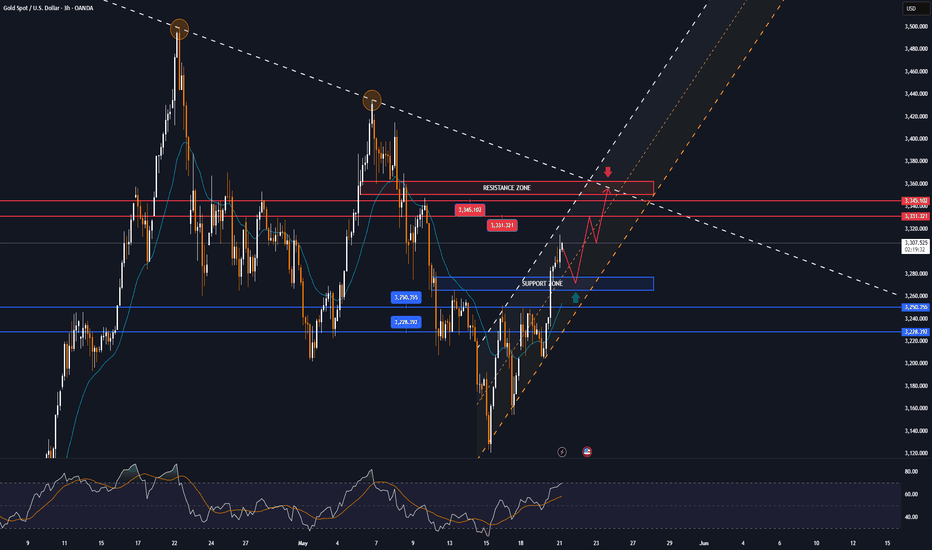

Technical Outlook Analysis

After gold broke the technical confluence of the 21-day moving average (EMA21) with the 0.382% Fibonacci retracement, it has qualified for further upside to the next target expected at $3,371, the price point of the 0.236% Fibonacci retracement.

Looking ahead, in the short term, gold has qualified for a new bullish cycle with the nearest support at the raw price point of $3,300 followed by $3,292. A bullish breakout of $3,371 would open the door to a new target at the raw price point of $3,400 in the short term, followed by $3,435.

As noted to readers throughout the publications since the beginning of the year, the trend of gold prices is fixed by the rising price channel, corrections can still take place negatively but the trend has not changed. "In fact, I have also encountered many failures when the market fluctuated too much recently, causing me to not believe in the rising price structure at times."

Trading is not just about fundamentals or technicals, it depends more on trading psychology. With the current market, experienced traders will still often encounter psychological problems, such as me, who is writing this article to you.

Finally, the short-term uptrend of gold prices in the main uptrend will be noted by the following notable levels.

Support: 3,300 – 3,292 – 3,250 USD

Resistance: 3,371 – 3,435 USD

SELL XAUUSD PRICE 3367 - 3365⚡️

↠↠ Stop Loss 3371

→Take Profit 1 3359

↨

→Take Profit 2 3353

BUY XAUUSD PRICE 3265 - 3267⚡️

↠↠ Stop Loss 3261

→Take Profit 1 3273

↨

→Take Profit 2 3279

Note

Gold price turns down to below 3,310 USD/ozNote

▫️ Spot gold fell more than $16 in 15 minutes, back below $3,290 an ounce, down 0.14% on the day.Note

Gold price continues to increase strongly to nearly 3,330 USD/ozNote

* World gold prices turned around and increased sharply after Mr. Trump threatened to impose new import taxes.Note

Gold prices fluctuate around 3,330 USD/ozNote

Spot gold prices continued to fall, down $5 in the short term to $3,340 an ounce.Note

Gold continues to weaken to 3,285 USD/ozNote

Gold prices suddenly plummeted early on May 28, falling to $3,285.25/ounce due to the temporary easing of US-EU trade tensions after Trump delayed imposing a 50% tax, causing demand for safe havens to decline.Note

Gold price recovers slightly to above 3,270 USD/oz🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.