Hey Everyone,

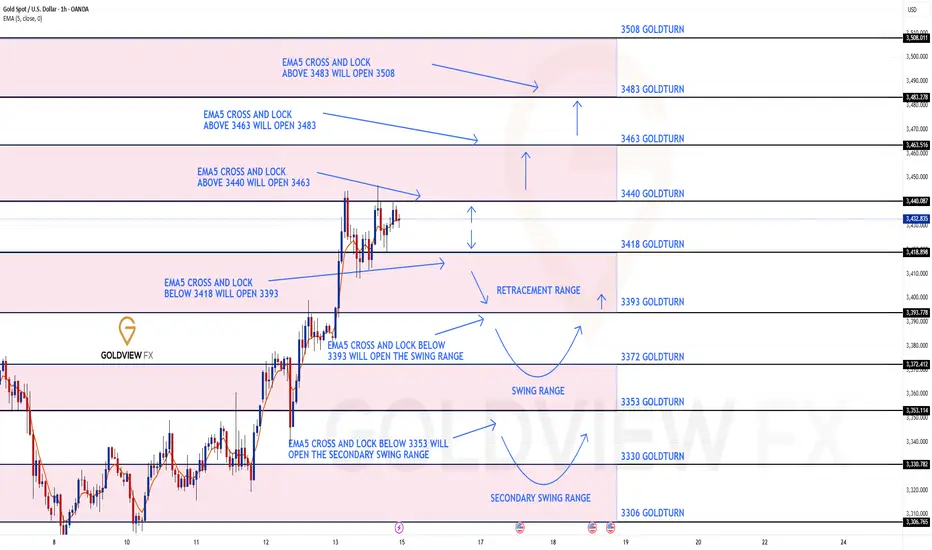

Please see our updated 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3340 and a gap below at 3418. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3340

EMA5 CROSS AND LOCK ABOVE 3340 WILL OPEN THE FOLLOWING BULLISH TARGETS

3463

EMA5 CROSS AND LOCK ABOVE 3463 WILL OPEN THE FOLLOWING BULLISH TARGET

3483

EMA5 CROSS AND LOCK ABOVE 3483 WILL OPEN THE FOLLOWING BULLISH TARGET

3508

BEARISH TARGETS

3418

EMA5 CROSS AND LOCK BELOW 3418 WILL OPEN THE FOLLOWING BEARISH TARGET

3393

EMA5 CROSS AND LOCK BELOW 3393 WILL OPEN THE SWING RANGE

3372

3353

EMA5 CROSS AND LOCK BELOW 3393 WILL OPEN THE SECONDARY SWING RANGE

3330

3306

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Please see our updated 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3340 and a gap below at 3418. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3340

EMA5 CROSS AND LOCK ABOVE 3340 WILL OPEN THE FOLLOWING BULLISH TARGETS

3463

EMA5 CROSS AND LOCK ABOVE 3463 WILL OPEN THE FOLLOWING BULLISH TARGET

3483

EMA5 CROSS AND LOCK ABOVE 3483 WILL OPEN THE FOLLOWING BULLISH TARGET

3508

BEARISH TARGETS

3418

EMA5 CROSS AND LOCK BELOW 3418 WILL OPEN THE FOLLOWING BEARISH TARGET

3393

EMA5 CROSS AND LOCK BELOW 3393 WILL OPEN THE SWING RANGE

3372

3353

EMA5 CROSS AND LOCK BELOW 3393 WILL OPEN THE SECONDARY SWING RANGE

3330

3306

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Trade active

Typo correction: GAP ABOVE 3440 NOT 3340Note

Typo correction: Ema5 cross and lock below 3353 will open the secondary swing range NOT 3393🪙 JOIN OUR FREE TELEGRAM GROUP 🪙 t.me/GoldView_FX

🪙 JOIN OUR DISCORD FOR BACKUP 🪙

discord.com/invite/9ZrEHGuaE2

🏆MESSAGE US FOR VIP SIGNALS🏆

t.me/GoldviewFX

or

email goldviewfx@gmail com

🪙 JOIN OUR DISCORD FOR BACKUP 🪙

discord.com/invite/9ZrEHGuaE2

🏆MESSAGE US FOR VIP SIGNALS🏆

t.me/GoldviewFX

or

email goldviewfx@gmail com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🪙 JOIN OUR FREE TELEGRAM GROUP 🪙 t.me/GoldView_FX

🪙 JOIN OUR DISCORD FOR BACKUP 🪙

discord.com/invite/9ZrEHGuaE2

🏆MESSAGE US FOR VIP SIGNALS🏆

t.me/GoldviewFX

or

email goldviewfx@gmail com

🪙 JOIN OUR DISCORD FOR BACKUP 🪙

discord.com/invite/9ZrEHGuaE2

🏆MESSAGE US FOR VIP SIGNALS🏆

t.me/GoldviewFX

or

email goldviewfx@gmail com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.